Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9 10 11 just need correction Gives the owner the exclusive right to publish and sell a musical or literary work during the life of

9

10

11

just need correction

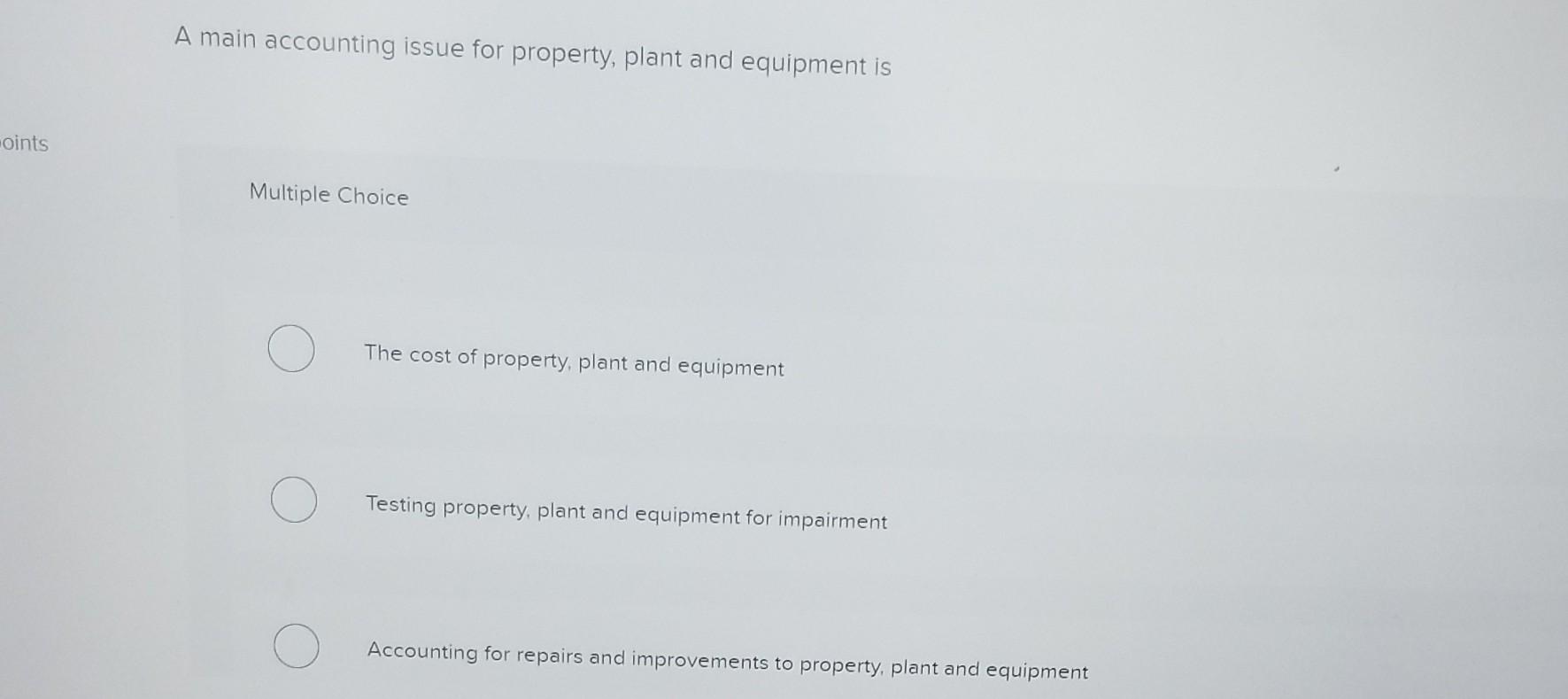

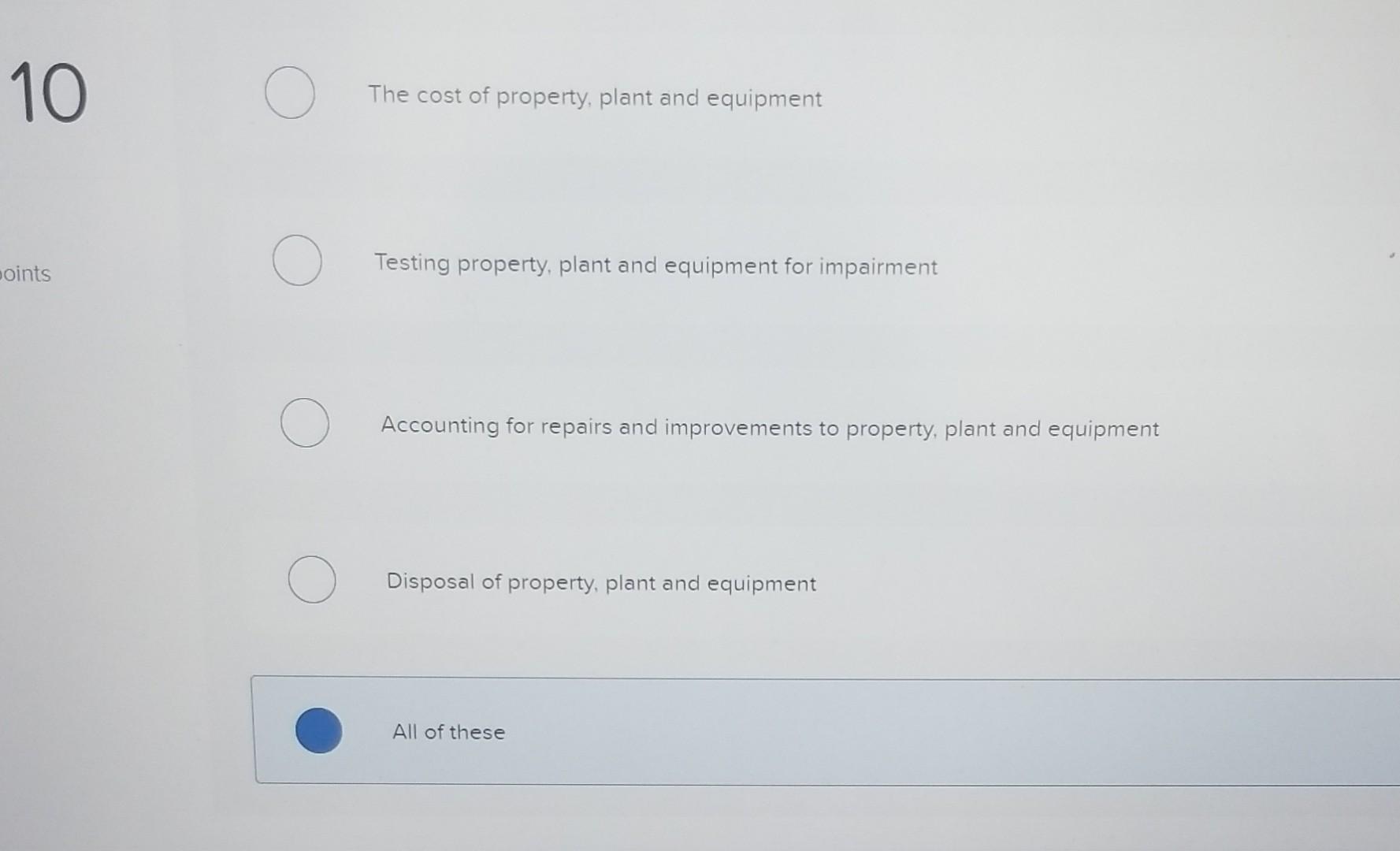

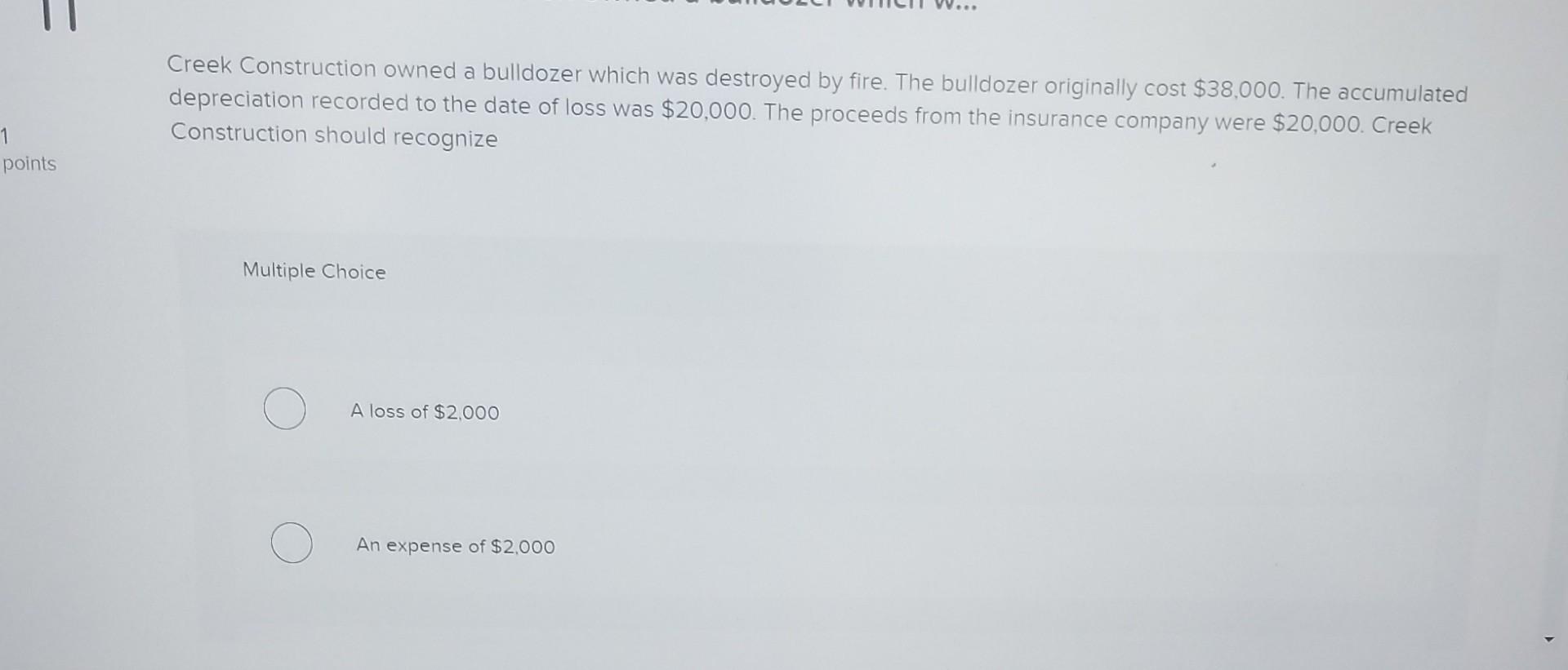

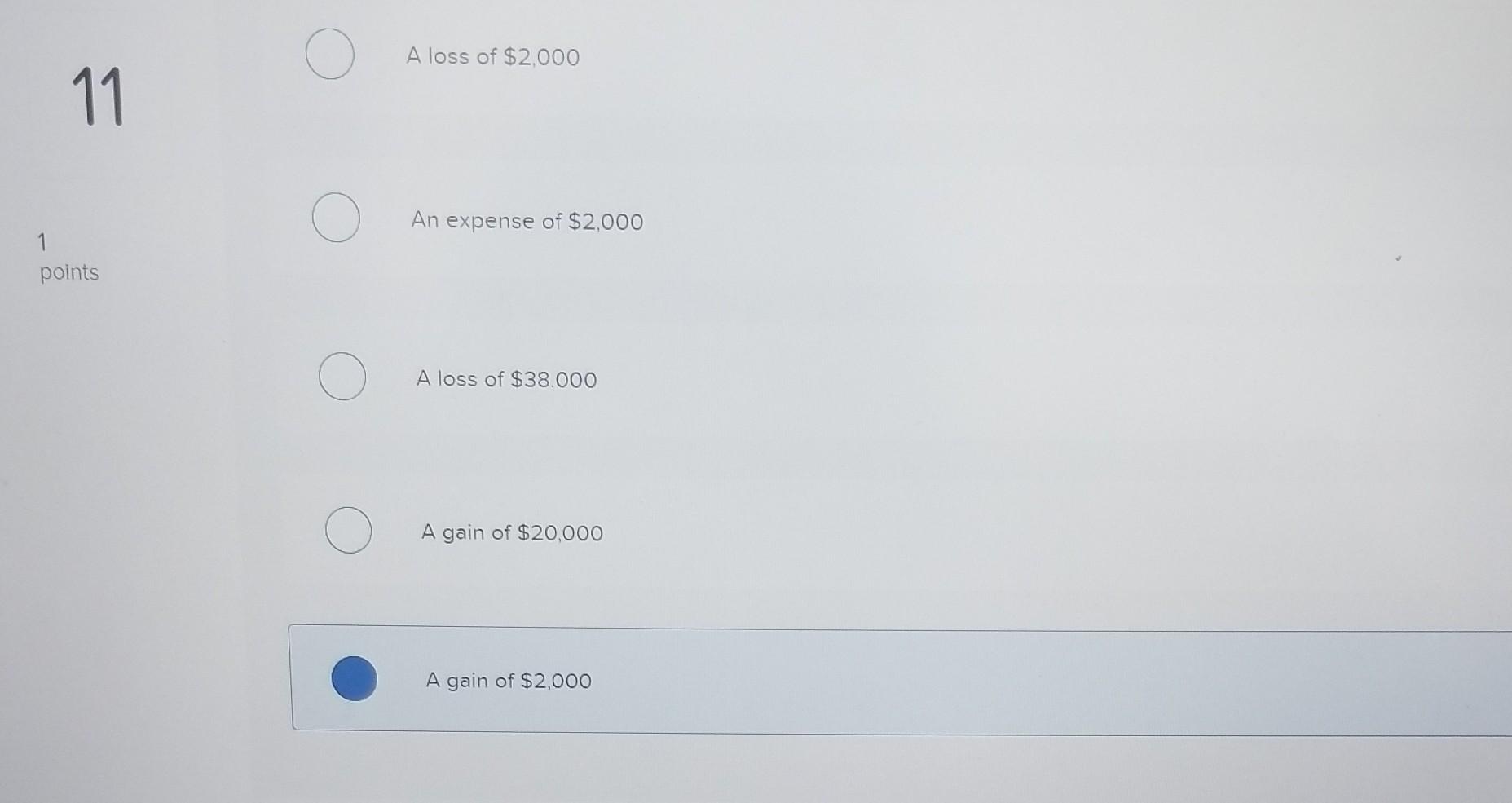

Gives the owner the exclusive right to publish and sell a musical or literary work during the life of the creator plus 50 years Is an exclusive right granted to its owner to manufacture and sell a machine or device, or to use a process, for 20 years Is an exclusive right granted to its owner to manufacture and sell a machine or device, or to use a process, for 20 years Is an exclusive right granted to its owner to manufacture and sell a machine or device, or to use a process, for 50 years The amount by which the value of a company exceeds the fair market value of a company's net assets if purchased separately Gives the owner the exclusive right to publish and sell a musical or literary work during the life of the creator plus 20 years Natural resources Multiple Choice Include trees, mineral deposits, and oil and gas fields Are consumed when used Are long-term assets Include trees, mineral deposits, and oil and gas fields Are consumed when used points Are long-term assets Can be amortized. All of these A main accounting issue for property, plant and equipment is Multiple Choice The cost of property, plant and equipment Testing property, plant and equipment for impairment Accounting for repairs and improvements to property, plant and equipment The cost of property, plant and equipment Testing property, plant and equipment for impairment Accounting for repairs and improvements to property, plant and equipment Disposal of property, plant and equipment All of these Creek Construction owned a bulldozer which was destroyed by fire. The bulldozer originally cost $38,000. The accumulated depreciation recorded to the date of loss was $20,000. The proceeds from the insurance company were $20,000. Creek Construction should recognize Multiple Choice A loss of $2,000 An expense of $2,000 A loss of $2,000 An expense of $2,000 1 points A loss of $38,000 A gain of $20,000 A gain of $2,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started