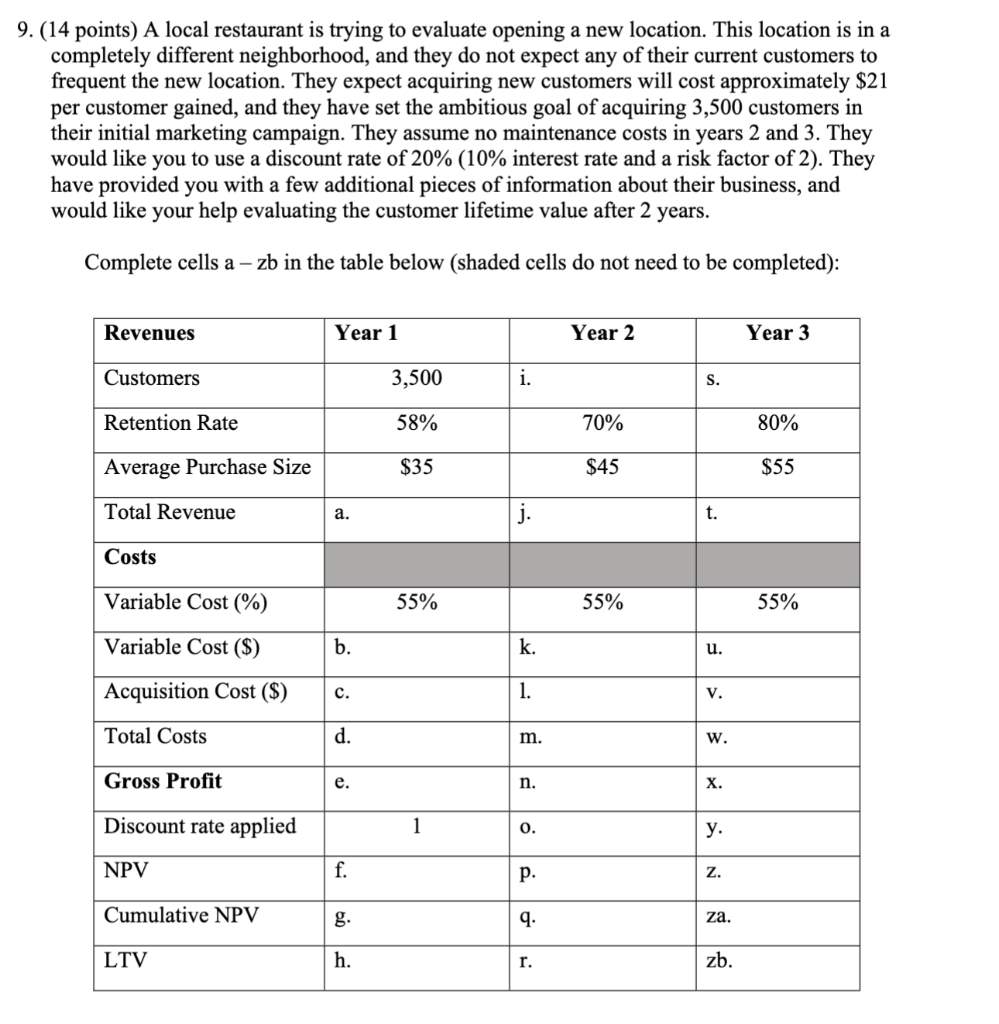

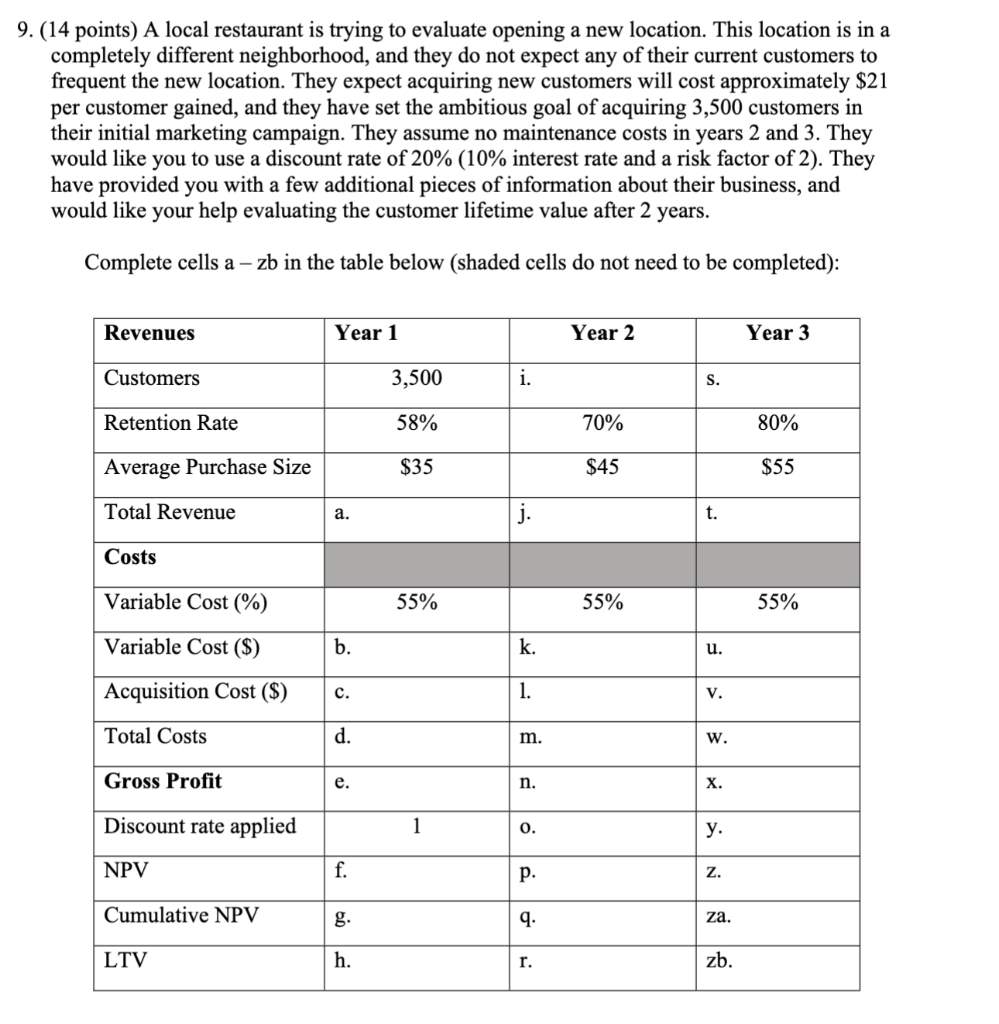

9. (14 points) A local restaurant is trying to evaluate opening a new location. This location is in a completely different neighborhood, and they do not expect any of their current customers to frequent the new location. They expect acquiring new customers will cost approximately $21 per customer gained, and they have set the ambitious goal of acquiring 3,500 customers in their initial marketing campaign. They assume no maintenance costs in years 2 and 3. They would like you to use a discount rate of 20% (10% interest rate and a risk factor of 2). They have provided you with a few additional pieces of information about their business, and would like your help evaluating the customer lifetime value after 2 years. Complete cells a - zb in the table below (shaded cells do not need to be completed): Revenues Year 1 Year 2 Year 3 Customers 3,500 i. Retention Rate 58% 70% 80% Average Purchase Size $35 $45 $55 Total Revenue Costs Variable Cost (%) 55% 55% 55% Variable Cost ($) b. Acquisition Cost ($) Total Costs Gross Profit Discount rate applied NPV Cumulative NPV bis LTV 9. (14 points) A local restaurant is trying to evaluate opening a new location. This location is in a completely different neighborhood, and they do not expect any of their current customers to frequent the new location. They expect acquiring new customers will cost approximately $21 per customer gained, and they have set the ambitious goal of acquiring 3,500 customers in their initial marketing campaign. They assume no maintenance costs in years 2 and 3. They would like you to use a discount rate of 20% (10% interest rate and a risk factor of 2). They have provided you with a few additional pieces of information about their business, and would like your help evaluating the customer lifetime value after 2 years. Complete cells a - zb in the table below (shaded cells do not need to be completed): Revenues Year 1 Year 2 Year 3 Customers 3,500 i. Retention Rate 58% 70% 80% Average Purchase Size $35 $45 $55 Total Revenue Costs Variable Cost (%) 55% 55% 55% Variable Cost ($) b. Acquisition Cost ($) Total Costs Gross Profit Discount rate applied NPV Cumulative NPV bis LTV