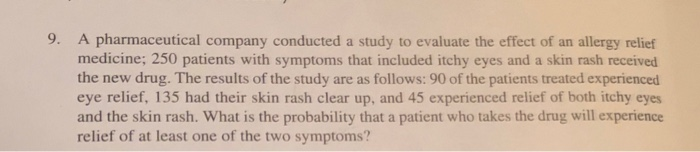

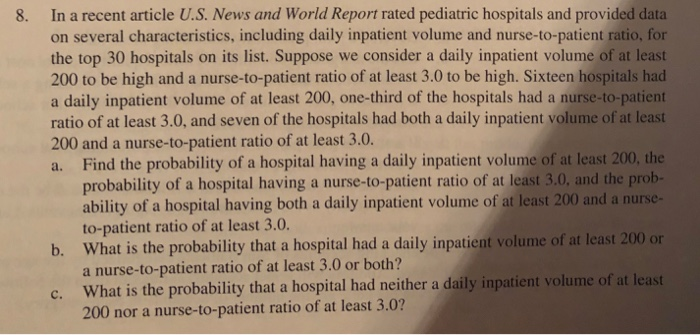

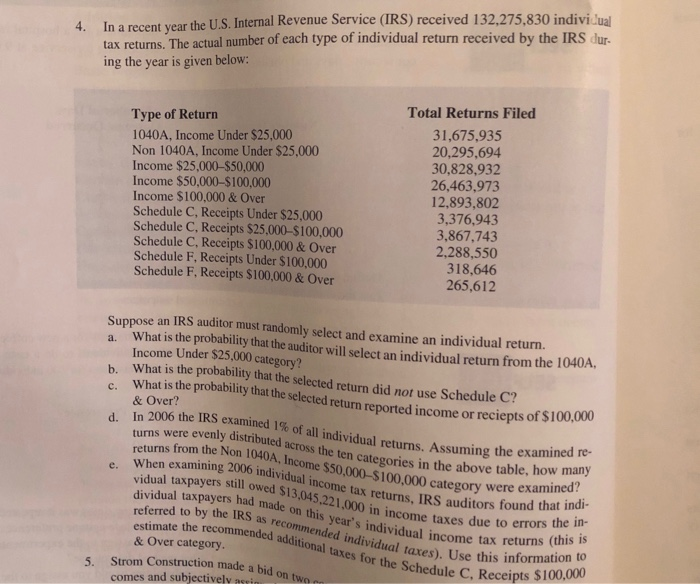

9. A pharmaceutical company conducted a study to evaluate the effect of an allergy relief medicine; 250 patients with symptoms that included itchy eyes and a skin rash received the new drug. The results of the study are as follows: 90 of the patients treated experienced eye relief, 135 had their skin rash clear up, and 45 experienced relief of both itchy eyes and the skin rash. What is the probability that a patient who takes the drug will experience relief of at least one of the two symptoms? 8. In a recent article U.S. News and World Report rated pediatric hospitals and provided data on several characteristics, including daily inpatient volume and nurse-to-patient ratio, for the top 30 hospitals on its list. Suppose we consider a daily inpatient volume of at least 200 to be high and a nurse-to-patient ratio of at least 3.0 to be high. Sixteen hospitals had a daily inpatient volume of at least 200, one-third of the hospitals had a nurse-to-patient ratio of at least 3.0, and seven of the hospitals had both a daily inpatient volume of at least 200 and a nurse-to-patient ratio of at least 3.0. Find the probability of a hospital having a daily inpatient volume of at least 200, the probability of a hospital having a nurse-to-patient ratio of at least 3.0, and the prob- ability of a hospital having both a daily inpatient volume of at least 200 and a nurse- to-patient ratio of at least 3.0. b. What is the probability that a hospital had a daily inpatient volume of at least 200 or a nurse-to-patient ratio of at least 3.0 or both? What is the probability that a hospital had neither a daily inpatient volume of at least 200 nor a nurse-to-patient ratio of at least 3.0? a. c. In a recent year the U.S. Internal Revenue Service (IRS) received 132,275,830 individual tax returns. The actual number of each type of individual return received by the IRS dur- ing the year is given below: Total Returns Filed 31,675,935 20,295,694 30,828,932 26,463,973 12,893,802 3,376,943 3,867,743 2,288,550 318,646 265,612 In 2006 the IRS examined 1% of all individual returns. Assuming the examined re- returns from the Non 1040A,Income $50,000-$100,000 category were examined? When examining 2006 individual income tax returns, IRS auditors found that indi- vidual taxpayers still owed $13.045.221.000 in income taxes due to errors the in- dividual taxpayers had made on this year's individual income tax returns (this is referred to by the IRS as recommended individual taxes). Use this information to estimate the recommended additional taxes for the Schedule C, Receipts $100,000 Strom Construction made a bid on two 4. Type of Return 1040A, Income Under $25,000 Non 1040A, Income Under $25,000 Income $25,000-$50,000 Income $50,000-$100,000 Income $100,000 & Over Schedule C, Receipts Under $25,000 Schedule C, Receipts $25,000-$100,000 Schedule C, Receipts $100,000 & Over Schedule F, Receipts Under $100,000 Schedule F, Receipts $100,000 & Over a. b. c. & Over? d. e. 5. comes and subjectively in Suppose an IRS auditor must randomly select and examine an individual return. What is the probability that the auditor will select an individual return from the 1040A, Income Under $25,000 category? What is the probability that the selected return did not use Schedule C? What is the probability that the selected return reported income or reciepts of $100,000 turns were evenly distributed across the ten categories in the above table, how many & Over category