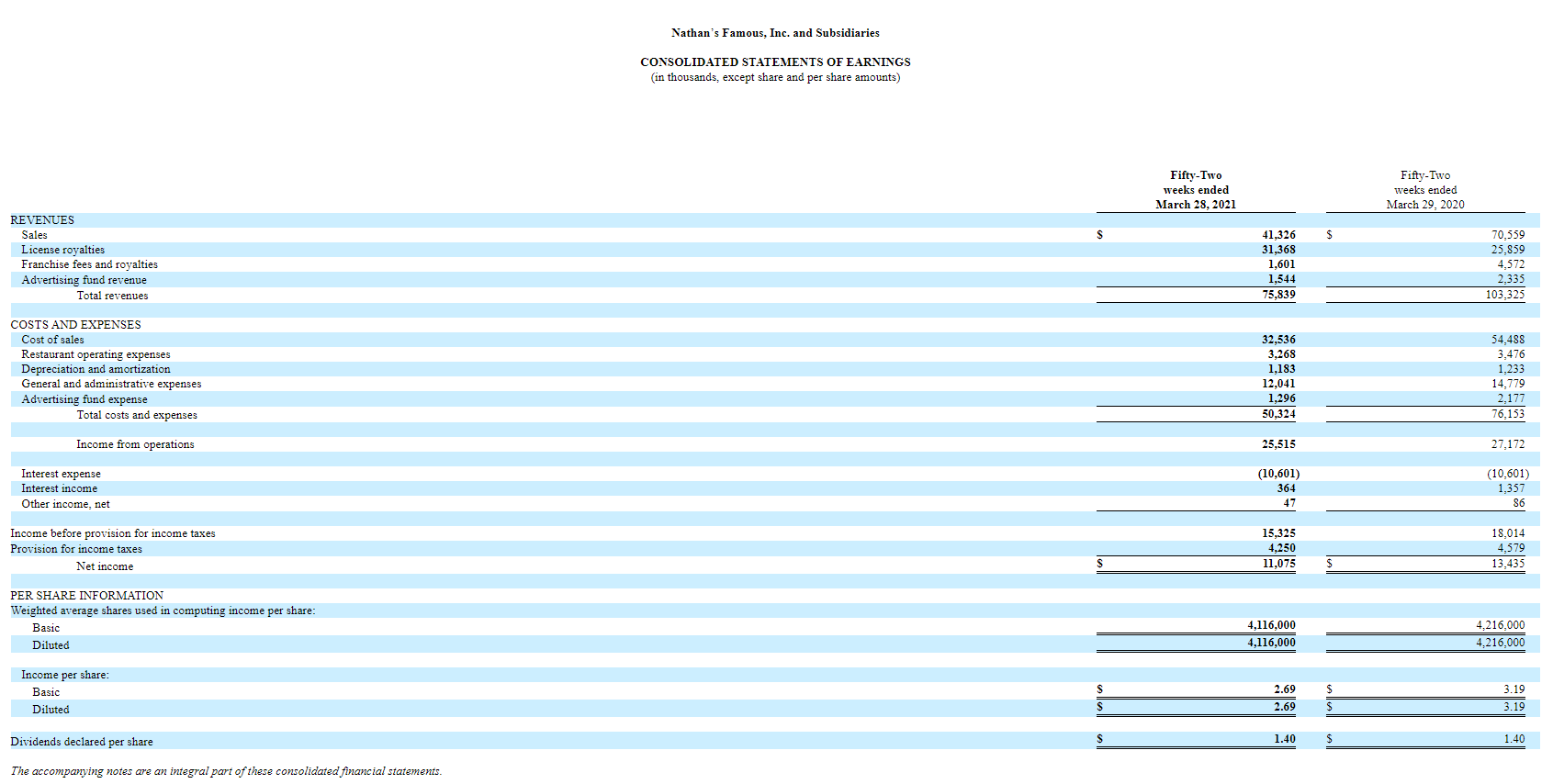

Utilizing the resources in this module, you should have familiarized yourself with the description of the company "Nathan's Famous" for all of the following: Nathan's Form 10-K: Annual report for year ending March 28, 2021. Look carefully at the various financial statements starting on F-1., paying particular attention to the Consolidated Statement of Earnings on F-4. Look at each of the lines in the Statement to see how revenues changed. How did cost change? Did cost go up (down) more than revenues went up (down)?

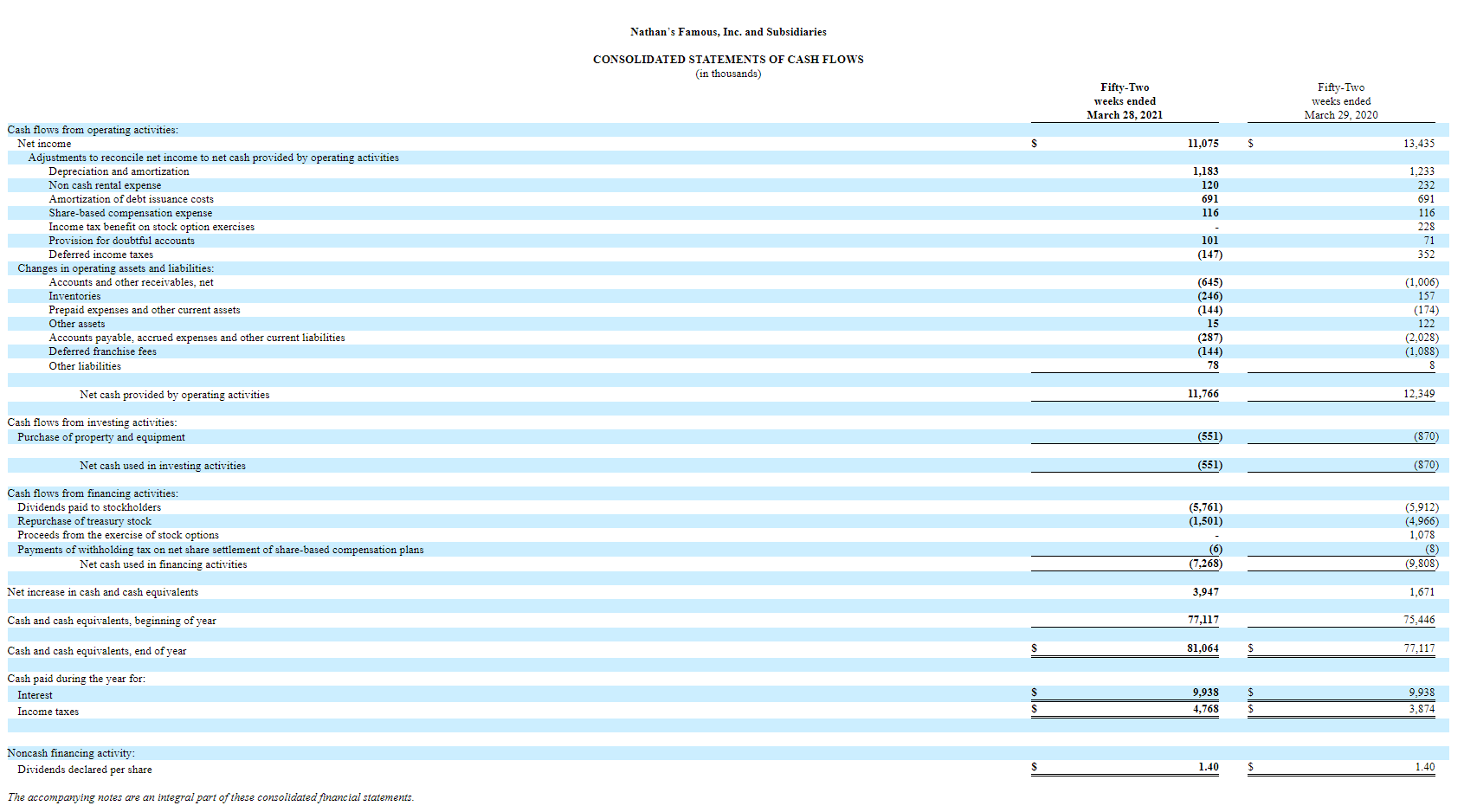

Recreate an income statement and a cash flow statement for the year ended March 28, 2021 assuming that all of Nathan's revenue falls to zero. For this project, you are to assume that all the revenue for Nathan's comes from their restaurants. Remember that the different types of costs will not react in the same way to this drop in revenue.

And then there needs to be a concise, but thorough description of why, and by how much, everything changed or did not change. Examples of things you may use to justify your answers- industry averages, prior year data of the company, estimates made in the footnotes of the 10-K, etc. Cost behaviors should definitely be part of the justifications! Each line should be described separately.

Nathan's Famous, Inc. and Subsidiaries CONSOLIDATED STATEMENTS OF EARNINGS (in thousands, except share and per share amounts) Nathan's Famous, Inc. and Subsidiaries CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities Depreciation and amortization Non cash rental expense Amortization of debt issuance costs Share-based compensation expense Income tax benefit on stock option exercises Drovision for doubtful Changes in operating assets and liabilities: Accounts and other receivables, net Inventories Other assets Accounts payable, accrued expenses and other current liabilities Deferred franchise fees Net cash provided by operating activities Cash flows from investing activities: Purchase of property and equipment Net cash used in investing activities Cash flows from financing activities: Dividends paid to stockholders Repurchase of treasury stock Proceeds from the exercise of stock options Payments of withholding tax on net share settlement of share-based compensation plans Net cash used in financing activities Net increase in cash and cash equivalents Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year Cash paid during the year for: Interest Income taxes Noncash financing activity: Dividends declared per share The accompanying notes are an integral part of these consolidated financial statements. Nathan's Famous, Inc. and Subsidiaries CONSOLIDATED STATEMENTS OF EARNINGS (in thousands, except share and per share amounts) Nathan's Famous, Inc. and Subsidiaries CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities Depreciation and amortization Non cash rental expense Amortization of debt issuance costs Share-based compensation expense Income tax benefit on stock option exercises Drovision for doubtful Changes in operating assets and liabilities: Accounts and other receivables, net Inventories Other assets Accounts payable, accrued expenses and other current liabilities Deferred franchise fees Net cash provided by operating activities Cash flows from investing activities: Purchase of property and equipment Net cash used in investing activities Cash flows from financing activities: Dividends paid to stockholders Repurchase of treasury stock Proceeds from the exercise of stock options Payments of withholding tax on net share settlement of share-based compensation plans Net cash used in financing activities Net increase in cash and cash equivalents Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year Cash paid during the year for: Interest Income taxes Noncash financing activity: Dividends declared per share The accompanying notes are an integral part of these consolidated financial statements