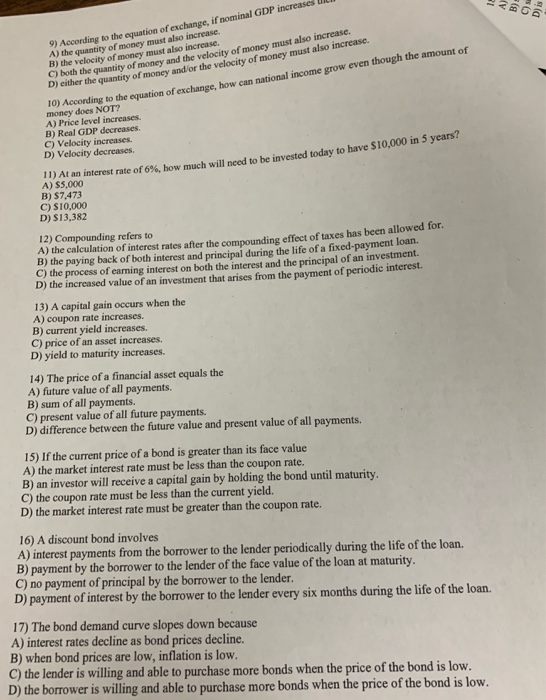

9) According to the equation of exchange, if nominal GDP increasca A) the quantity of money must also increase B) the velocity of money must also increase Ch both the quantity of money and the velocity of money must also increase D) either the quantity of money and or the velocity of money must also increase According to the equation of exchange, how can national income grow even though the amount of money does NOT? A) Price level increases B) Real GDP decreases C) Velocity increases. D) Velocity decreases At an interest rate of 6%, how much will need to be invested today to have $10,000 in 5 years! A) $5,000 B) S7,473 C) $10,000 D) $13,382 12) Compounding refers to A) the calculation of interest rates after the compounding effect of taxes has been allowed for B) the paying back of both interest and principal during the life of a fixed-payment loan C) the process of earning interest on both the interest and the principal of an investment. D) the increased value of an investment that arises from the payment of periodic interest 13) A capital gain occurs when the A) coupon rate increases. B) current yield increases. C) price of an asset increases. D) yield to maturity increases. 14) The price of a financial asset equals the A) future value of all payments. B) sum of all payments. C) present value of all future payments. D) difference between the future value and present value of all payments. 15) If the current price of a bond is greater than its face value A) the market interest rate must be less than the coupon rate. B) an investor will receive a capital gain by holding the bond until maturity. C) the coupon rate must be less than the current yield. D) the market interest rate must be greater than the coupon rate. 16) A discount bond involves A) interest payments from the borrower to the lender periodically during the life of the loan. B) payment by the borrower to the lender of the face value of the loan at maturity. C) no payment of principal by the borrower to the lender. D) payment of interest by the borrower to the lender every six months during the life of the loan. 17) The bond demand curve slopes down because A) interest rates decline as bond prices decline. B) when bond prices are low, inflation is low. C) the lender is willing and able to purchase more bonds when the price of the bond is low. D) the borrower is willing and able to purchase more bonds when the price of the bond is low