Answered step by step

Verified Expert Solution

Question

1 Approved Answer

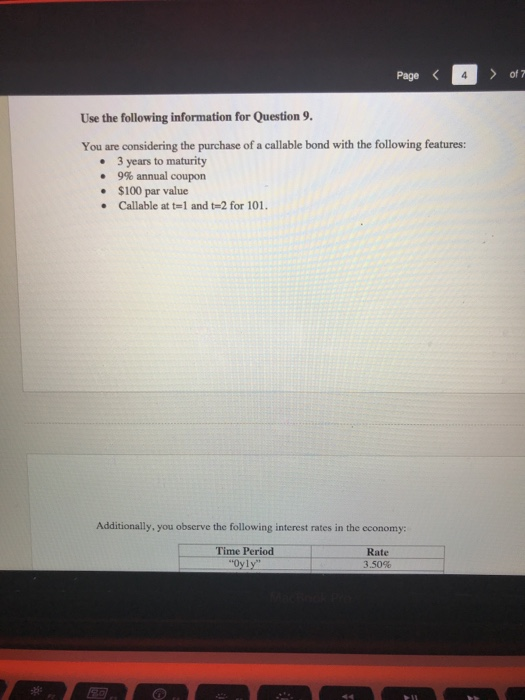

9. A-F Page of 7 Use the following information for Question 9. You are considering the purchase of a callable bond with the following features:

9. A-F

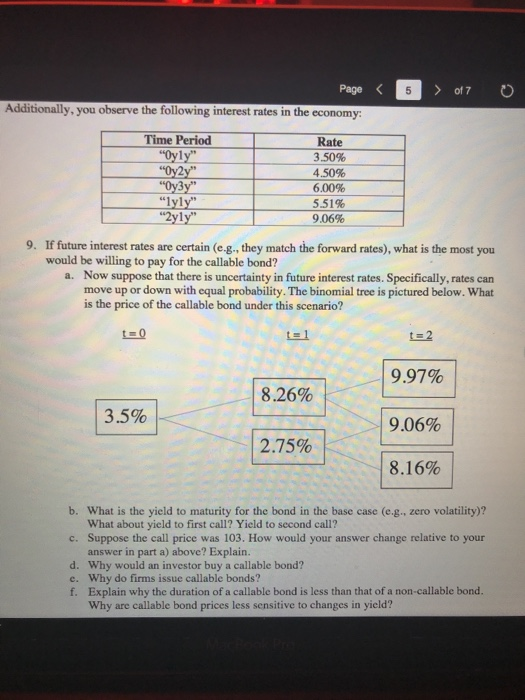

Page of 7 Use the following information for Question 9. You are considering the purchase of a callable bond with the following features: 3 years to maturity 9% annual coupon $100 par value Callable at t=1 and 2 for 101. Additionally, you observe the following interest rates in the economy: Time Period "Oyly" Rate 3.5096 Page of 7 0 Time Period "Oyly" "Oy2y" "Oy3y" "Iyly" "2yly" Rate 3.50% 4.50% 6.00% 5.51% 9.06% 9. If future interest rates are certain (e.g., they match the forward rates), what is the most you would be willing to pay for the callable bond? a. Now suppose that there is uncertainty in future interest rates. Specifically, rates can move up or down with equal probability. The binomial tree is pictured below. What is the price of the callable bond under this scenario? t=0 t=1 t=2 9.97% 8.26% 3.5% 9.06% | 2.75% 8.16% b. What is the yield to maturity for the bond in the base case (e... zero volatility)? What about yield to first call? Yield to second call? C. Suppose the call price was 103. How would your answer change relative to your answer in part a) above? Explain. d. Why would an investor buy a callable bond? e. Why do firms issue callable bonds? f. Explain why the duration of a callable bond is less than that of a non-callable bond. Why are callable bond prices less sensitive to changes in yield? Page of 7 Use the following information for Question 9. You are considering the purchase of a callable bond with the following features: 3 years to maturity 9% annual coupon $100 par value Callable at t=1 and 2 for 101. Additionally, you observe the following interest rates in the economy: Time Period "Oyly" Rate 3.5096 Page of 7 0 Time Period "Oyly" "Oy2y" "Oy3y" "Iyly" "2yly" Rate 3.50% 4.50% 6.00% 5.51% 9.06% 9. If future interest rates are certain (e.g., they match the forward rates), what is the most you would be willing to pay for the callable bond? a. Now suppose that there is uncertainty in future interest rates. Specifically, rates can move up or down with equal probability. The binomial tree is pictured below. What is the price of the callable bond under this scenario? t=0 t=1 t=2 9.97% 8.26% 3.5% 9.06% | 2.75% 8.16% b. What is the yield to maturity for the bond in the base case (e... zero volatility)? What about yield to first call? Yield to second call? C. Suppose the call price was 103. How would your answer change relative to your answer in part a) above? Explain. d. Why would an investor buy a callable bond? e. Why do firms issue callable bonds? f. Explain why the duration of a callable bond is less than that of a non-callable bond. Why are callable bond prices less sensitive to changes in yield Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started