Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please write out every single step for this problem. I am finding the binomial model very difficult to learn and I am coming to Chegg

Please write out every single step for this problem. I am finding the binomial model very difficult to learn and I am coming to Chegg to see if someone can help me with this, I need every little detail explained.

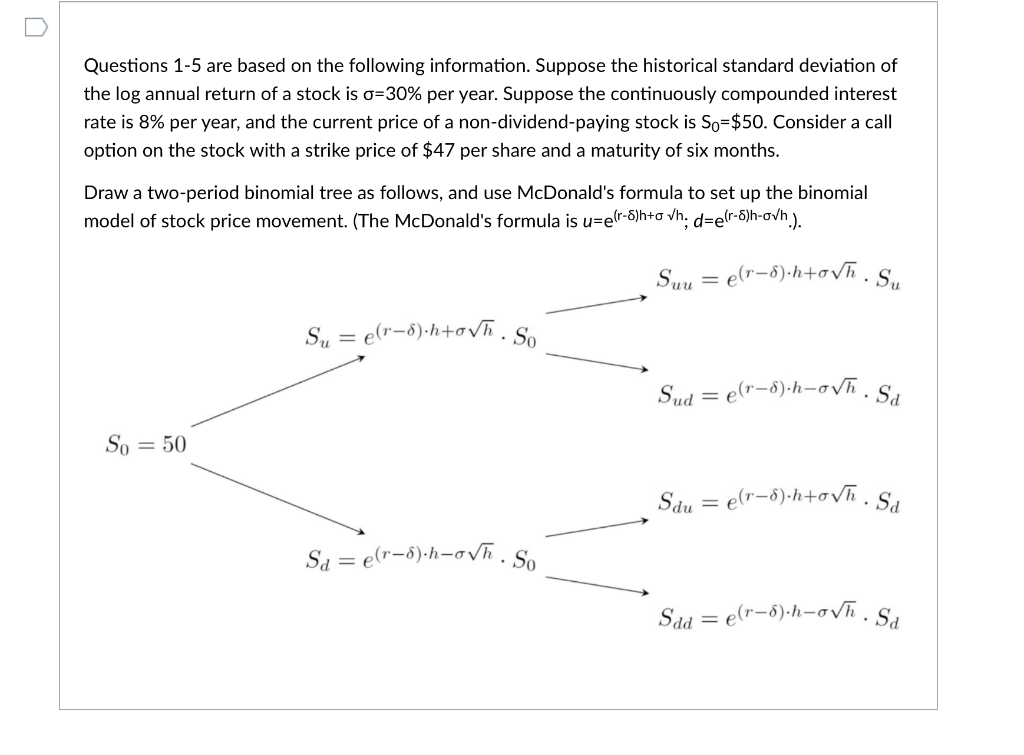

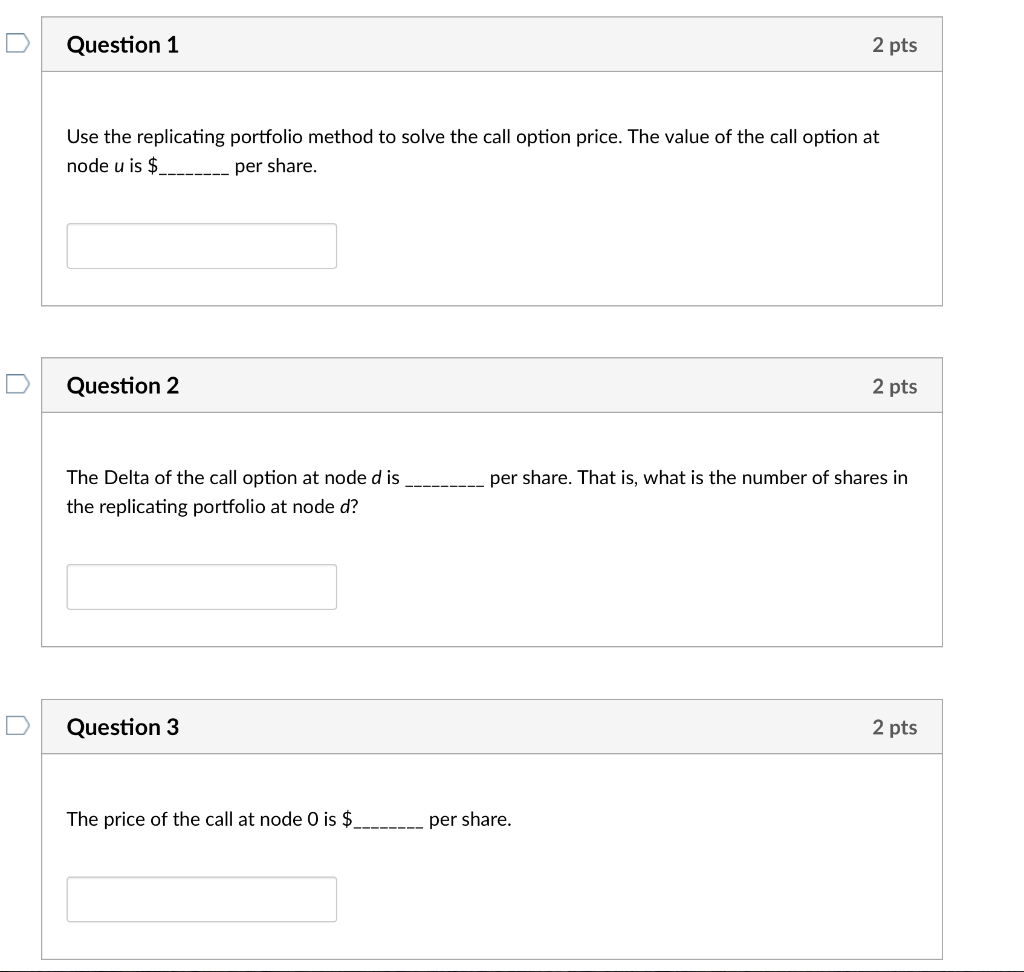

Questions 1-5 are based on the following information. Suppose the historical standard deviation of the log annual return of a stock is o=30% per year. Suppose the continuously compounded interest rate is 8% per year, and the current price of a non-dividend-paying stock is So=$50. Consider a call option on the stock with a strike price of $47 per share and a maturity of six months. Draw a two-period binomial tree as follows, and use McDonald's formula to set up the binomial model of stock price movement. (The McDonald's formula is u=e1r-)hto vh; d=e(r-)h-ovh.). Suu = e(r-8).htovh. Su Su = e(r8).htovn. So Sud = e(r8).h-ova. Sa So = 50 Sau = e(r-9) htov.sa Sa= e(r-o).h-ovh. S. Saa = e(r8).h-ova.se Question 1 2 pts Use the replicating portfolio method to solve the call option price. The value of the call option at node u is $ per share. Question 2 2 pts per share. That is, what is the number of shares in The Delta of the call option at node d is the replicating portfolio at node d? Question 3 2 pts The price of the call at node 0 is $ per share. Questions 1-5 are based on the following information. Suppose the historical standard deviation of the log annual return of a stock is o=30% per year. Suppose the continuously compounded interest rate is 8% per year, and the current price of a non-dividend-paying stock is So=$50. Consider a call option on the stock with a strike price of $47 per share and a maturity of six months. Draw a two-period binomial tree as follows, and use McDonald's formula to set up the binomial model of stock price movement. (The McDonald's formula is u=e1r-)hto vh; d=e(r-)h-ovh.). Suu = e(r-8).htovh. Su Su = e(r8).htovn. So Sud = e(r8).h-ova. Sa So = 50 Sau = e(r-9) htov.sa Sa= e(r-o).h-ovh. S. Saa = e(r8).h-ova.se Question 1 2 pts Use the replicating portfolio method to solve the call option price. The value of the call option at node u is $ per share. Question 2 2 pts per share. That is, what is the number of shares in The Delta of the call option at node d is the replicating portfolio at node d? Question 3 2 pts The price of the call at node 0 is $ per shareStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started