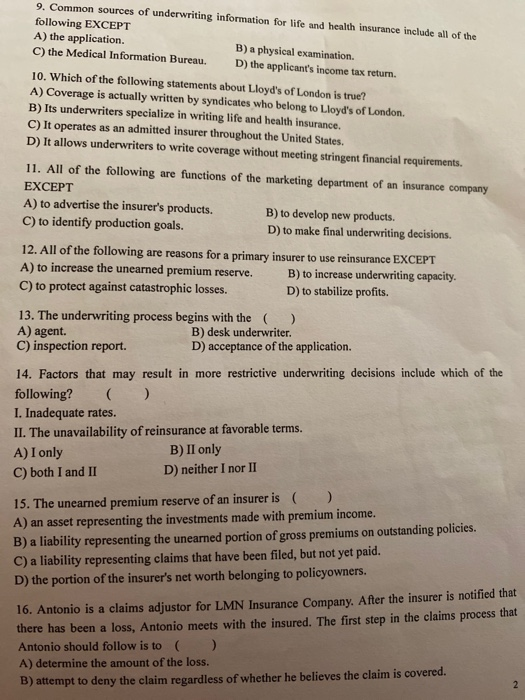

9. Common sources of underwriting information for life and health insurance include all of the following EXCEPT A) the application. B) a physical examination. C) the Medical Information Bureau. D) the applicant's income tax return. 10. Which of the following statements about Lloyd's of London is true? A) Coverage is actually written by syndicates who belong to Lloyd's of London. B) Its underwriters specialize in writing life and health insurance. C) It operates as an admitted insurer throughout the United States. D) It allows underwriters to write coverage without meeting stringent financial requirements. 11. All of the following are functions of the marketing department of an insurance company EXCEPT A) to advertise the insurer's products. B) to develop new products. C) to identify production goals. D) to make final underwriting decisions. 12. All of the following are reasons for a primary insurer to use reinsurance EXCEPT A) to increase the unearned premium reserve. B) to increase underwriting capacity. C) to protect against catastrophic losses. D) to stabilize profits. 13. The underwriting process begins with the ( ) A) agent. B) desk underwriter. C) inspection report. D) acceptance of the application. 14. Factors that may result in more restrictive underwriting decisions include which of the following? ( ) 1. Inadequate rates. II. The unavailability of reinsurance at favorable terms. A) I only B) II only C) both I and II D) neither I nor II 15. The unearned premium reserve of an insurer is ( ) A) an asset representing the investments made with premium income. b) a liability representing the unearned portion of gross premiums on outstanding policies. C) a liability representing claims that have been filed, but not yet paid. D) the portion of the insurer's net worth belonging to policyowners. 16. Antonio is a claims adjustor for LMN Insurance Company. After the insurer is notified that there has been a loss, Antonio meets with the insured. The first step in the claims process that Antonio should follow is to ( ) A) determine the amount of the loss. B) attempt to deny the claim regardless of whether he believes the claim is covered