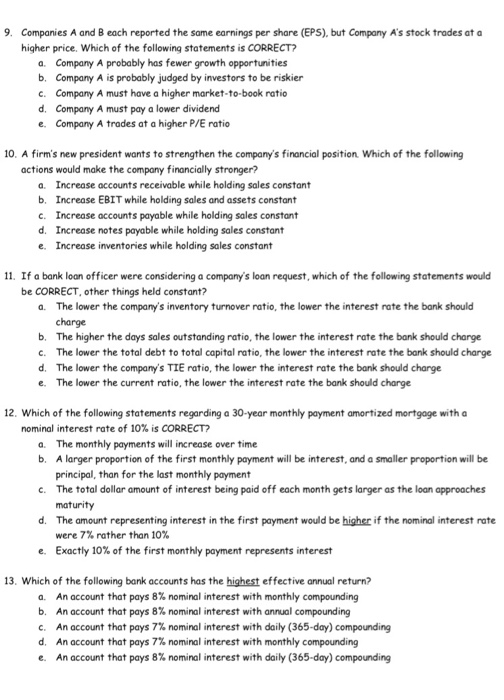

9. Companies A and Beach reported the same earnings per share (EPS), but Company A's stock trades at a higher price. Which of the following statements is CORRECT? a. Company A probably has fewer growth opportunities b. Company A is probably judged by investors to be riskier c. Company A must have a higher market-to-book ratio d. Company A must pay a lower dividend e Company A trades at a higher P/E ratio 10. A firm's new president wants to strengthen the company's financial position. Which of the following actions would make the company financially stronger? a. Increase accounts receivable while holding sales constant b. Increase EBIT while holding sales and assets constant c. Increase accounts payable while holding sales constant d. Increase notes payable while holding sales constant e. Increase inventories while holding sales constant 11. If a bank loan officer were considering a company's loan request, which of the following statements would be CORRECT, other things held constant? a. The lower the company's inventory turnover ratio, the lower the interest rate the bank should charge b. The higher the days sales outstanding ratio, the lower the interest rate the bank should charge c. The lower the total debt to total capital ratio, the lower the interest rate the bank should charge d. The lower the company's TIE ratio, the lower the interest rate the bank should charge e. The lower the current ratio, the lower the interest rate the bank should charge 12. Which of the following statements regarding a 30-year monthly payment amortized mortgage with a nominal interest rate of 10% is CORRECT? a. The monthly payments will increase over time b. A larger proportion of the first monthly payment will be interest, and a smaller proportion will be principal, than for the last monthly payment c. The total dollar amount of interest being paid off each month gets larger as the loan approaches maturity d. The amount representing interest in the first payment would be higher if the nominal interest rate were 7% rather than 10% e. Exactly 10% of the first monthly payment represents interest 13. Which of the following bank accounts has the highest effective annual return? a. An account that pays 8% nominal interest with monthly compounding b. An account that pays 8% nominal interest with annual compounding C. An account that pays 7% nominal interest with daily (365-day) compounding d. An account that pays 7% nominal interest with monthly compounding An account that pays 8% nominal interest with daily (365-day) compounding e