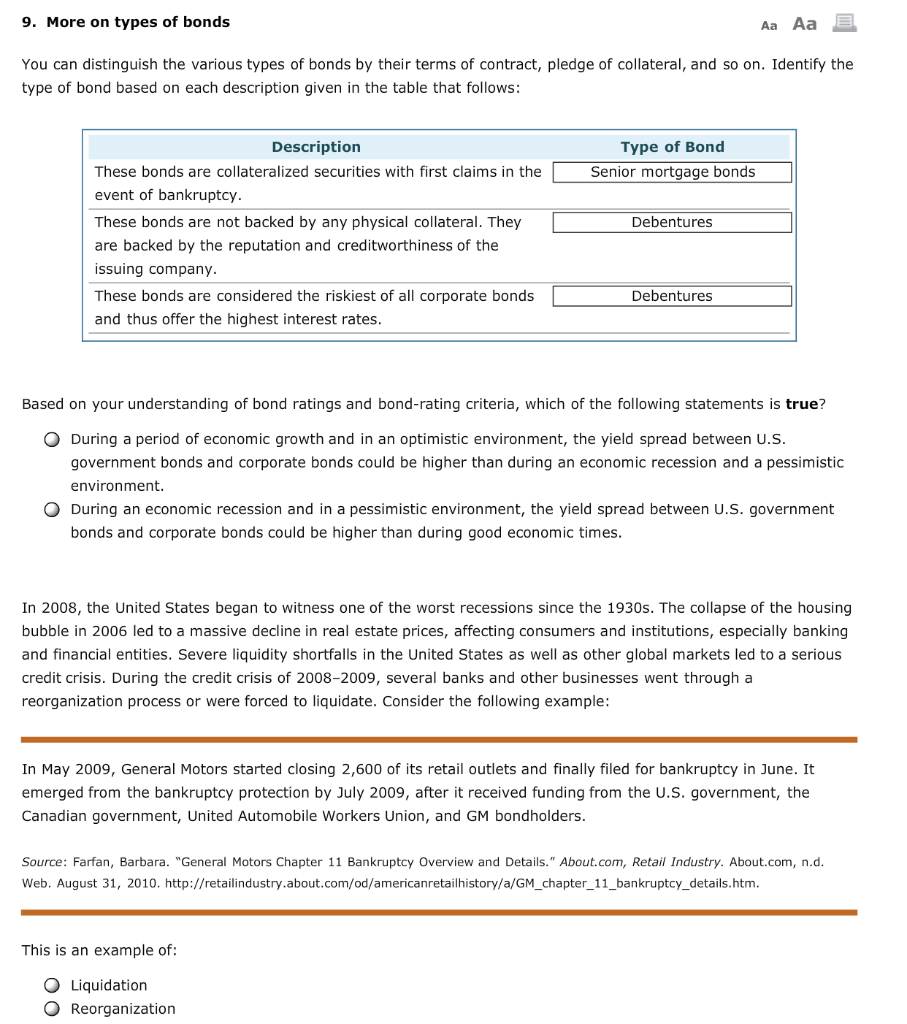

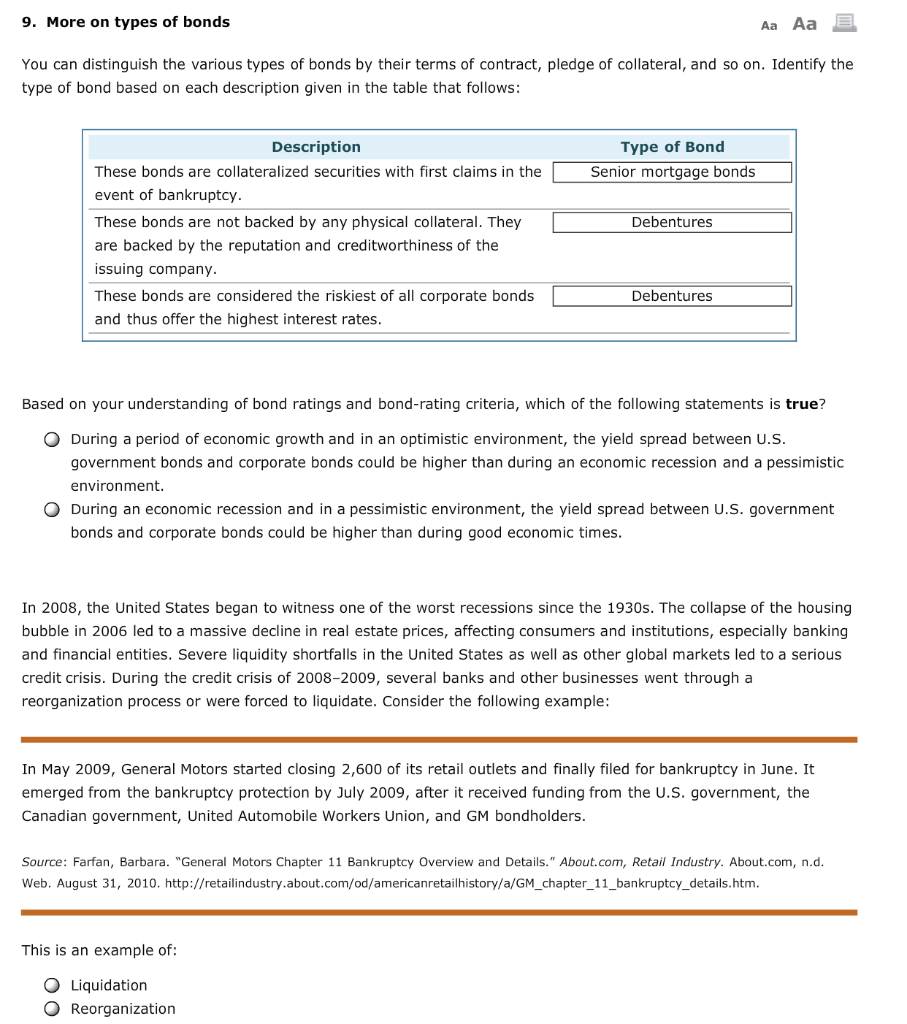

9. More on types of bonds Aa Aa E You can distinguish the various types of bonds by their terms of contract, pledge of collateral, and so on. Identify the type of bond based on each description given in the table that follows: Type of Bond Senior mortgage bonds Debentures Description These bonds are collateralized securities with first claims in the event of bankruptcy. These bonds are not backed by any physical collateral. They are backed by the reputation and creditworthiness of the issuing company. These bonds are considered the riskiest of all corporate bonds and thus offer the highest interest rates. Debentures Based on your understanding of bond ratings and bond-rating criteria, which of the following statements is true? During a period of economic growth and in an optimistic environment, the yield spread between U.S. government bonds and corporate bonds could be higher than during an economic recession and a pessimistic environment. During an economic recession and in a pessimistic environment, the yield spread between U.S. government bonds and corporate bonds could be higher than during good economic times. In 2008, the United States began to witness one of the worst recessions since the 1930s. The collapse of the housing bubble in 2006 led to a massive decline in real estate prices, affecting consumers and institutions, especially banking and financial entities. Severe liquidity shortfalls in the United States as well as other global markets led to a serious credit crisis. During the credit crisis of 2008-2009, several banks and other businesses went through a reorganization process or were forced to liquidate. Consider the following example: In May 2009, General Motors started closing 2,600 of its retail outlets and finally filed for bankruptcy in June. It emerged from the bankruptcy protection by July 2009, after it received funding from the U.S. government, the Canadian government, United Automobile Workers Union, and GM bondholders. Source: Farfan, Barbara. "General Motors Chapter 11 Bankruptcy Overview and Details." About.com, Retail Industry. About.com, n.d. Web. August 31, 2010. http://retailindustry.about.com/od/americanretailhistory/a/GM_chapter_11_bankruptcy_details.htm. This is an example of: O Liquidation O Reorganization