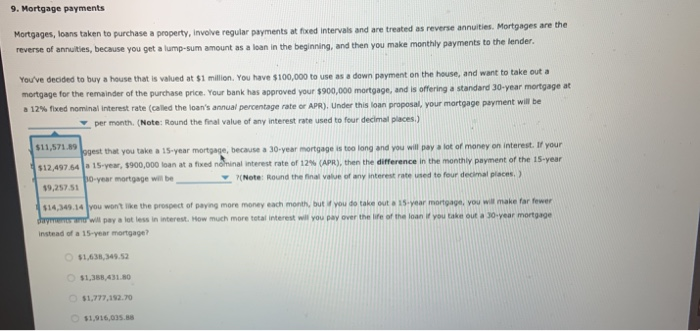

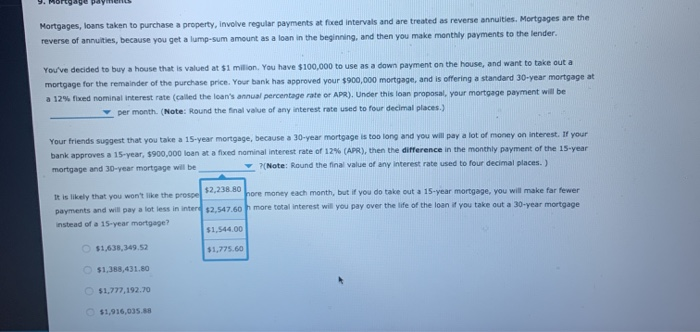

9. Mortgage payments Mortgages, loans taken to purchase a property, involve regular payments at fixed intervals and are treated as reverse annuities. Mortgages are the reverse of annuities, because you get a lump sum amount as a loan in the beginning, and then you make monthly payments to the lender. You've decided to buy a house that is valued at $1 million. You have $100,000 to use as a down payment on the house, and want to take out a mortgage for the remainder of the purchase price. Your bank has approved your $900,000 mortgage, and is offering a standard 30-year mortgage at a 12% fixed nominal interest rate (called the loan's annual percentage rate or APR). Under this loan proposal, your mortgage payment will be per month (Note: Round the final value of any interest rate used to four decimal places.) $11,571.9 ggest that you take a 15-year mortgage, because a 30-year mortgage is too long and you will pay a lot of money on interest. If your $12,497.54 a 15-year, 5900,000 loan at a fixed nominal interest rate of 12% (APR), then the difference in the monthly payment of the 15-year bo-year mortgage will be Note: Round the final value of any interest rate used to four decimal places) $14,349.14you want the prospect of paying more money each month, but you do take out a 15-year more you will make for fewer Jayments and will pay a lot less in interest. How much more total interest will you pay over the life of the loan if you take out a 30-year mortgage instead of a 15-year mortgage? 1.6352 $1,777,192.70 $1.9160 Mortgages, loans taken to purchase a property, involve regular payments at fixed intervals and are treated as reverse annuities. Mortgages are the reverse of annuities, because you get a lump-sum amount as a loan in the beginning, and then you make monthly payments to the lender. You've decided to buy a house that is valued at $1 million. You have $100,000 to use as a down payment on the house, and want to take out a mortgage for the remainder of the purchase price. Your bank has approved your $900,000 mortgage, and is offering a standard 30-year mortgage at a 12% fixed nominal interest rate (called the loan's annual percentage rate or APR). Under this loan proposal, your mortgage payment will be per month (Note: Round the final value of any interest rate used to four decimal places.) Your friends suggest that you take a 15-year mortgage, because a 30-year mortgage is too long and you will pay a lot of money on interest. If your bank approves a 15-year, $900,000 loan at a fixed nominal interest rate of 12% (APR), then the difference in the monthly payment of the 15-year mortgage and 30-year mortgage will be (Note: Round the final value of any interest rate used to four decimal places.) pore money each month, but if you do take out a 15-year mortgage you will make far fewer more total interest will you pay over the life of the loan if you take out a 30-year mortgage It is that you won't $2235.80 payments and will pay a lot less in inter 52,547.60 instead of a 15-year mortgage? $1,544.00 51.638,349.52 $1,775.60 $1.358.431.80 $1,777,192.70 $1,916,035.88