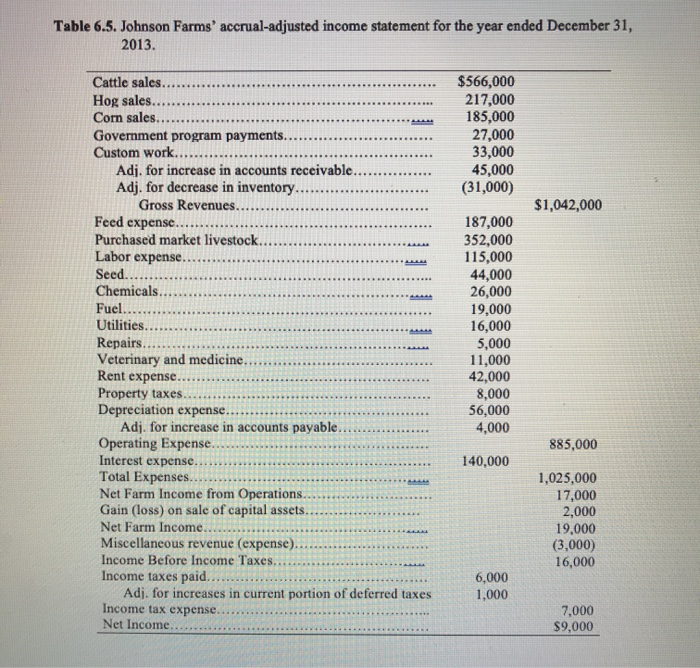

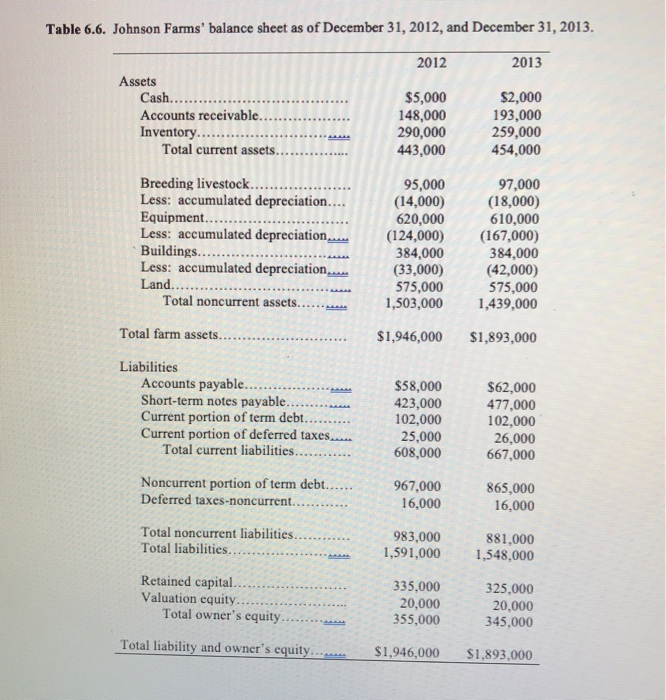

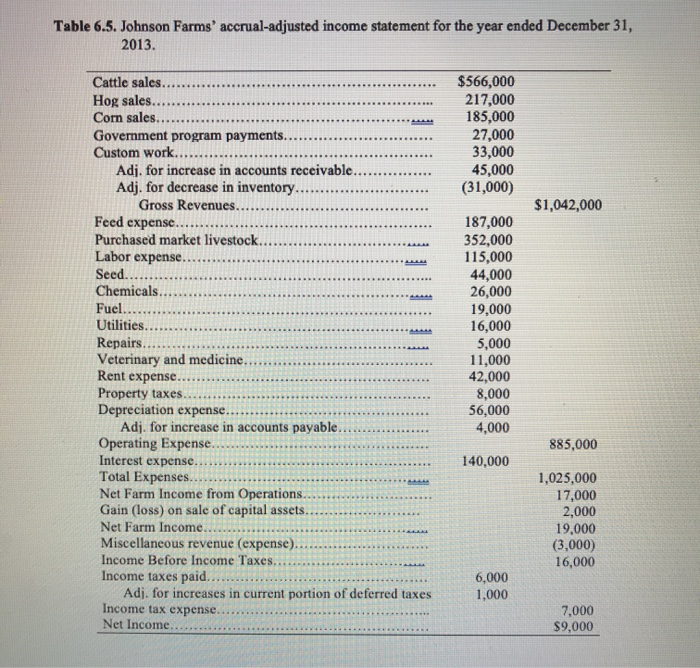

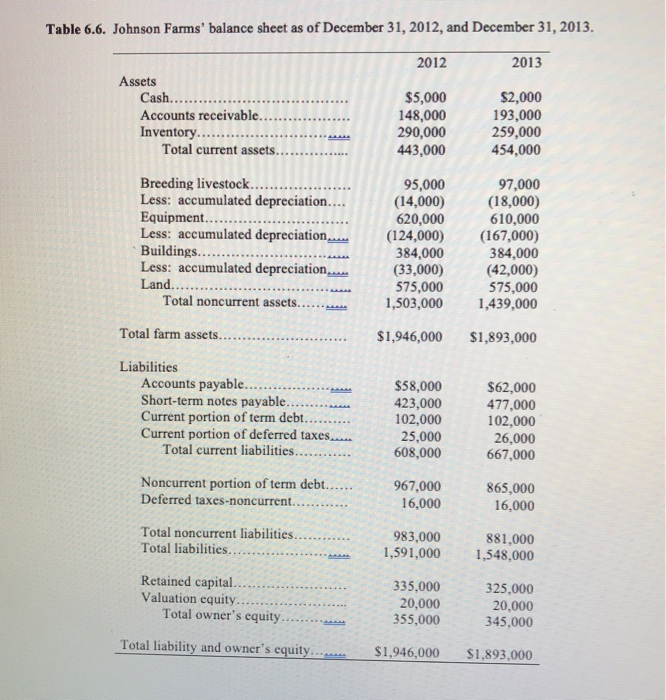

The accountant for Johnson Farms has prepared the following accrual-adjusted income statement (Table 6.5) and balance sheets (Table 6.6). Please refer to the tables provided at the end of this exercise.

Supplemental information:

(i) Owner withdrawals for unpaid labor and management were equal to $19,000 during 2013.

Using the income statement and balance sheets for Johnson Farms, calculate the ratios and measures listed below for 2013. Set up the formulas and show all the numbers you use in you use in your calculations:

a. Current ratio

b. Working capital

c. Debt-to-equity ratio

d. Debt-to-asset ratio

e. Equity-to-asset ratio

f. Rate of return on farm assets

g. Rate of return on farm equity

h. Operating profit margin ratio

i. Asset-turnover ratio

j. Operating-expense ratio

k. Depreciation-expense ratio

l. Interest-expense ratio

m. Net-farm-income-from-operations ratio

Table 6.5. Johnson Farms' accrual-adjusted income statement for the year ended December 31, 2013. $566,000 217,000 185,000 27,000 33,000 45,000 (31,000) Cattle sales... Hog sales... Corn sales.. Government program payments... Custom work...... Adj. for increase in accounts receivable....... Adj. for decrease in inventory... Gross Revenues....... Feed expense. Purchased market livestock.. Labor expense. Seed....... Chemicals.. Fuel.... Utilities... $1,042,000 187,000 352,000 115,000 44,000 26,000 19,000 16,000 Repairs....... . 5,000 11,000 42,000 8,000 56,000 4,000 885,000 140,000 Veterinary and medicine..... Rent expense... Property taxes.... Depreciation expense.. Adj. for increase in accounts payable... Operating Expense. Interest expense.... Total Expenses Net Farm Income from Operations.. Gain (loss) on sale of capital assets... Net Farm Income............. Miscellaneous revenue (expense)..... Income Before Income Taxes... Income taxes paid............ Adj. for increases in current portion of deferred taxes Income tax expense. Net Income.... 1,025,000 17,000 2,000 19.000 (3,000) 16,000 6,000 1,000 7,000 $9,000 Table 6.6. Johnson Farms' balance sheet as of December 31, 2012, and December 31, 2013. 2012 2013 Assets Cash..................... Accounts receivable.......... Inventory................ Total current assets..... $5,000 148,000 290,000 443,000 $2,000 193,000 259,000 454,000 Breeding livestock............. Less: accumulated depreciation.... Equipment............... Less: accumulated depreciation Buildings...... Less: accumulated depreciation..... Land. Total noncurrent assets. 95,000 (14,000) 620,000 (124,000) 384,000 (33,000) 575,000 1,503,000 97,000 (18,000) 610,000 (167,000) 384,000 (42,000) 575,000 1,439,000 AUDI SVD. Total farm assets..... $1,946,000 $1,893,000 Liabilities Accounts payable......... Short-term notes payable. Current portion of term debt. Current portion of deferred taxes.... Total current liabilities. $58,000 423,000 102,000 25,000 608,000 $62,000 477,000 102,000 26,000 667,000 Noncurrent portion of term debt.... Deferred taxes-noncurrent. 967,000 16,000 865,000 16,000 Total noncurrent liabilities.... Total liabilities..... 983,000 1,591,000 881,000 1,548,000 Retained capital....... Valuation equity.... Total owner's equity... 335,000 20,000 355,000 325,000 20.000 345,000 Total liability and owner's equity........ $1,946,000 $1.893.000