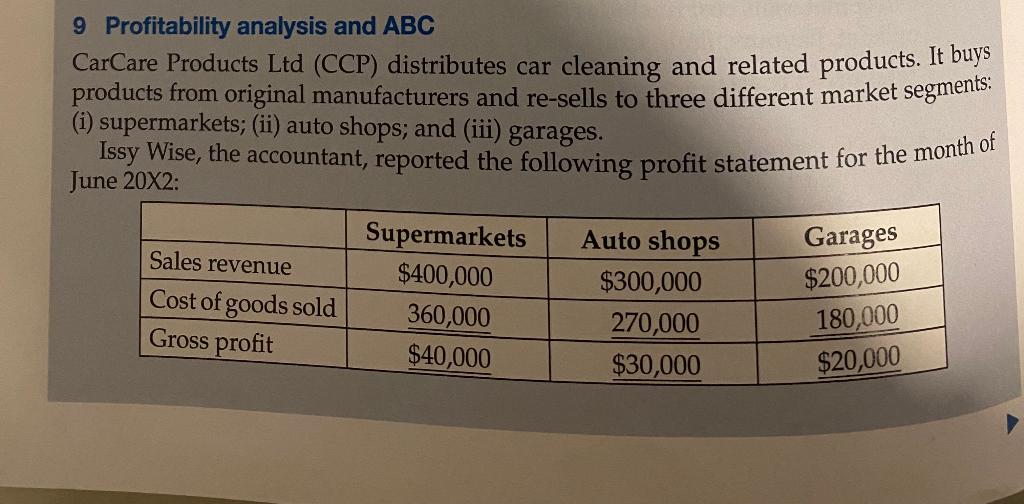

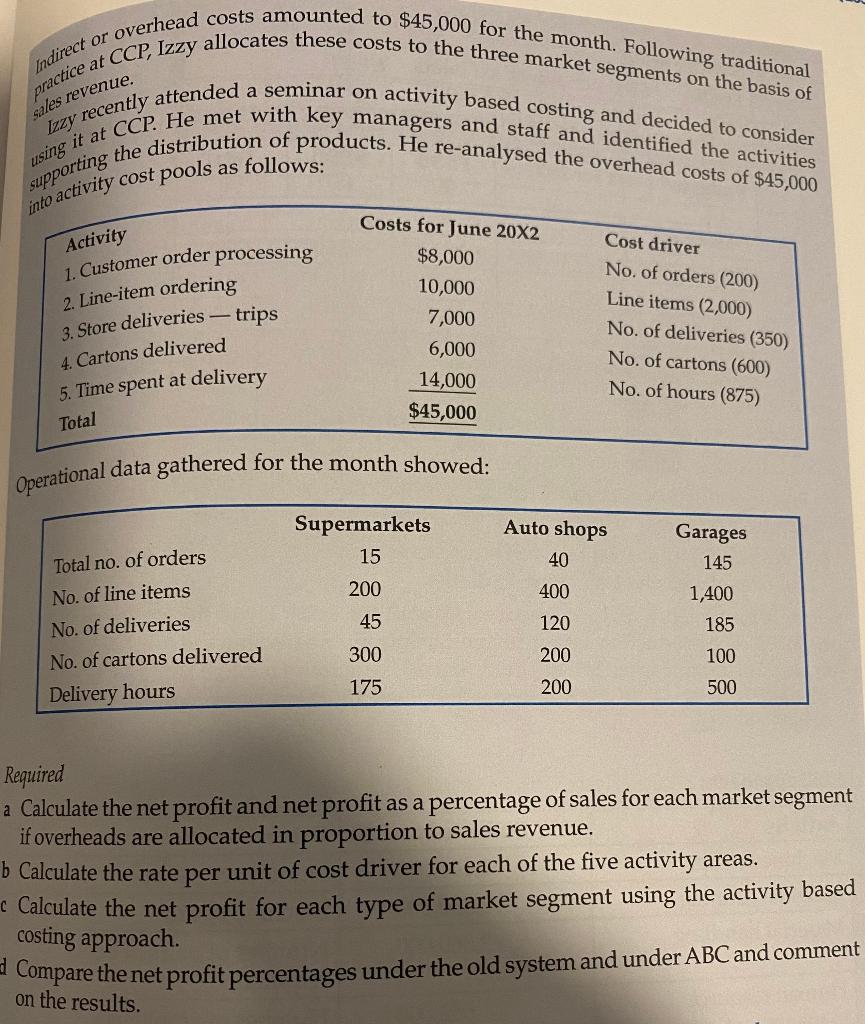

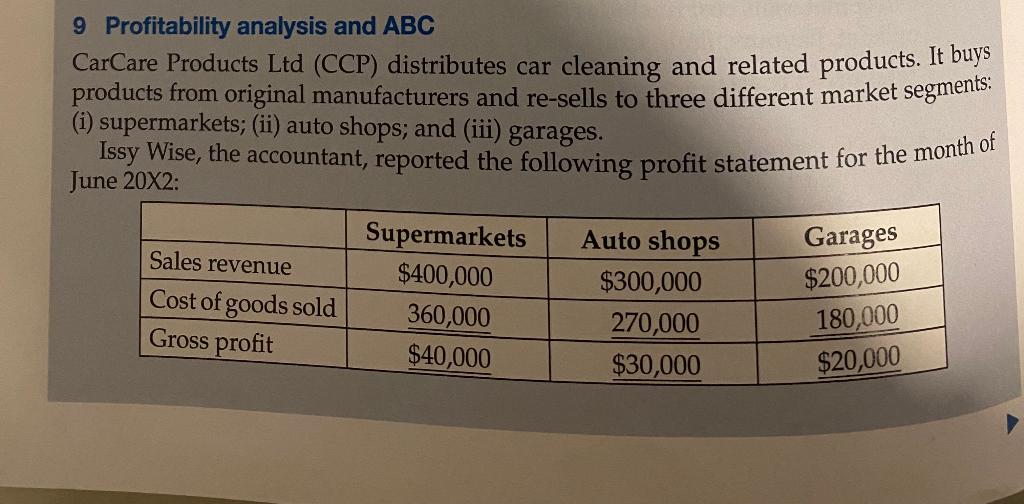

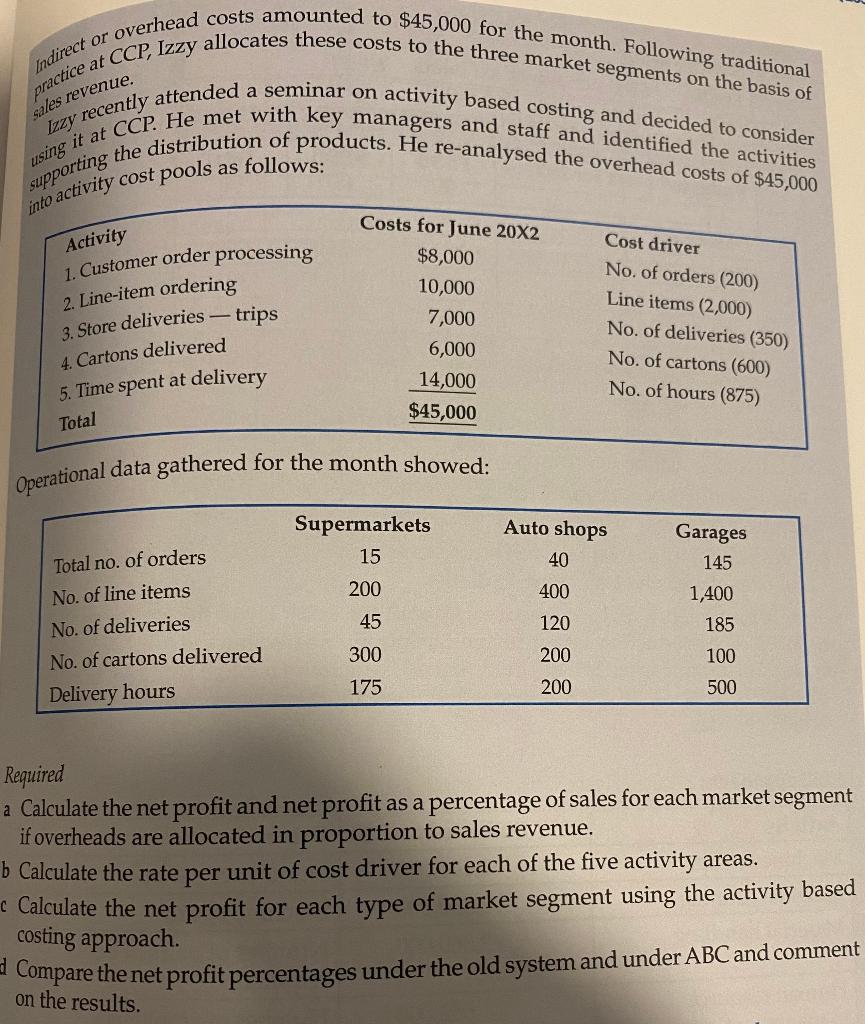

9 Profitability analysis and ABC CarCare Products Ltd (CCP) distributes car cleaning and related products. It buys products from original manufacturers and re-sells to three different market segments: (i) supermarkets; (ii) auto shops; and (iii) garages. Issy Wise, the accountant, reported the following profit statement for the month of June 20X2: In direct of overhead costs amounted to $45,000 for the month. Following traditional pratice at CCP, Izzy allocates these costs to the three market segments on the basis of 12zy recently attended a seminar on activity based costing and decided to consider using it at CCP. He met with key managers and staff and identified the activities supporting the distribution of products. He re-analysed the overhead costs of $45,000 tivity cost pools as follows: Operational data gathered for the month showed: Required a Calculate the net profit and net profit as a percentage of sales for each market segment if overheads are allocated in proportion to sales revenue. b Calculate the rate per unit of cost driver for each of the five activity areas. Calculate the net profit for each type of market segment using the activity based costing approach. Compare the net profit percentages under the old system and under ABC and comment on the results. 9 Profitability analysis and ABC CarCare Products Ltd (CCP) distributes car cleaning and related products. It buys products from original manufacturers and re-sells to three different market segments: (i) supermarkets; (ii) auto shops; and (iii) garages. Issy Wise, the accountant, reported the following profit statement for the month of June 20X2: In direct of overhead costs amounted to $45,000 for the month. Following traditional pratice at CCP, Izzy allocates these costs to the three market segments on the basis of 12zy recently attended a seminar on activity based costing and decided to consider using it at CCP. He met with key managers and staff and identified the activities supporting the distribution of products. He re-analysed the overhead costs of $45,000 tivity cost pools as follows: Operational data gathered for the month showed: Required a Calculate the net profit and net profit as a percentage of sales for each market segment if overheads are allocated in proportion to sales revenue. b Calculate the rate per unit of cost driver for each of the five activity areas. Calculate the net profit for each type of market segment using the activity based costing approach. Compare the net profit percentages under the old system and under ABC and comment on the results