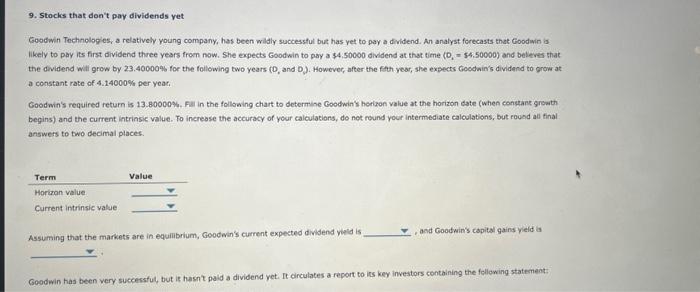

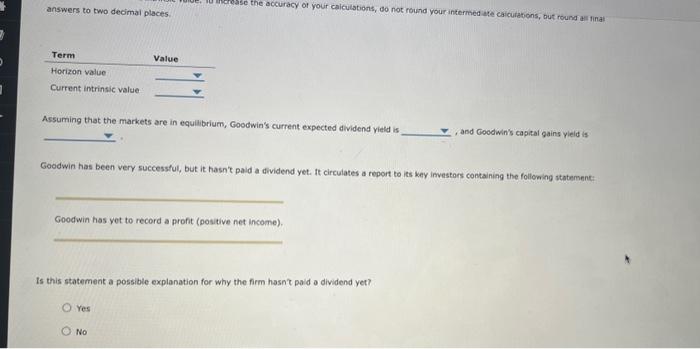

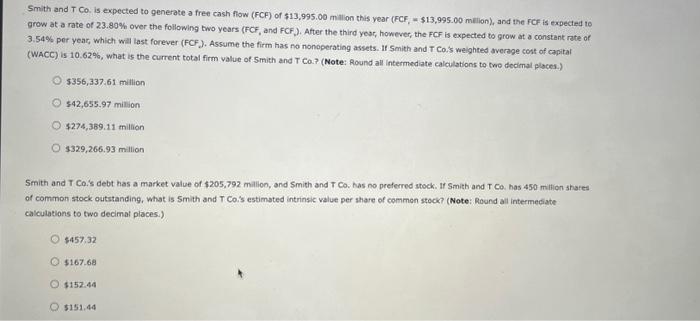

9. Stocks that don't pay dividends yet Goodwin Technolof es, a relatively young company, has been wildly successful but has yet to pay a dividend. An analyst forecasts that Goodinin is likely to pay its first dividend three years froen now. She expects Goodwin to pay a $4,50000 dividend at that time (0, =54,50000 ) and beleves that the dividend will grow by 23.40000$ for the following two years (D, and D). However, after the fath year, she expects Goedinin's dividend to grow at a constant rate of 4.14000% per yeac. Coodrin's required return is 13.80000\%. Fill in the following chart to determine Coodwin's horison value at the horizon date (when constans growth begins) and the current intrinsic value. To increase the accuracy of your calculations, do not round your intermediate caloulabions, but round ali final answers to two decimal places. Assuming that the markets are in equilibrium, Good win's current expected dividend vild is and Goodwin's capital gains yield is Goodwin has been wery successful, but is hasnt pald a dividend yet. It circulates a report to ins key investors containing the following statement: answers to two decimai places. Assuming that the markets are in equilibrium, Goodwin's current expected dividend yield is , and coodwin's capital gains yleld is Goodwin has been very successful, but it hasn't paid a dividend yet. ft circulates a report to its key imvestors containing the folloming statement: Goodwin has yet to record a proft (positive net income). Is this statement a possible explanation for why the firm hasnt paid a dividend yet? Yes No Smith and T Co. is expected to generate a free cash flow (FCF) of $13,995.00 milion this year (FCF, = $13,995.00 mellon), and the FCF is expected to grow at a rate of 23.80% over the following two years (FCF, and FCF, . After the third year, however, the FCF is expected to grow at a constant rate of 3.54\% per year, which will last forever (FCF). Assume the firm has no nonoperating assets. If Smith and T Co.s welghted average cost of capital (WACC) is 10.62%, what is the current total firm value of Smith and T Co.? (Note: Round all intermediate calculations to two docimal places.) $356,337.61 mitlion 542,655.97 milion $274,369.11 million 3329,266.93m illion Smith and T Co.'s debt has a market value of 1205,792 millon, and Smith and T Co. has no preferred stock. If Smith and T Co. has 450 miltion shates of common stock outstanding, what is Smith and T Co.'s estimated intrinsic value per share of common stock? (Note: Round all intermediate calculations to two decimat places.) 4457,32 $167.68 115249 5151,44