Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9) What is the function of the gap-filling rule used under the UCC? A) It assures the offeree that goods will be held open

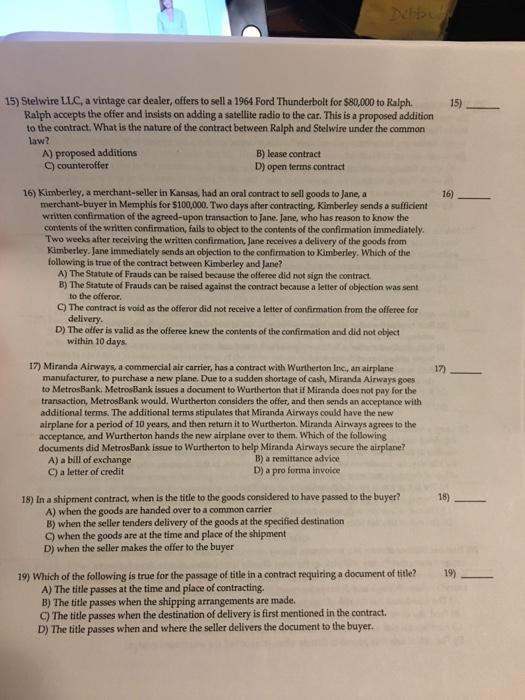

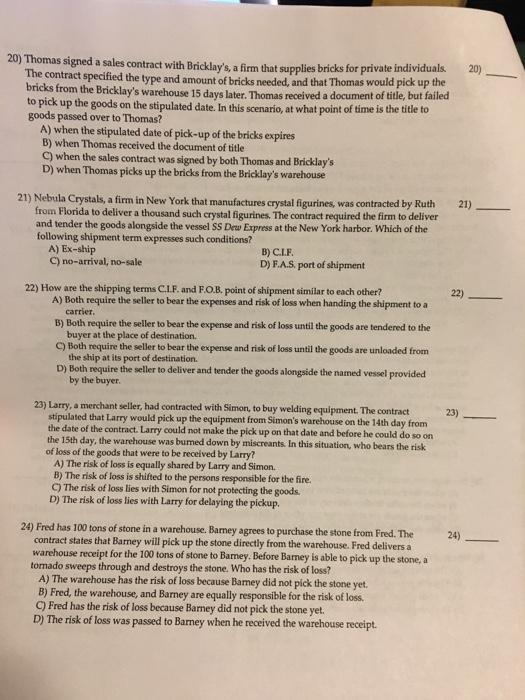

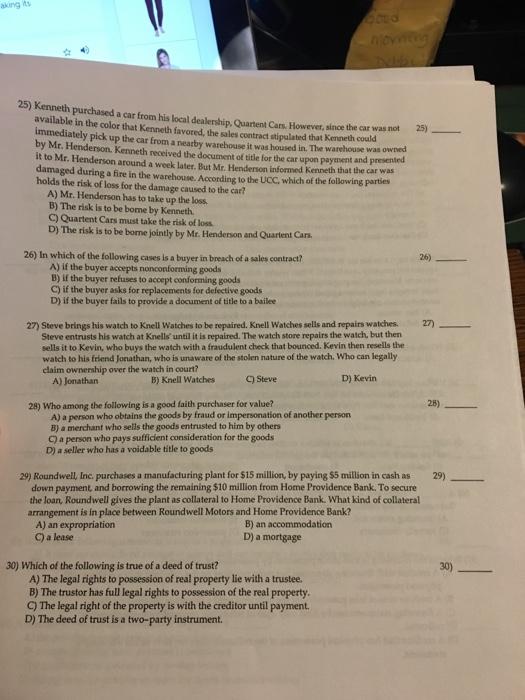

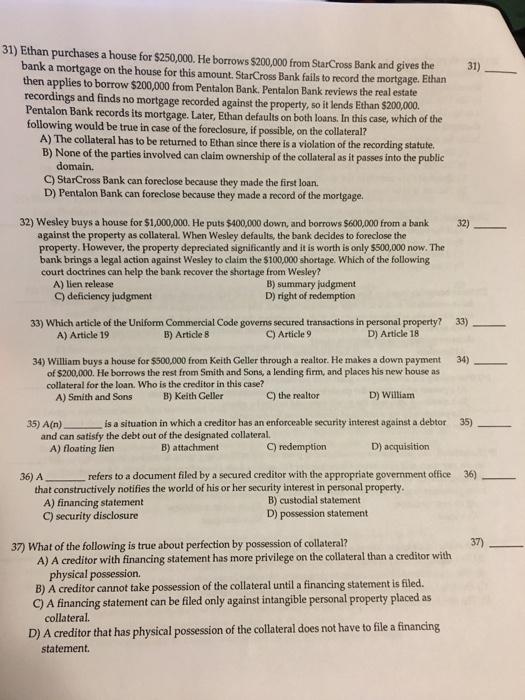

9) What is the function of the gap-filling rule used under the UCC? A) It assures the offeree that goods will be held open for a reasonable time. B) It helps open terms be read into a contract. C) It protects the offeror from additional terms that may be added by the offeree. D) It helps a merchant revoke his offer even after acceptance. 10) If an order or other offer to buy goods requires immediate or current shipment, the offer is accepted 10) A) if the seller reasonably notifies the buyer that the shipment is an accommodation B) after the buyer has reasonable opportunities to inspect the goods 12) C) if the seller promptly ships either conforming goods D) after the seller sends a written confirmation within 3 months of the contracting 11) A written modification to an oral contract is required if the oral modification to the contract B) involves specially manufactured goods D) is worth less than $500 in costs A) has been performed to an extent C) is within the Statutes of Frauds is a rule that says that if a written contract is a complete and final statement of the parties 12) agreement, any prior or contemporaneous oral or written statements that alter, contradict, or are in addition to the terms of the written contract are inadmissible in court regarding a dispute over the contract. A) Gap-filling rule Parol evidence rule B) Open terms rule D) Firm offer rule 13) Miranda Airways, a commercial air carrier, has a contract with Wurtherton, Inc., an airplane manufacturer, to purchase a new plane. Due to a sudden shortage of cash, Miranda Airways goes to MetrosBank. MetrosBank issues a document to Wurtherton that if Miranda does not pay for the transaction, MetrosBank would. Wurtherton considers the offer, and then sends an acceptance with additional terms. The additional terms stipulates that Miranda Airways could have the new. airplane for a period of 10 years, and then return it to Wurtherton. Miranda Airways agrees to the acceptance, and Wurtherton hands the new airplane over to them. What UCC rule was applied when Miranda Airways agreed to the additional terms acceptance provided by Wurtherton? A) battle of the forms rule C) mirror image rule B) firm offer rule D) gap-filling rule 11) 13) 14) Stelwire LLC, a vintage car dealer, advertises the sale of a 1964 Ford Thunderbolt. Ralph responds to the advertisement with an offer of $80,000 for the car. Stelwire signs a written assurance to keep that offer open to Ralph for a fortnight. Five days before the fortnight is up, Stelwire sells the car to another buyer. At the end of the fortnight period, Ralph tenders $80,000 for the car, but the car has already been sold. Ralph then buys the same model car from another dealer for $90,000 and sues Stelwire for breach of contract. The court rules that Stelwire is liable to Ralph for breach of contract, and orders Stelwire to pay Ralph the difference of $10,000 he paid extra to the second dealer for the car. Which of the following rules governs the execution of this contract? A) mirror image rule B) firm offer rule C) battle of the forms rule D) gap-filling rule 14) 15) Stelwire LLC, a vintage car dealer, offers to sell a 1964 Ford Thunderbolt for $80,000 to Ralph. Ralph accepts the offer and insists on adding a satellite radio to the car. This is a proposed addition to the contract. What is the nature of the contract between Ralph and Stelwire under the common law? A) proposed additions C) counteroffer B) lease contract D) open terms contract 16) Kimberley, a merchant-seller in Kansas, had an oral contract to sell goods to Jane, a merchant-buyer in Memphis for $100,000. Two days after contracting, Kimberley sends a sufficient written confirmation of the agreed-upon transaction to Jane. Jane, who has reason to know the contents of the written confirmation, fails to object to the contents of the confirmation immediately. Two weeks after receiving the written confirmation, Jane receives a delivery of the goods from Kimberley. Jane immediately sends an objection to the confirmation to Kimberley. Which of the following is true of the contract between Kimberley and Jane? A) The Statute of Frauds can be raised because the offeree did not sign the contract. B) The Statute of Frauds can be raised against the contract because a letter of objection was sent to the offeror. C) The contract is void as the offeror did not receive a letter of confirmation from the offeree for delivery. D) The offer is valid as the offeree knew the contents of the confirmation and did not object within 10 days. 17) Miranda Airways, a commercial air carrier, has a contract with Wurtherton Inc., an airplane manufacturer, to purchase a new plane. Due to a sudden shortage of cash, Miranda Airways goes to MetrosBank. MetrosBank issues a document to Wurtherton that if Miranda does not pay for the transaction, MetrosBank would. Wurtherton considers the offer, and then sends an acceptance with t additional terms. The additional terms stipulates that Miranda Airways could have the new airplane for a period of 10 years, and then return it to Wurtherton. Miranda Airways agrees to the acceptance, and Wurtherton hands the new airplane over to them. Which of the following documents did MetrosBank issue to Wurtherton to help Miranda Airways secure the airplane? A) a bill of exchange C) a letter of credit B) a remittance advice. D) a pro forma invoice 18) In a shipment contract, when is the title to the goods considered to have passed to the buyer? A) when the goods are handed over to a common carrier B) when the seller tenders delivery of the goods at the specified destination C) when the goods are at the time and place of the shipment D) when the seller makes the offer to the buyer 19) Which of the following is true for the passage of title in a contract requiring a document of title? A) The title passes at the time and place of contracting. B) The title passes when the shipping arrangements are made. C) The title passes when the destination of delivery is first mentioned in the contract. D) The title passes when and where the seller delivers the document to the buyer. 16) 17) 15) 18) 19) 20) Thomas signed a sales contract with Bricklay's, a firm that supplies bricks for private individuals. The contract specified the type and amount of bricks needed, and that Thomas would pick up the bricks from the Bricklay's warehouse 15 days later. Thomas received a document of title, but failed to pick up the goods on the stipulated date. In this scenario, at what point of time is the title to goods passed over to Thomas? A) when the stipulated date of pick-up of the bricks expires B) when Thomas received the document of title - C) when the sales contract was signed by both Thomas and Bricklay's D) when Thomas picks up the bricks from the Bricklay's warehouse 21) Nebula Crystals, a firm in New York that manufactures crystal figurines, was contracted by Ruth from Florida to deliver a thousand such crystal figurines. The contract required the firm to deliver and tender the goods alongside the vessel SS Dew Express at the New York harbor. Which of the following shipment term expresses such conditions? A) Ex-ship C) no-arrival, no-sale B) C.LF. D) F.A.S. port of shipment 22) How are the shipping terms C.L.F. and F.O.B. point of shipment similar to each other? A) Both require the seller to bear the expenses and risk of loss when handing the shipment to a carrier. B) Both require the seller to bear the expense and risk of loss until the goods are tendered to the buyer at the place of destination. C) Both require the seller to bear the expense and risk of loss until the goods are unloaded from the ship at its port of destination. D) Both require the seller to deliver and tender the goods alongside the named vessel provided by the buyer. 23) Larry, a merchant seller, had contracted with Simon, to buy welding equipment. The contract stipulated that Larry would pick up the equipment from Simon's warehouse on the 14th day from the date of the contract. Larry could not make the pick up on that date and before he could do so on the 15th day, the warehouse was bumed down by miscreants. In this situation, who bears the risk of loss of the goods that were to be received by Larry? A) The risk of loss is equally shared by Larry and Simon. B) The risk of loss is shifted to the persons responsible for the fire. C) The risk of loss lies with Simon for not protecting the goods. D) The risk of loss lies with Larry for delaying the pickup. 24) Fred has 100 tons of stone in a warehouse. Barney agrees to purchase the stone from Fred. The contract states that Barney will pick up the stone directly from the warehouse. Fred delivers a warehouse receipt for the 100 tons of stone to Barney. Before Barney is able to pick up the stone, a tornado sweeps through and destroys the stone. Who has the risk of loss? A) The warehouse has the risk of loss because Barney did not pick the stone yet. B) Fred, the warehouse, and Barney are equally responsible for the risk of loss. C) Fred has the risk of loss because Barney did not pick the stone yet. D) The risk of loss was passed to Barney when he received the warehouse receipt. 21) 22) 23) 20) 24) aking its 25) Kenneth purchased a car from his local dealership, Quartent Cars. However, since the car was not available in the color that Kenneth favored, the sales contract stipulated that Kenneth could immediately pick up the car from a nearby warehouse it was housed in. The warehouse was owned by Mr. Henderson, Kenneth received the document of title for the car upon payment and presented it to Mr. Henderson around a week later. But Mr. Henderson informed Kenneth that the car was damaged during a fire in the warehouse. According to the UCC, which of the following parties holds the risk of loss for the damage caused to the car? A) Mr. Henderson has to take up the loss B) The risk is to be borne by Kenneth C) Quartent Cars must take the risk of loss D) The risk is to be borne jointly by Mr. Henderson and Quartent Cars. 26) In which of the following cases is a buyer in breach of a sales contract? A) if the buyer accepts nonconforming goods B) if the buyer refuses to accept conforming goods C) if the buyer asks for replacements for defective goods D) if the buyer fails to provide a document of title to a bailee 27) Steve brings his watch to Knell Watches to be repaired. Knell Watches sells and repairs watches. Steve entrusts his watch at Knells' until it is repaired. The watch store repairs the watch, but then sells it to Kevin, who buys the watch with a fraudulent check that bounced. Kevin then resells the watch to his friend Jonathan, who is unaware of the stolen nature of the watch. Who can legally. claim ownership over the watch in court? A) Jonathan B) Knell Watches C) Steve D) Kevin 28) Who among the following is a good faith purchaser for value? A) a person who obtains the goods by fraud or impersonation of another person B) a merchant who sells the goods entrusted to him by others C) a person who pays sufficient consideration for the goods D) a seller who has a voidable title to goods A) an expropriation C) a lease 25) 29) Roundwell, Inc. purchases a manufacturing plant for $15 million, by paying $5 million in cash as down payment, and borrowing the remaining $10 million from Home Providence Bank. To secure the loan, Roundwell gives the plant as collateral to Home Providence Bank. What kind of collateral arrangement is in place between Roundwell Motors and Home Providence Bank? B) an accommodation D) a mortgage 30) Which of the following is true of a deed of trust? A) The legal rights to possession of real property lie with a trustee. B) The trustor has full legal rights to possession of the real property. C) The legal right of the property is with the creditor until payment. D) The deed of trust is a two-party instrument. 26) 27) 28) 29) 30) 31) Ethan purchases a house for $250,000. He borrows $200,000 from StarCross Bank and gives the bank a mortgage on the house for this amount. StarCross Bank fails to record the mortgage. Ethan then applies to borrow $200,000 from Pentalon Bank. Pentalon Bank reviews the real estate recordings and finds no mortgage recorded against the property, so it lends Ethan $200,000. Pentalon Bank records its mortgage. Later, Ethan defaults on both loans. In this case, which of the following would be true in case of the foreclosure, if possible, on the collateral? A) The collateral has to be returned to Ethan since there is a violation of the recording statute. B) None of the parties involved can claim ownership of the collateral as it passes into the public domain. C) StarCross Bank can foreclose because they made the first loan. D) Pentalon Bank can foreclose because they made a record of the mortgage. 32) Wesley buys a house for $1,000,000. He puts $400,000 down, and borrows $600,000 from a bank against the property as collateral. When Wesley defaults, the bank decides to foreclose the property. However, the property depreciated significantly and it is worth is only $500,000 now. The bank brings a legal action against Wesley to claim the $100,000 shortage. Which of the following court doctrines can help the bank recover the shortage from Wesley? A) lien release C) deficiency judgment B) summary judgment D) right of redemption 34) William buys a house for $500,000 from Keith Geller through a realtor. He makes a down payment of $200,000. He borrows the rest from Smith and Sons, a lending firm, and places his new house as collateral for the loan. Who is the creditor in this case? A) Smith and Sons B) Keith Geller C) the realtor D) William 33) Which article of the Uniform Commercial Code governs secured transactions in personal property? 33) A) Article 19 B) Article 8 C) Article 9 D) Article 18 31) A) financing statement C) security disclosure 32) 35) A(n) is a situation in which a creditor has an enforceable security interest against a debtor 35) and can satisfy the debt out of the designated collateral. A) floating lien B) attachment C) redemption D) acquisition 37) What of the following is true about perfection by possession of collateral? A) A creditor with financing statement has more privilege on the collateral than a creditor with physical possession. B) A creditor cannot take possession of the collateral until a financing statement is filed. C) A financing statement can be filed only against intangible personal property placed as collateral. D) A creditor that has physical possession of the collateral does not have to file a financing statement. 34) 36) A refers to a document filed by a secured creditor with the appropriate government office 36) that constructively notifies the world of his or her security interest in personal property. B) custodial statement D) possession statement 38) Stan bought a motorcycle for $4,000 on credit extended by the seller Cooper Motors. Stan signed a 38) security agreement with the seller for the credit he obtained. Cooper Motors didn't file a financing statement for the credit offered. In this case, Cooper Motors automatically obtained the creditor's security interest through A) perfection by attachment C) perfection by claim B) perfection by possession of collateral D) perfection by financing 39) Kelly borrows $12,000 from Terry Oswald to pay for her mother's surgery. The debt-repayment period is 15 months but Kelly manages to repay it in 11 months. Which of the following must be filed by Oswald after receiving the final installment of his money? A) a statement of collateral claim C) a termination statement B) a financing statement D) a continuation statement 40) Which of the following is true of priority of claims? A) If two or more secured parties claim an interest in the same collateral but only one has perfected his or her security interest, the perfected security interest has priority. B) If two or more secured parties claim an interest in the same collateral but neither has a perfected claim, they are given equal priority irrespective of attachments. C) Although one of the parties to claim an interest in the collateral has perfected his or her security interest, all the parties are given fair and equal priority over the collateral. D) If two or more secured parties claim an interest in the same collateral but neither has a perfected claim, the first to claim has priority. 41) Darrel, Smith, Keith and Aaron are claimants to a collateral interest. All four have secured their interests on the collateral. Aaron takes physical possession of the collateral. Keith files a financing statement some time later. Who among the four would have highest priority of claim to the collateral? A) Aaron B) Keith C) Smith D) Darrel 42) Which of the following federal laws allows debtors who are subject to a writ of gamishment to retain 75 percent of their weekly disposable earnings? - A) Title II of Fair Credit Billing Act B) Title III of Fair Credit Reporting Act C) Title IV of Fair Debt Collection Practices Act D) Title III of the Consumer Credit Protection Act 43) Which of the following statements is true of a negotiable instrument? A) It need not state a fixed amount of money and can include a service that needs to be rendered. B) It should be signed by the payee. C) It should not require any undertaking other than the payment of money. D) It can be either written or oral. 44) A promise or order is only considered negotiable if A) the promise or order to pay is unconditional B) an express condition to payment is mentioned C) it is subject to or governed by another writing D) the rights to the promise or order are stated in another writing 45) Shawn draws a bearer check that is payable on January 2, 2014. This check is an example of a(n) instrument. A) time B) demand C) order D) indorsed 7 39) 40) 41) 44) 45) 46) A is a three-party instrument that is an unconditional written order by one party that orders a second party to pay money to a third party. A) promissory note C) lease 47) Karen has a checking account at First Bank. Karen writes a check to Bonanza Apartments for her rent. Which of the following is true of this situation? A) Karen is the payee, First Bank is the drawee, and Bonanza is the drawer. B) Karen is the payee, First Bank is the drawer, and Bonanza is the drawee. C) Karen is the drawee, First Banks is the drawer, and Bonanza is the payee. D) Karen is the drawer, First Bank is the drawee, and Bonanza is the payee. 48) Who is the drawee of a check? A) The financial institution where the drawer has an account. B) The party to whom a check is written and who has a checking account with the same financial institution as the drawer. C) The party who signs the check. D) The drawer of the check is also its drawee. 49) Which of the following is true of a promissory note? A) It is an evidence of extension of credit. C) It is a note of acknowledgement of debt. 50) A is a two-party negotiable instrument that is an unconditional written pledge by one party to pay money to another party. A) check C) certificate of deposit B) draft D) certificate of deposit A) It is a negotiable instrument if Jax accepts it. B) It is a nonnegotiable instrument. C) It is invalid. D) It is negotiable for the next five years. 51) Which of the following is true of a certificate of deposit? A) It is used to extend credit to a buyer. C) It is a promise to pay. 53) A(n) 54) A(n). B) It is an evidence of repayment of debt. D) It is a note denying the credit. 52) Roger, a certified lawyer, borrows money from Jax to start a business. He executes a promissory note stating that he will repay the money within the next five years if he inherits any money from his parents. Which of the following is true of the negotiability of the promissory note executed by Roger? A) specific payee or indorsee C) acceleration clause A) warranty B) promissory note D) bill of exchange B) It is a savings account passbook. D) It is a three-party instrument. is necessary for a bearer paper to be negotiable. B) indorsement D) delivery is required to negotiate order paper, but not to negotiate bearer paper. B) collateral C) indorsement D) security 49) 50) 51) 52) 53) 54) 55) Which of the following is a similarity between a bearer paper and an order paper? A) both require delivery to be considered negotiable B) both require a specific payee to be named C) both require indorsements to be considered negotiable D) both can be claimed by whoever presents the instrument for payment 56) When an indorser indorses an instrument in blank, it changes a(n). A) negotiable instrument into a nonnegotiable instrument B) order instrument into a bearer instrument C) valid instrument into an invalid instrument D) bearer instrument into an order instrument 57) The holder of an instrument wants the instrument to be paid to a specific person, ensure that the amount mentioned on the instrument is deposited in that person's account. The holder does not want to be liable to that person in the event that the instrument is not paid. In this scenario, the holder should most likely execute a A) blank, qualified, unrestrictive indorsement B) special, qualified, unrestrictive indorsement C) blank, qualified, restrictive indorsement D) special, qualified, restrictive indorsement 58) Which of the following qualifications renders a person as a holder in due course of a negotiable instrument? A) if he takes the negotiable instrument for value B) if he is in possession of an instrument issued in his name C) if he is in possession of an instrument issued in another's name D) if he is subject to claims and defenses against the transferor 59) Charles executes a note payable to Hilarie for $1,000 for goods she purchased from him. Hilarie transfers the note to Lucas, who pays $850 for the note. By doing this, which requirement for acquiring the holder in due course status does Lucas meet? A) taking for value B) taking without notice C) taking where there is no evidence of forgery, alteration, or irregularity D) taking in good faith 60) Under the UCC, value is given if the holder_ A) detects an unauthorized signature C) performs the agreed-upon promise B) takes an instrument in good faith D) notices that the instrument is defective 61) Mark acquires an instrument from a stranger under suspicious circumstances and at a high discount. This disqualifies him from acquiring HDC status because he did not B) give value for the instrument A) take the instrument in good faith C) check the authenticity of the instrument D) check if the instrument was defective 55) 56) 57) 58) 59) 61) 62) Lisa buys a used car from Kelly. She pays 10 percent down of the cost and signs a negotiable promissory note, promising to pay Kelly the remainder of the purchase price, with interest, in 12 equal monthly installments. At the time of sale, Kelly materially misrepresented the mileage of the automobile. Later, Kelly negotiates the note to Frances, who has no notice of the misrepresentation. Frances, an HDC, negotiates the note to Zoe, who is not an HDC. Which of the following is Zoe in regards to the indorsement? A) an assignor C) a holder in due course 64) Which of the following is a personal defense? A) forgery C) fraud in inception B) a holder D) an assignee 63) Gary asks his friend, Adam, to look after his house while he goes to another country for work, for 63) two years. Adam leases the house to Brad by signing a contract with Brad. Adam signs as a representative of Gary even though he does not have the right to do so. Gary comes back and attempts to evict Brad. Brad can claim the defense of A) mental incapacity C) fraud in the inception A) Tom C) the bank that issued the check to Tom B) breach of contract D) extreme duress B) extreme duress D) breach of contract 65) Martin borrows $15,000 from Tom, in the form of a check, and signs a promissory note, promising to pay Tom this amount plus 10 percent interest in one year. Tom indorses the note and negotiates it to Fronston, Fronston indorses the note and negotiates it to Liza. Liza presents the note to Martin for payment when the note is due. Martin refuses to pay the note. Who is secondarily liable to pay Liza? B) Frontston D) all liabilities lie with Martin 66) Sylvester, acting as a representative agent for Jerry, signs a negotiable instrument with the signature Sylvester, by Jerry, agent. What kind of liability does Sylvester have for this type of signature? A) he is liable to the HDC of the instrument C) he is liable to Jerry B) he is not liable to the instrument D) he is liable to the payee 67) Cameron, a purported agent, signs a contract and promissory note to purchase a building for Burnstar Constructions, a purported principal. Though Cameron is an unauthorized representative, Burnstar Constructions likes the deal and accepts it. Which of the following is true of the deal ratified by Burnstar Constructions? A) Burnstar Constructions is liable on the note. B) Cameron is liable on the note. C) The deal is invalid due to the fraud in the inducement rule. D) The deal is invalid due to the fraud in the inception rule. 62) 68) Martha draws a check payable to the order of Stella. Stella indorses the check to Karen. But Leslie steals the check from Karen, forges Karen's indorsement, and cashes the check at a liquor store. Who is liable to the check? A) Leslie B) the liquor store C) Stella D) Martha 64) 65) 67) g 69) Martha draws a check payable to the order of Stella Stella indorses the check to Karen. But Leslie steals the check from Karen, forges Karen's indorsement, and cashes the check at a liquor store. When the forgery is exposed, who can the liquor store legally recover from? A) Martha B) Karen C) Leslie D) Stella 70) Susan purchases goods by telephone from Parker. Susan has never met Parker. Brenton goes to Susan and pretends to be Parker. Susan draws a check payable to the order of Parker and gives the check to Brenton, believing him to be Parker. Brenton forges Parker's indorsement and indorses the check to his brother, William, with the term "without recourse." William then cashes the check at a liquor store. Under the imposter rule, who is liable on the check? A) William B) Brenton C) Susan D) the liquor store 71) Which of the following statements is true of Title VII of the Civil Rights Act of 1964? A) It does not apply to Native American tribes. B) It does not cover state and local governments. C) It applies to all employers irrespective of the number of employees. D) It does not apply to labor unions. 72) Which of the following is true of employment discriminations defined under Title VII? A) Disparate-treatment discrimination can be proven through statistical data about an employer's employment practices. B) Sexual harassment and refusal to hire physically challenged employees are illustrations of disparate-impact discrimination. C) Disparate-impact discrimination occurs when an employer adopts a work rule that is neutral on its face but is shown to cause an adverse impact on a protected class. D) Disparate-treatment discrimination occurs when an employer discriminates against an individual of a protected class 73) Which of the following is an instance of disparate-treatment discrimination? A) An employer refuses to install a wooden ramp to accommodate Lin who is restricted to a wheelchair. B) Ghalib, who is fluent in English, is not hired as a writer due to his Iraqi heritage. C) An employer does not promote Kelly as she is about take maternity leave. D) A factory hires 22-year old Jerry over 46-year old Barry, citing age as the reason. 74) Which of the following is true of religious discrimination under Title VII? A) An employer should reasonably accommodate religious observances or practices of its employees at the workplace. B) Religious organizations cannot give preference in employment to individuals of a particular religion. C) An employee who claims religious discrimination cannot sue the employer for any other violation of Title VII. D) Only monotheistic religions are covered under Title VII. 75) Jason is a Hispanic scriptwriter from Brazil who works for a television show on an American cable network. He was fired after the producer came to know that Smith was of a certain faith. The producer's official reason for this termination was that as Smith was based in Brazil, communication was a problem. This is an example of discrimination that violates Title VII of the Civil Rights Act. A) religious C) racial 11 B) disparate-impact D) national origin 69) 70) 71) 72) 73) 74) 75) 76) Which of the following best describes quid pro quo sex discrimination? A) employment discrimination because of pregnancy, childbirth or related medical conditions B) selective or partial treatment offered to an employee or a group of employees based on their gender C) discrimination where sexual favors are requested in order to obtain a job or be promoted D) discrimination in hiring or promotion based on the gender of the employee under consideration 77) Lila, who works for a large software firm, is four-months pregnant and is also due for a promotion. 77) However, her employer offers the promotion to Harry, a less-experienced candidate, as Lila would go on maternity leave soon and would be unable to perform her duties. Which of the following is true of this scenario? A) Lila's employer has violated Title VII of the Civil Rights Act of 1964. B) The employer was lawful in denying Lila the promotion. C) Lila's employer is liable for disparate-treatment discrimination. D) Lila's employer is liable for disparate-impact discrimination. 78) Which of the following is true of impairments under the Americans with Disabilities Act (ADA)? A) The employer must not accommodate an individual's disability. B) Injuries resulting from pregnancy are considered as disabilities under the ADA. C) It allows for preemployment medical examinations before a job offer. D) It permits employers to ask job applicants about the existence, nature, or severity of a disability. 79) Jorge, a fork-lift truck operator for retail chain Hansridges, was injured when the fork-lift he was operating toppled over. The fork-lift truck was manufactured and maintained by Ionic Machines, Inc. As he was covered by workers' compensation insurance, he could recover workers' compensation benefits. However, it was later found that the fork-lift truck was not designed to be used to lift as much weight as lonic Machines claimed it could. Which of the following statements is Jorge's course of action? A) He can sue Hansridges for hazardous work environment. B) He cannot sue anyone as he has already received workers' compensation. C) He can sue Ionic Machines for damages. D) He can sue Hansridges for injuries suffered during employment. 80) Which of the following statements about the Family and Medical Leave Act is true? A) Employers are required to provide up to 12 weeks of unpaid leave due to the birth of and care for a child. B) Employers are required to provide up to 5 weeks of unpaid leave due to the placement of a child with an employee for adoption or foster care. C) To be covered by the act, an employee must have worked for the employer for at least 6 months and must have performed more than 650 hours of service. D) The act applies to companies with 25 or more workers as well as federal, state, and local governments. 81) The act of negotiating contract terms between an employer and the members of a union is known as A) arbitration collective bargaining 76) B) mediation D) litigation 78) 79) 80) 81) 82) Which of the following is true of subsurface rights in real property? A) Minerals found beneath real property have to be given up to the government. B) Subsurface rights can only be invoked to dig oil wells. C) Subsurface rights cannot be used to mine radioactive elements. D) Subsurface rights can be sold separately from surface rights. 83) Plant life that is severed from the land is considered to be A) personal property C) intangible property 84) Which of the following best describes air rights? A) legally block the airspace above the land from commercial use B) develop natural and cultivated plant life on the land C) lease or sell the space above the property for commercial purposes D) create fixtures inside the real property that become a part of the sale agreement 85) A person's ownership right in real property is called an A) estate in land C) easement B) real property D) immovable property 86) Which of the following is true of an ownership of real property in fee simple absolute? A) It terminates based on the occurrence of a specified event. B) It cannot be inherited. C) It is infinite in duration. D) It cannot be transferred at will. 87) After the death of Horace, the other two joint tenants of the luxury dining restaurant "Rendezvous" became the owners of Horace's interest in the property automatically. This feature of their concurrent ownership is called, A) right of survivorship C) adverse possession B) eminent domain D) arraignment 88) In which of the following conditions does a joint tenancy become a tenancy in common? A) when one of the joint tenants dies A) the quitclaim deed C) the right of survivorship 90) A(n). B) when two joint tenants interchange their share in the tenancy C) when two joint tenants are bound by a marital relationship D) when a joint tenant sells his or her property 89) Which of the following provisions protects the interest of a joint tenancy upon the death of a joint tenant? property. A) deed B) quiet title action D) nonconforming use B) easement B) the quiet title action D) the estate in land is an instrument that describes a person's ownership interest in a piece of real C) title insurance D) license 84) 86) 88) 89) 90) 91) A(n). is a situation in which a person who wrongfully possesses someone else's real property obtains title to that property if certain statutory requirements are met. A) nonpossessory interest C) reversion B) adverse possession D) future interest 92) In which of the following cases of consumer safety violations will the U.S. Department of Agriculture be required to take action? A) A new drug was released into the market without adequate testing and this lead to adverse side effects among users. B) A brand of soft toys for infants was produced with low grade foam and fabrics that could prove harmful when ingested. C) A fleet of cars released into the market by a popular automobile manufacturer was found to have a defective braking system which could prove fatal for owners. D) A batch of sausages and cold cuts from a particular vendor was found to have high levels of salmonella and other pathogenic organisms. 93) Which of the following is true of the Health Care Reform Act? A) All employers are mandatorily required to provide health insurance coverage to their employees. B) Insurers can establish an annual spending cap for benefit payments. C) Persons who do not obtain coverage are required to pay a tax penalty to the federal government. D) Employers of big corporations are given subsidies for providing health insurance to their employees. 94) Which of the following statements is true of the Bureau of Consumer Financial Protection? A) It has a special wing that only supervises the automobile industry. B) It supervises depository institutions such as commercial and savings banks. C) It does not have the authority to supervise debt collectors and debt buyers. D) It lacks investigative and subpoena powers. B) consider focusing on air and water pollution to the exclusion of other sources of pollution as these two modes of pollution have the greatest impact on human lives C) consider the adverse impact a federal government action would have on the environment before the action is implemented D) implement a zero-tolerance policy for all business activities that discharge waste products into water bodies 96) Which of the following would be considered a stationary source of air pollution? C) cargo ships A) aircrafts B) automobiles D) oil rigs 97) A geographical area that does not meet established air quality standards is designated as a A) limited pollution area C) federal regulation area 91) 95) The National Environmental Policy Act (NEPA) is a federal statute which mandates that the federal 95) government must A) execute a complete ban on the commercial usage of the two hundred toxic substances identified as being harmful and polluting B) zoned ordinance area D) nonattainment area 92) 93) 94) 96) 97)

Step by Step Solution

★★★★★

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is prov...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

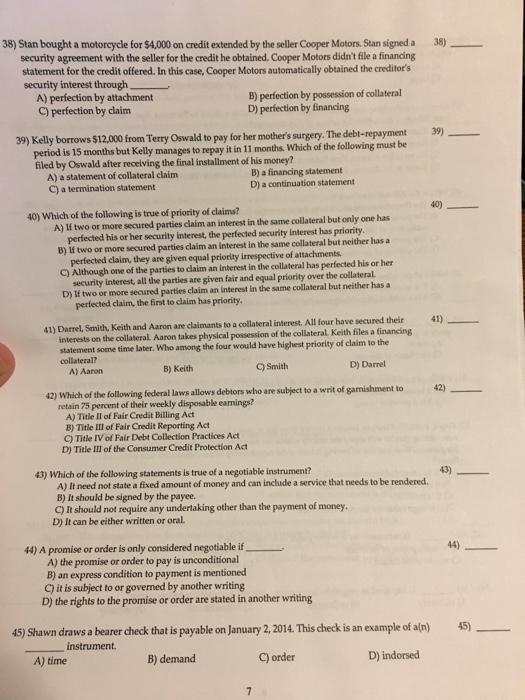

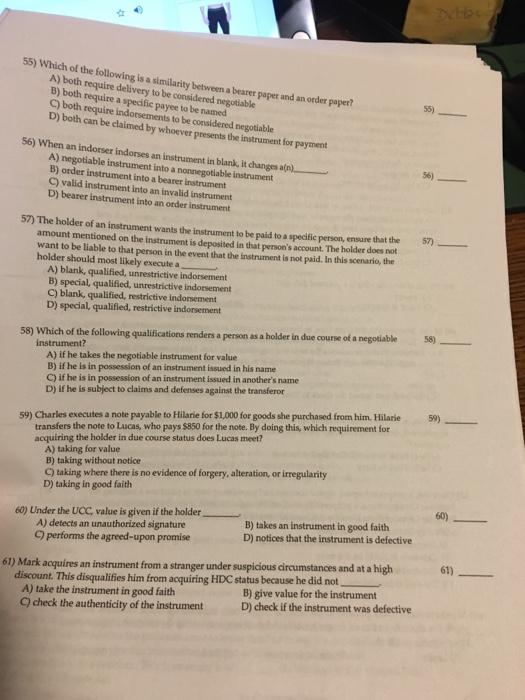

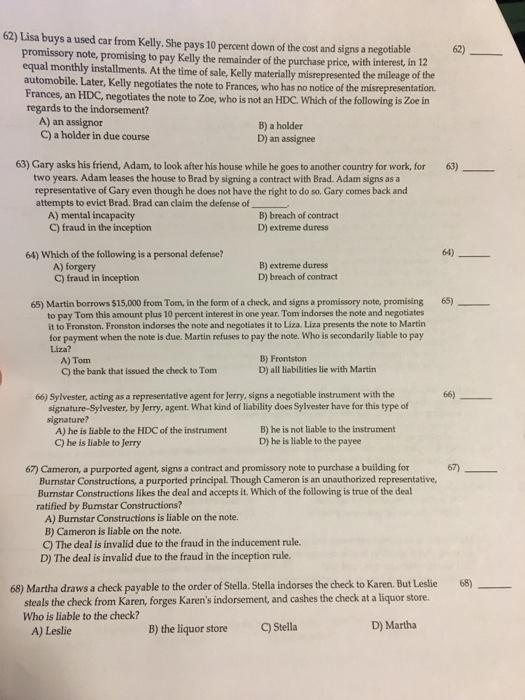

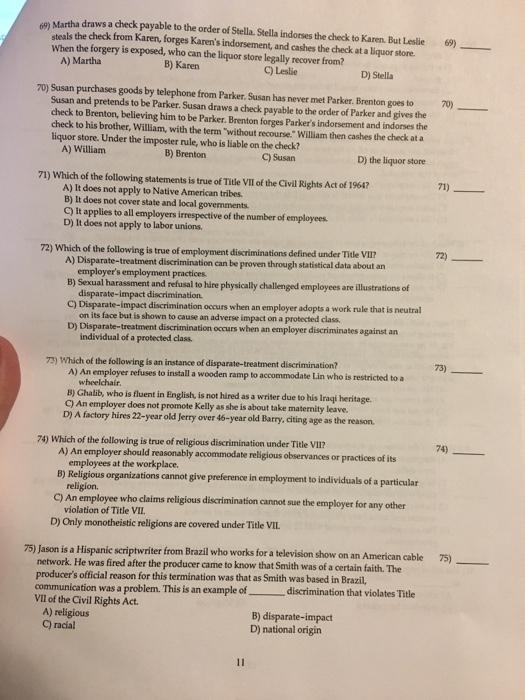

Get Started