Question

9. What is the principal reduction of the loan in month 2? 10.What is the remaining principal of the loan in month 2? 11. What

9. What is the principal reduction of the loan in month 2?

10.What is the remaining principal of the loan in month 2?

11. What is the interest expense of the loan in month 3?

12. What is the principal reduction of the loan in month 3?

13.What is the remaining principal of the loan in month 3?

14. What is the interest expense of the loan in month 4?

15. What is the principal reduction of the loan in month 4?

16.What is the remaining principal of the loan in month 4?

17. What is the interest expense of the loan in month 4?

18. What is the principal reduction of the loan in month 5?

19.What is the remaining principal of the loan in month 5?

20. What is the interest expense of the loan in month 6?

21. What is the principal reduction of the loan in month 6?

22. What is the remaining principal of the loan in month 6? Note that following this procedure you can complete the amortization schedule for the entire

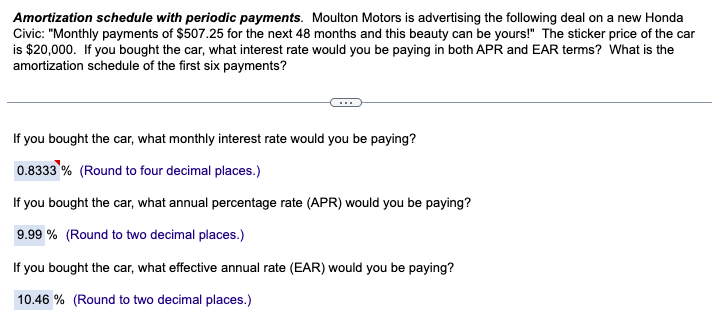

Amortization schedule with periodic payments. Moulton Motors is advertising the following deal on a new Honda Civic: "Monthly payments of $507.25 for the next 48 months and this beauty can be yours!" The sticker price of the car is $20,000. If you bought the car, what interest rate would you be paying in both APR and EAR terms? What is the amortization schedule of the first six payments? If you bought the car, what monthly interest rate would you be paying? % (Round to four decimal places.) If you bought the car, what annual percentage rate (APR) would you be paying? \% (Round to two decimal places.) If you bought the car, what effective annual rate (EAR) would you be paying? % (Round to two decimal places.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started