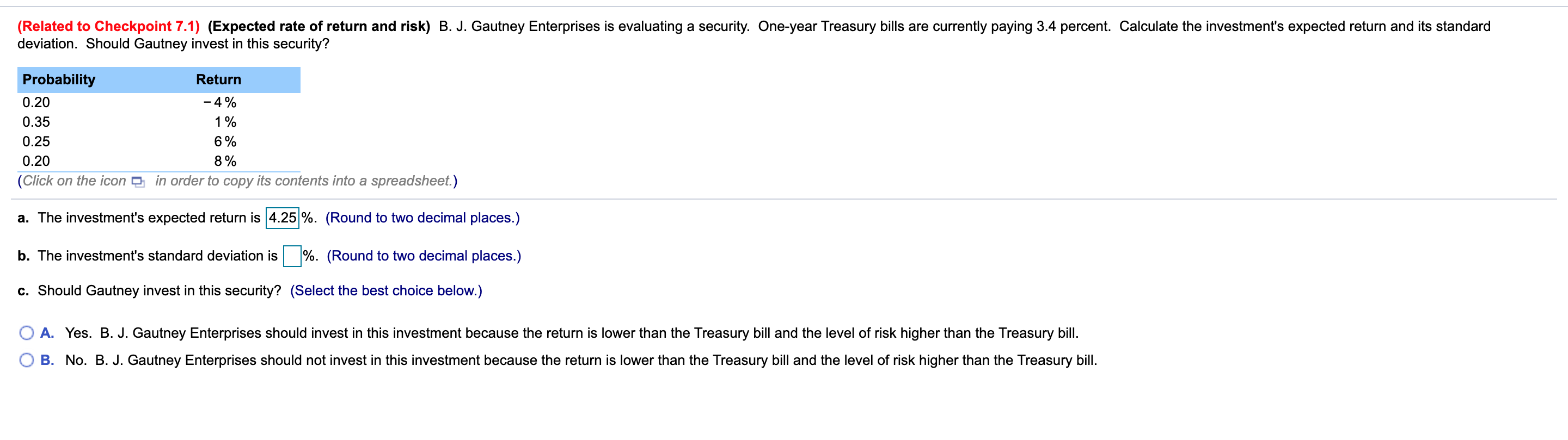

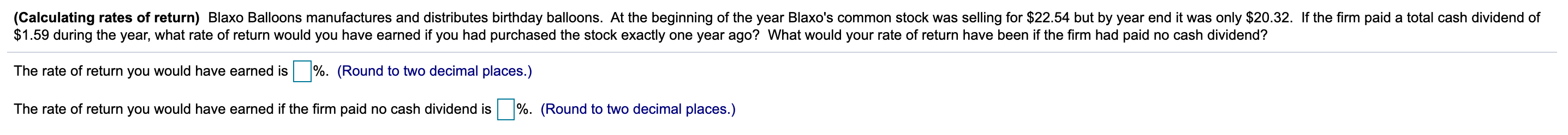

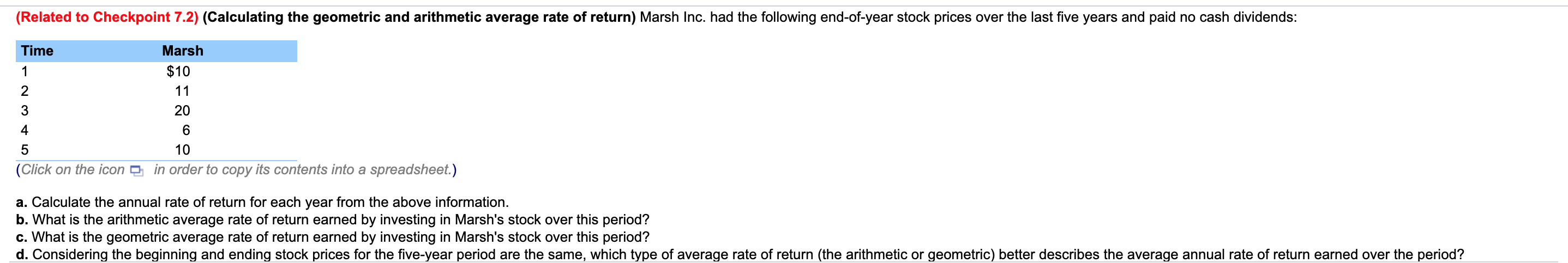

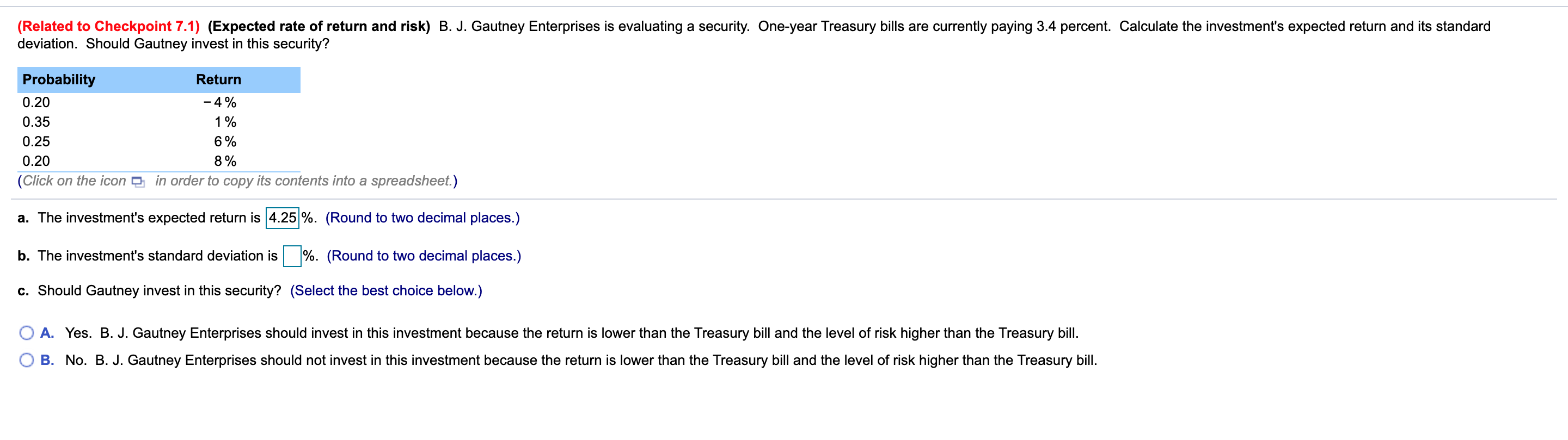

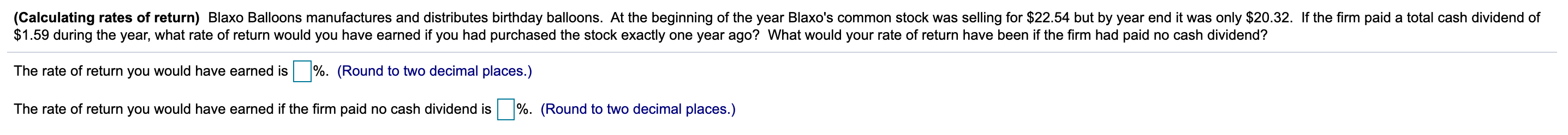

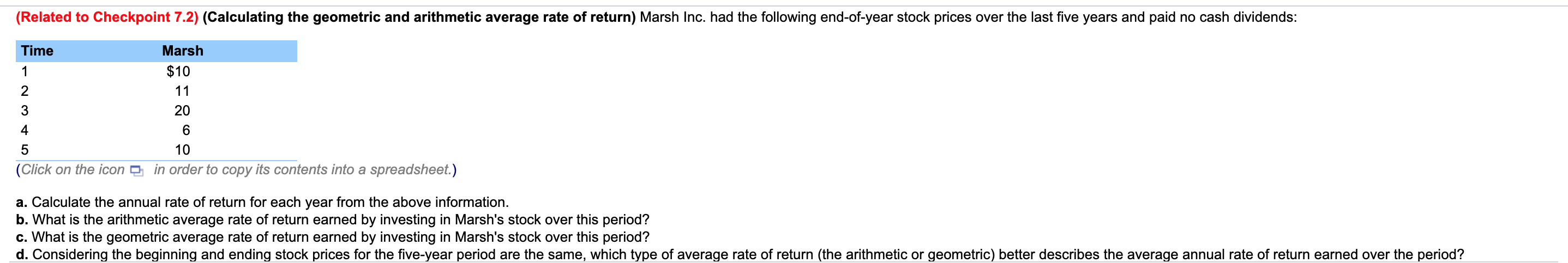

(Related to Checkpoint 7.1) (Expected rate of return and risk) B. J. Gautney Enterprises is evaluating a security. One-year Treasury bills are currently paying 3.4 percent. Calculate the investment's expected return and its standard deviation. Should Gautney invest in this security? Probability Return 0.20 -4% 0.35 1 % 0.25 6% 0.20 8% (Click on the icon in order to copy its contents into a spreadsheet.) a. The investment's expected return is 4.25 %. (Round to two decimal places.) b. The investment's standard deviation is %. (Round to two decimal places.) c. Should Gautney invest in this security? (Select the best choice below.) A. Yes. B. J. Gautney Enterprises should invest in this investment because the return is lower than the Treasury bill and the level of risk higher than the Treasury bill. B. No. B. J. Gautney Enterprises should not invest in this investment because the return is lower than the Treasury bill and the level of risk higher than the Treasury bill. (Calculating rates of return) Blaxo Balloons manufactures and distributes birthday balloons. At the beginning of the year Blaxo's common stock was selling for $22.54 but by year end it was only $20.32. If the firm paid a total cash dividend of $1.59 during the year, what rate of return would you have earned if you had purchased the stock exactly one year ago? What would your rate of return have been if the firm had paid no cash dividend? The rate of return you would have earned is %. (Round to two decimal places.) The rate of return you would have earned if the firm paid no cash dividend is %. (Round to two decimal places.) (Related to Checkpoint 7.2) (Calculating the geometric and arithmetic average rate of return) Marsh Inc. had the following end-of-year stock prices over the last five years and paid no cash dividends: Time 1 Marsh $10 11 20 2 3 4 6 5 (Click on the icon 10 in order to copy its contents into a spreadsheet.) a. Calculate the annual rate of return for each year from the above information. b. What is the arithmetic average rate of return earned by investing in Marsh's stock over this period? c. What is the geometric average rate of return earned by investing in Marsh's stock over this period? d. Considering the beginning and ending stock prices for the five-year period are the same, which type of average rate of return (the arithmetic or geometric) better describes the average annual rate of return earned over the period