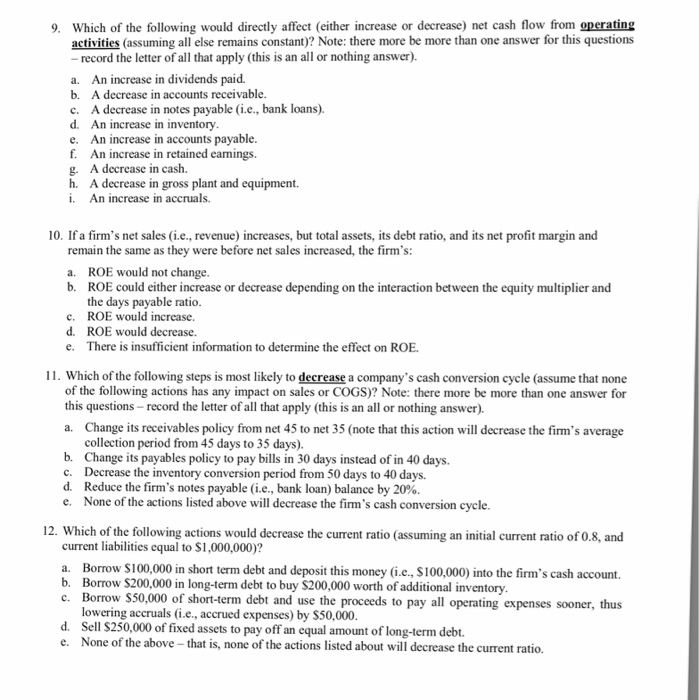

9. Which of the following would directly affect (either increase or decrease) net cash flow from operating activities (assuming all else remains constant)? Note: there more be more than one answer for this questions record the letter of all that apply (this is an all or nothing answer). a. b. c. d. e. f. g. h. i. An increase in dividends paid. A decrease in accounts receivable A decrease in notes payable (i.e., bank loans) An increase in inventory An increase in accounts payable An increase in retained eamings. A decrease in cash. A decrease in gross plant and equipment. An increase in accruals. 10. Ifa firm's net sales (i.e., revenue) increases, but total assets, its debt ratio, and its net profit margin and remain the same as they were before net sales increased, the firm's: a. ROE would not change b. ROE could either increase or decrease depending on the interaction between the equity multiplier and the days payable ratio c. ROE would increase. d. ROE would decrease. e. There is insufficient information to determine the effect on ROE 11. Which of the following steps is most likely to decrease a company's cash conversion cycle (assume that none of the following actions has any impact on sales or COGS)? Note: there more be more than one answer for this questions-record the letter of all that apply (this is an all or nothing answer). a. Change its receivables policy from net 45 to net 35 (note that this action will decrease the firm's average collection period from 45 days to 35 days). b. Change its payables policy to pay bills in 30 days instead of in 40 days. c. Decrease the inventory conversion period from 50 days to 40 days d. Reduce the firm's notes payable (i.e., bank loan) balance by 20%. e. None of the actions listed above will decrease the firm's cash conversion cycle. 12. Which of the following actions would decrease t current ratio (assuming an initial current ratio of 0.8, and current liabes equal to S1,000,000)? a. Borrow $100,000 in short term debt and deposit this money (i.e., $100,000) into the firm's cash account b. Borrow $200,000 in long-term debt to buy $200,000 worth of additional inventory c. Borrow S50,000 of short-term debt and use the proceeds to pay all operating expenses sooner, thus lowering accruals (i.e., accrued expenses) by $50,000 I$250,000 of fixed assets to pay off an equal amount of long-term debt. None of the above- that is, none of the actions listed about will decrease the current ratio. e