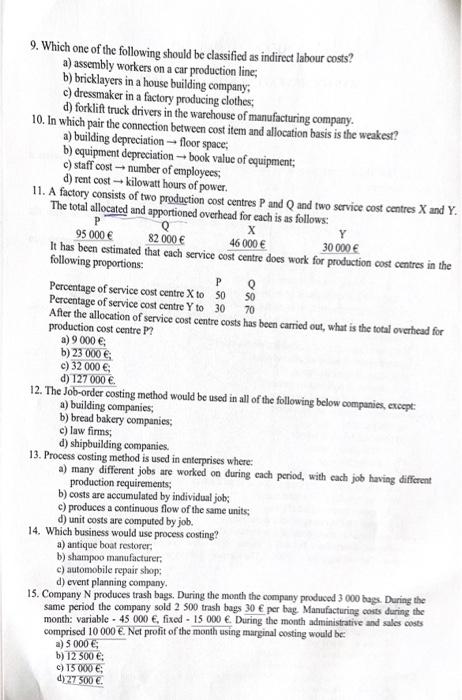

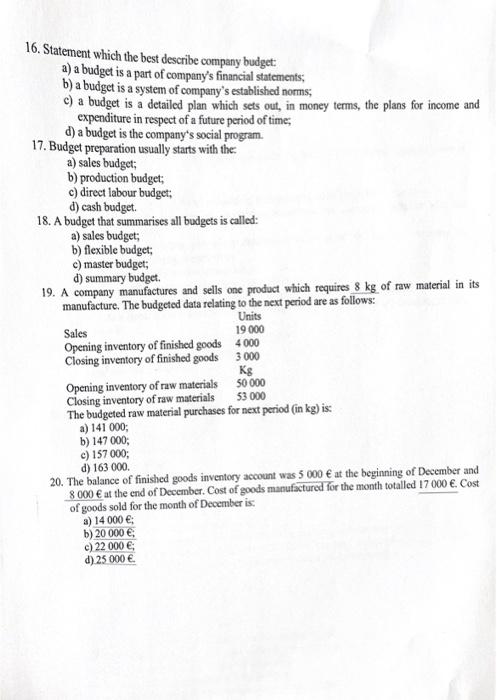

9. Which one of the following should be classified as indirect labour costs? a) assembly workers on a car production line; b) bricklayers in a house building company; c) dressmaker in a factory producing clothes; d) forklift truck drivers in the warchouse of manufacturing company. 10. In which pair the connection between cost item and allocation basis is the weakest? a) building depreciation floor space; b) equipment depreciation book value of equipment; c) staff cost number of employees; d) rent cost kilowatt hours of power. 11. A factory consists of two production cost centres P and Q and two service cost centres X and Y. The total allocated and apportioned overhead for each is as follows: following proportions: PercentageofservicecostcentreXtoPercentageofservicecostcentreYtoAftertheP3070Q50 After the allocation of service cost centre costs has been carnied out, what is the total overhead for production cost centre P? a) 9000 b) 23000 c) 32000 e d) 127000e 12. The Job-order costing method would be used in all of the following below compuniex, except: a) building companies; b) bread bakery companies; c) law firms; d) shipbuilding companies. 13. Process costing method is used in enterprises where: a) many different jobs are worked on during each period, with each job having different production requirements; b) costs are accumulated by individual jobs c) produces a continuous flow of the same units; d) unit costs are computed by job. 14. Which business would use process costing? a) antique boat restorer, b) shampoo manufacturer. c) automobile repair shop; d) event planning company. 15. Company N produces trash bags. During the month the company produced 3000 bags. During the same period the company sold 2500 trash bags 30 per bag Manufacturing cors during the month: variable 45000, fixed =15000. During the month administrative and sales costs comprised 10000. Net profit of the month asing marginal costing would be: a) 5000 b) 12500% c) 15000 d) 27500 16. Statement which the best describe company budget: a) a budget is a part of company's financial statements; b) a budget is a system of company's established norms; c) a budget is a detailed plan which sets out, in money terms, the plans for income and expenditure in respect of a future period of time; d) a budget is the company's social program. 17. Budget preparation usually starts with the: a) sales budget; b) production budget; c) direct labour budget; d) cash budget. 18. A budget that summarises all budgets is called: a) sales budget; b) flexible budget; c) master budget; d) summary budget. 19. A company manufactures and sells one product which requires 8kg of raw material in its manufacture. The budgeted data relating to the next period are as follows: The budgeted raw material purchases for next period (in kg ) is: a) 141000 ; b) 147000 ; c) 157000 ; d) 163000 . 20. The balance of finished goods inventory account was 5000 at the beginning of Deeember and 8000 at the end of December. Cost of goods manufactured for the month totalled 17000. Cost of goods sold for the month of December is: a) 14000; b) 20000; c) 22000 d) 25000