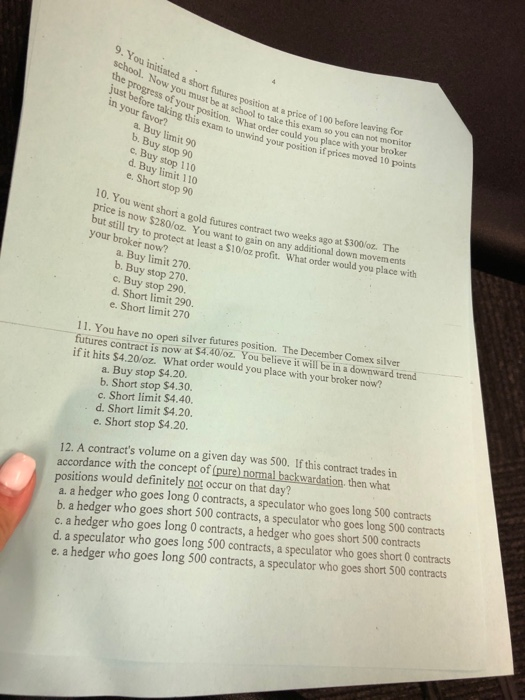

9. You initiated a short futures position of a price school. Now you must be the progress of your position us betore taking this exam to in your favor? t be at school to take this mat a price of 100 before leaving for so can not motito position. What one could you place with your broke wind your post your position if prices moved 10 points a. Buy limit 90 b. Buy stop 90 c. Buy stop 110 d. Buy limit 110 e. Short stop 90 10. You went short a gold went short a gold future contract two weeks ago at $300 oz The price is how $280/2. You want to gain on any additional down movements I try to protect at least a $10/oz profit What order would you place with your broker now? a. Buy limit 270 b. Buy stop 270. c. Buy stop 290. d. Short limit 290. e. Short limit 270 11. You have no open silver futures position. The December Comex silver futures contract is now at $4.40/oz. You believe it will be in a downward trend if it hits $4.20/oz. What order would you place with your broker now? a. Buy stop $4.20 b. Short stop $4.30. c. Short limit $4.40. d. Short limit $4.20. e. Short stop $4.20. 12. A contract's volume on a given day was 500. If this contract trades in accordance with the concept of pure normal backwardation, then what positions would definitely not occur on that day? a. a hedger who goes long 0 contracts, a speculator who goes long 500 contracts b. a hedger who goes short 500 contracts, a speculator who goes long 500 contracts c. a hedger who goes long 0 contracts, a hedger who goes short 500 contracts d. a speculator who goes long 500 contracts, a speculator who goes short O contracts e. a hedger who goes long 500 contracts, a speculator who goes short 500 contracts 9. You initiated a short futures position of a price school. Now you must be the progress of your position us betore taking this exam to in your favor? t be at school to take this mat a price of 100 before leaving for so can not motito position. What one could you place with your broke wind your post your position if prices moved 10 points a. Buy limit 90 b. Buy stop 90 c. Buy stop 110 d. Buy limit 110 e. Short stop 90 10. You went short a gold went short a gold future contract two weeks ago at $300 oz The price is how $280/2. You want to gain on any additional down movements I try to protect at least a $10/oz profit What order would you place with your broker now? a. Buy limit 270 b. Buy stop 270. c. Buy stop 290. d. Short limit 290. e. Short limit 270 11. You have no open silver futures position. The December Comex silver futures contract is now at $4.40/oz. You believe it will be in a downward trend if it hits $4.20/oz. What order would you place with your broker now? a. Buy stop $4.20 b. Short stop $4.30. c. Short limit $4.40. d. Short limit $4.20. e. Short stop $4.20. 12. A contract's volume on a given day was 500. If this contract trades in accordance with the concept of pure normal backwardation, then what positions would definitely not occur on that day? a. a hedger who goes long 0 contracts, a speculator who goes long 500 contracts b. a hedger who goes short 500 contracts, a speculator who goes long 500 contracts c. a hedger who goes long 0 contracts, a hedger who goes short 500 contracts d. a speculator who goes long 500 contracts, a speculator who goes short O contracts e. a hedger who goes long 500 contracts, a speculator who goes short 500 contracts