Answered step by step

Verified Expert Solution

Question

1 Approved Answer

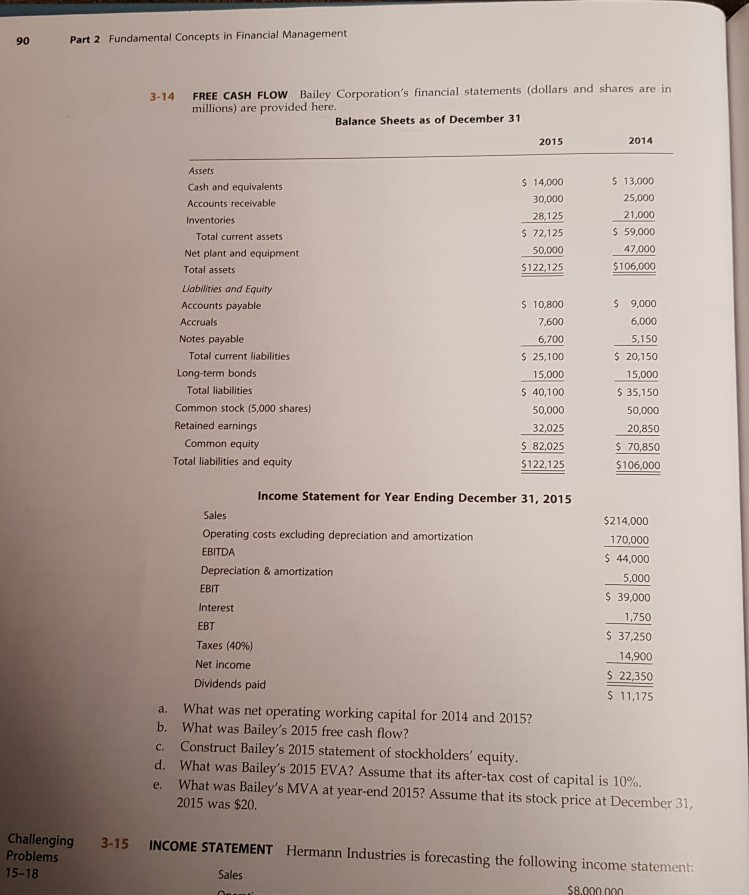

90 Part 2 Fundamental Concepts in Financial Management 3-14 FREE CASH FLOW Bailey Corporation's financial statements (dollars and shares are in millions) are provided here.

90 Part 2 Fundamental Concepts in Financial Management 3-14 FREE CASH FLOW Bailey Corporation's financial statements (dollars and shares are in millions) are provided here. Balance Sheets as of December 31 2015 2014 Assets S14,000 30,000 28,125 72,125 50,000 $122,125 $13,000 25,000 21,000 59,000 Cash and equivalents Total current assets Net plant and equipment Total assets Liabilities and Equity Accounts payable Accruals Notes payable 47 $106,000 $ 9,000 6,000 10,800 7,600 6,700 25,100 15,000 $ 40,100 20,150 15,000 $35,150 50,000 Total current liabilities Long-term bonds Total liabilities Common stock (5,000 shares) Retained earnings 32,025 Common equity Total liabilities and equity 70,850 5122125 $106000 Income Statement for Year Ending December 31, 2015 Sales Operating costs excluding depreciation and amortization EBITDA Depreciation & amortization EBIT Interest EBT Taxes (40%) Net income $214,000 170,000 44,000 5,000 39,000 1,750 37,250 14,900 22,350 $ 11,175 Dividends paid a. What was net operating working capital for 2014 and 2015? b. What was Bailey's 2015 free cash flow? c. Construct Bailey's 2015 statement of stockholders' equity. d, what was Bailey's 2015 EVA? Assume that its after-tax cost of capital is 10%. e. What was Bailey's MVA at year-end 2015? Assume that its stock price at December 31, 2015 was $20. Challenging Problems 15-18 3-15 INCOME STATEMENT Hermann Industries is forecasting the following income statement Sales 8.000 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started