Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(90 points) You are hired as an investment advisor for Eisenstein Bagel Cousins, a major chain of ecologically harvested teas. The companies reported data on

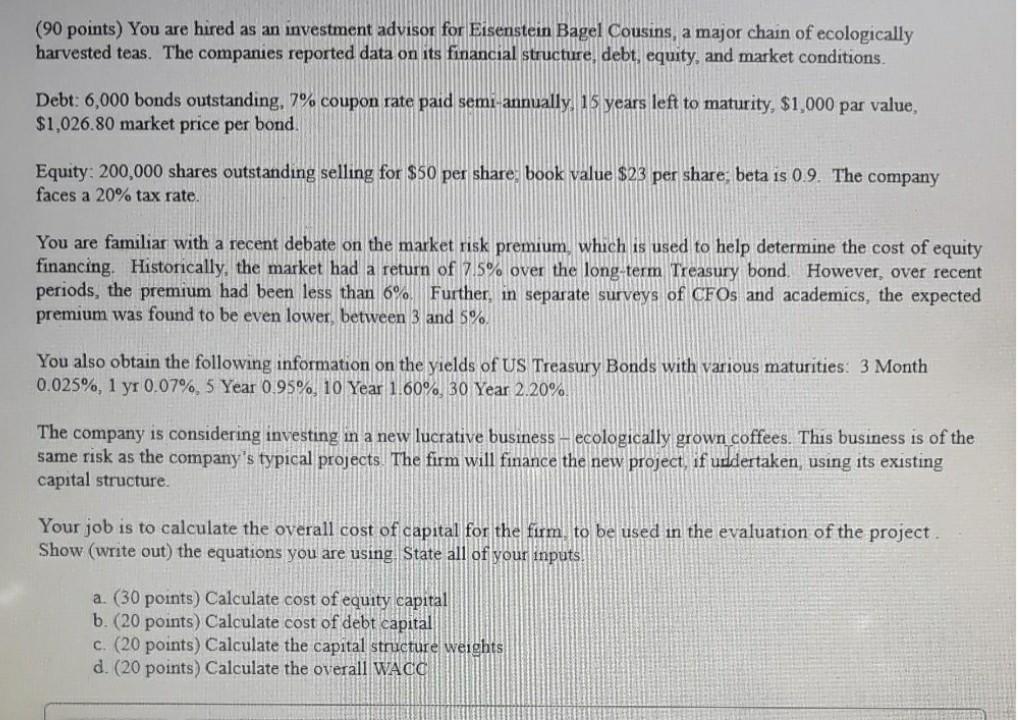

(90 points) You are hired as an investment advisor for Eisenstein Bagel Cousins, a major chain of ecologically harvested teas. The companies reported data on its financial structure, debt, equity, and market conditions. Debt: 6,000 bonds outstanding, 7% coupon rate paid semi-annually, 15 years left to maturity, $1,000 par value, $1,026.80 market price per bond. Equity: 200,000 shares outstanding selling for $50 per share book value $23 per share, beta is 0.9. The company faces a 20% tax rate. You are familiar with a recent debate on the market risk premium, which is used to help determine the cost of equity financing. Historically, the market had a return of 7.5% over the long-term Treasury bond. However, over recent periods, the premium had been less than 6% Further, in separate surveys of CFOs and academics, the expected premium was found to be even lower between 3 and 5% You also obtain the following information on the yields of US Treasury Bonds with various maturities: 3 Month 0.025%, 1 yr 0.07%, 5 Year 0.95%, 10 Year 1.60%, 30 Year 2.20% The company is considering investing in a new lucrative business - ecologically grown coffees. This business is of the same risk as the company's typical projects. The firm will finance the new project, if undertaken using existing capital structure. Your job is to calculate the overall cost of capital for the firm, to be used in the evaluation of the project Show (write out) the equations you are using State all of your inputs. a. (30 points) Calculate cost of equity capital b. (20 points) Calculate cost of debt capital c. (20 points) Calculate the capital structure weights d. (20 points) Calculate the overall WACC

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started