Answered step by step

Verified Expert Solution

Question

1 Approved Answer

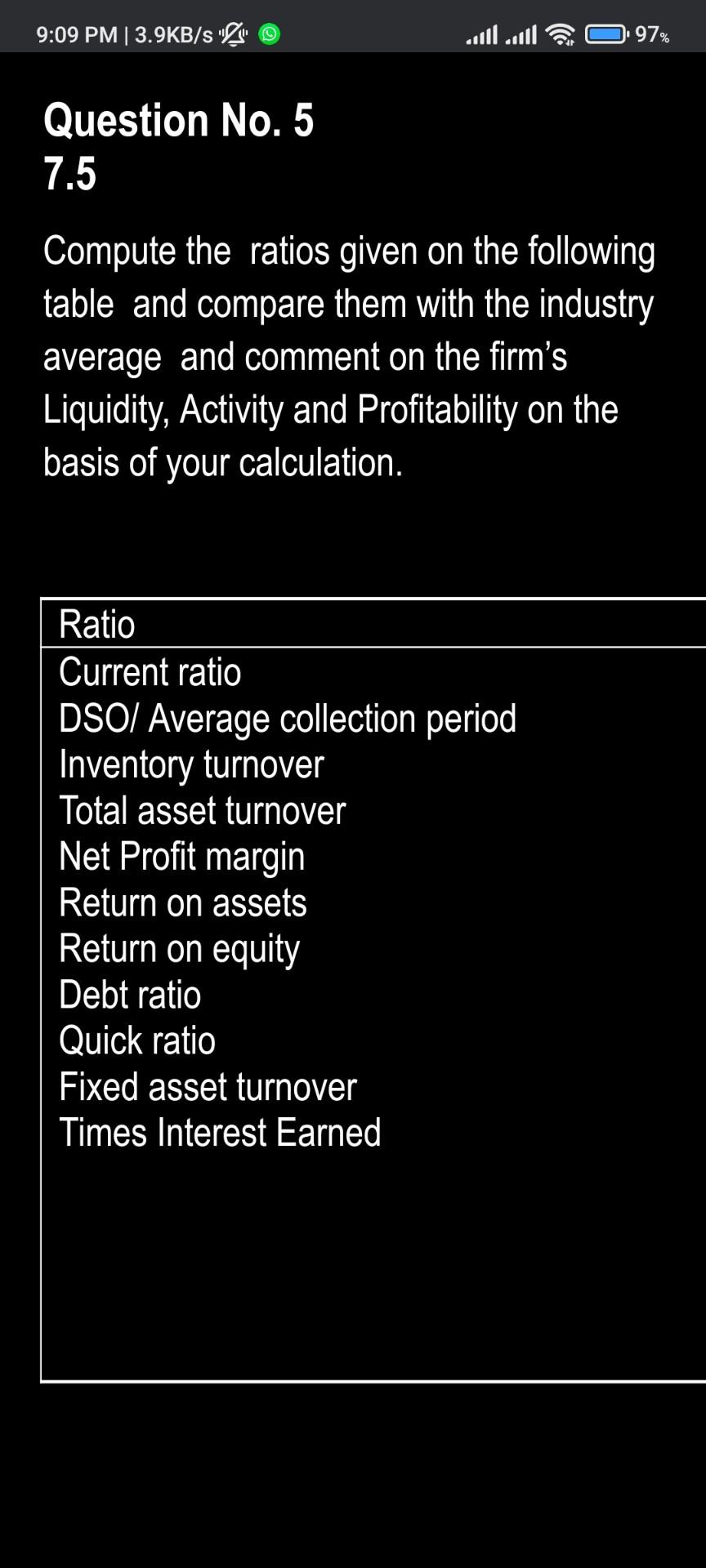

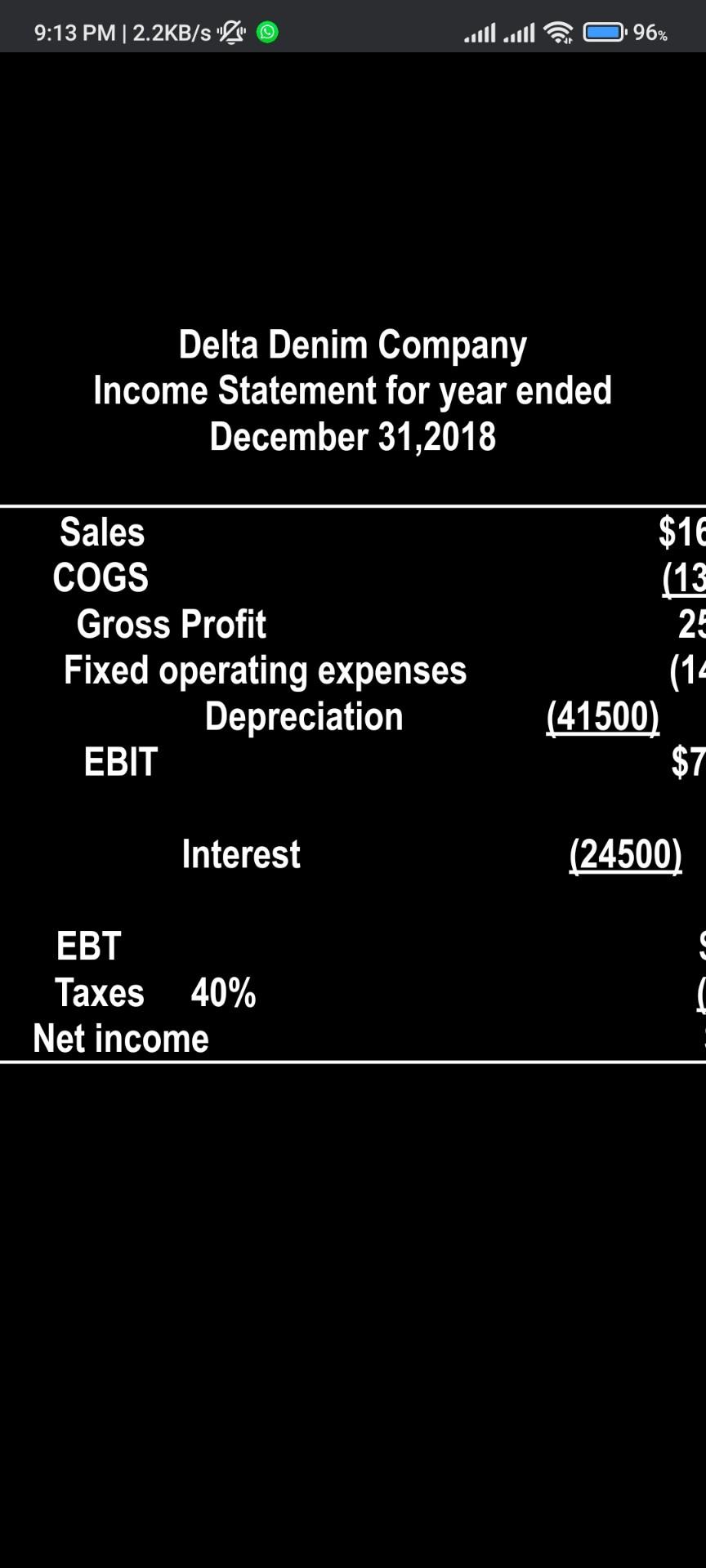

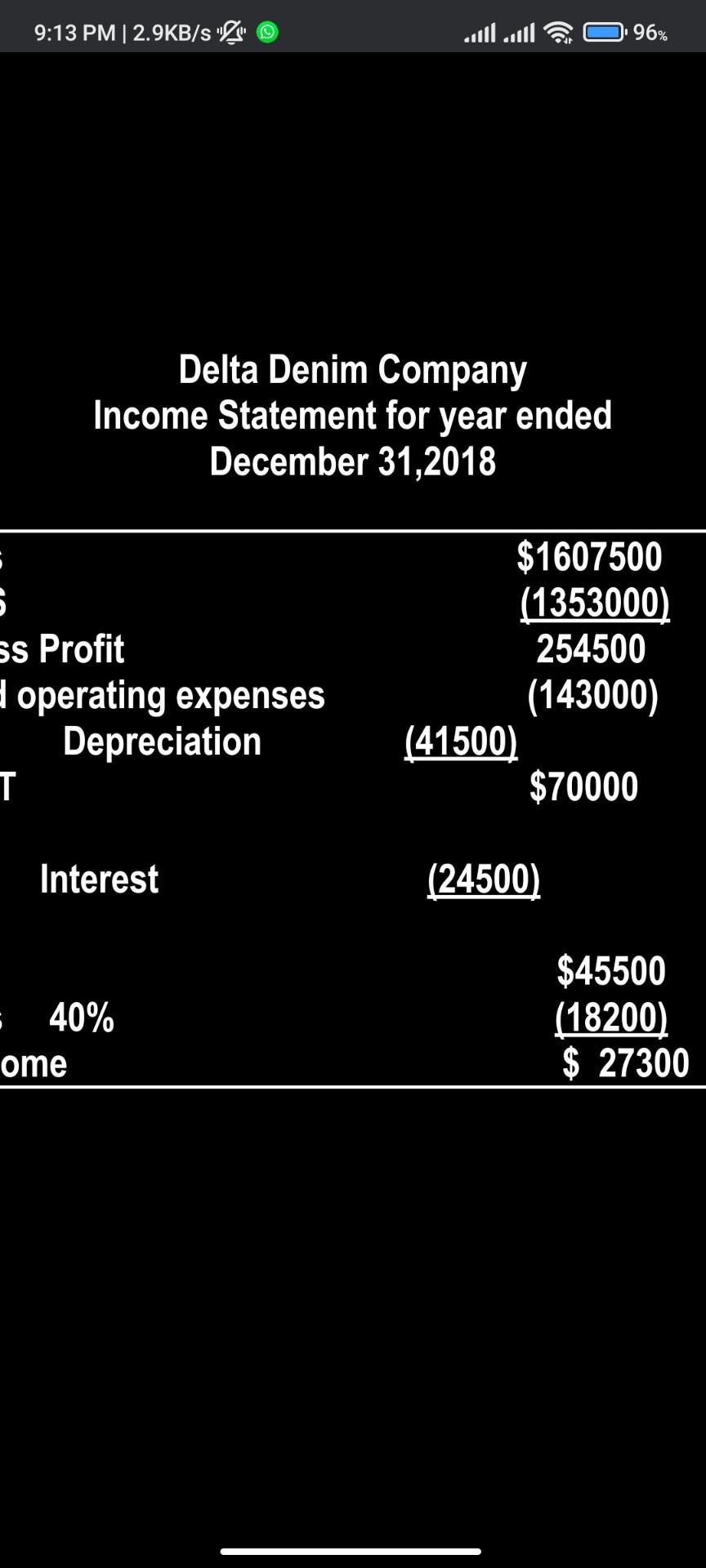

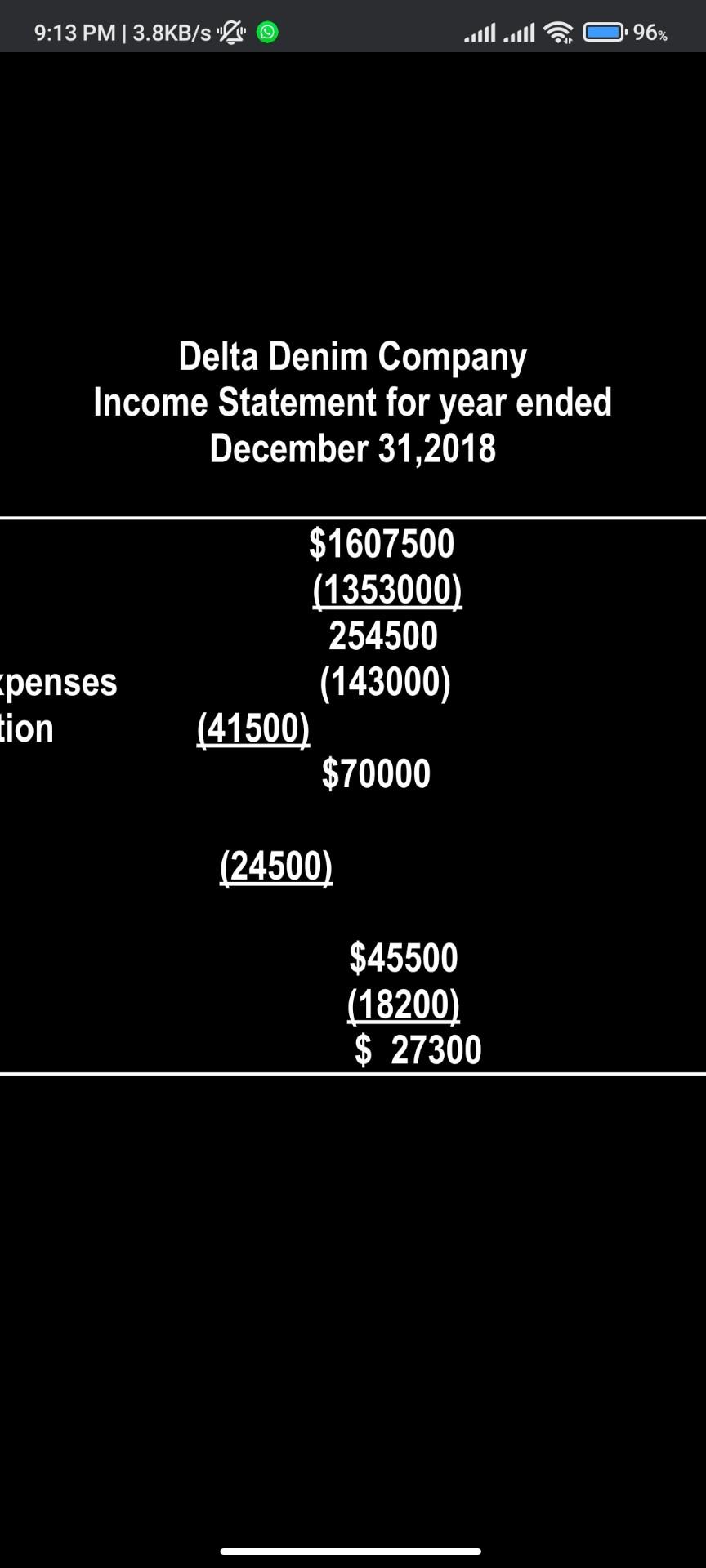

9:09 PM | 3.9KB/s 23 97% Question No. 5 7.5 Compute the ratios given on the following table and compare them with the industry average

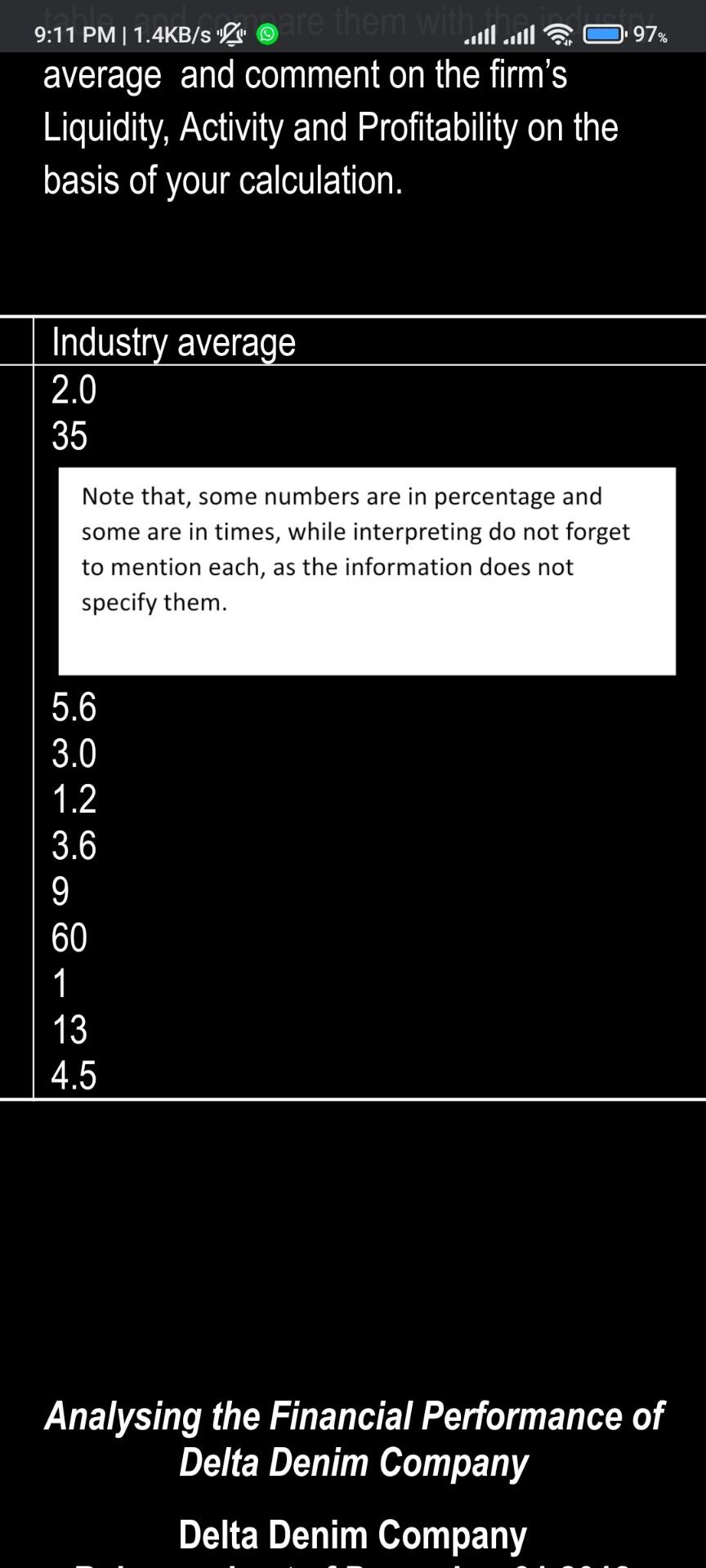

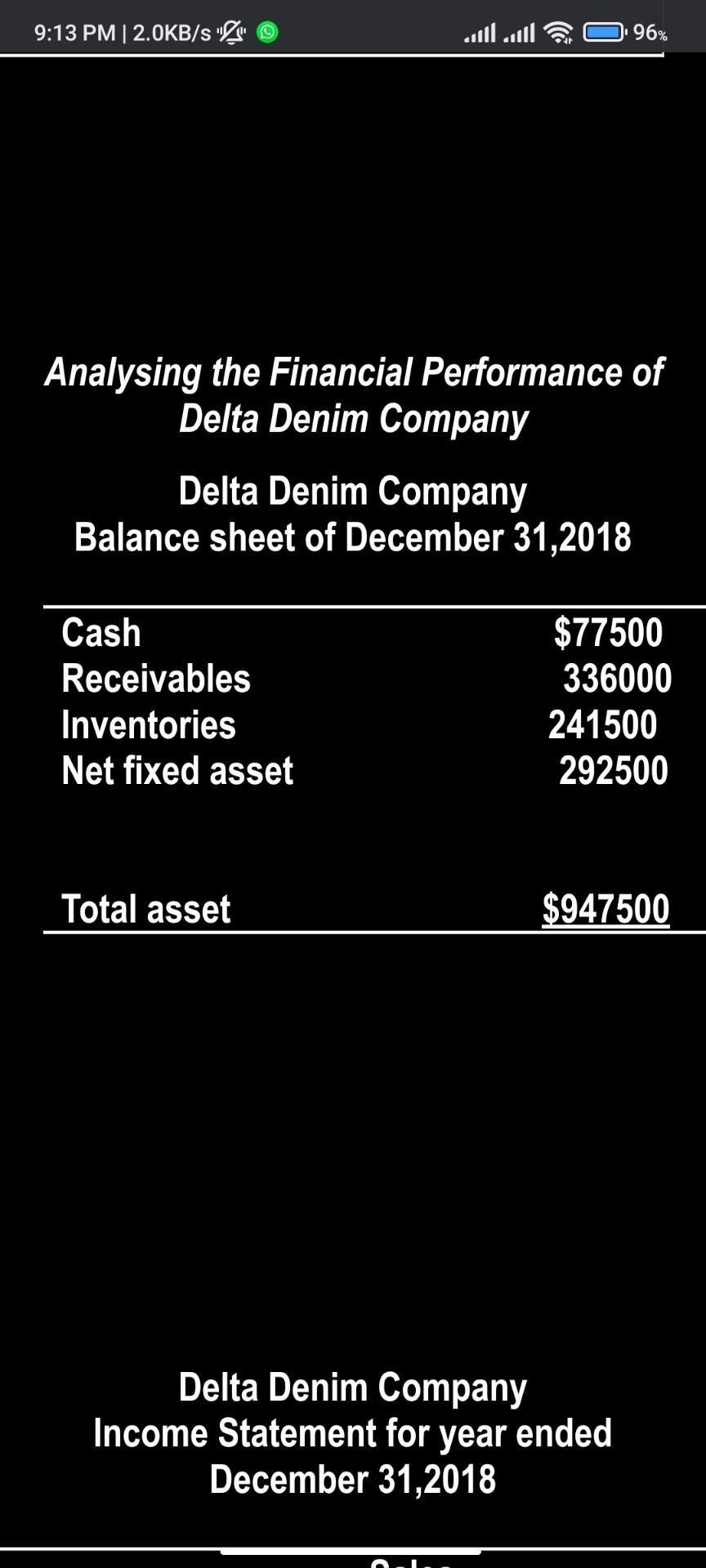

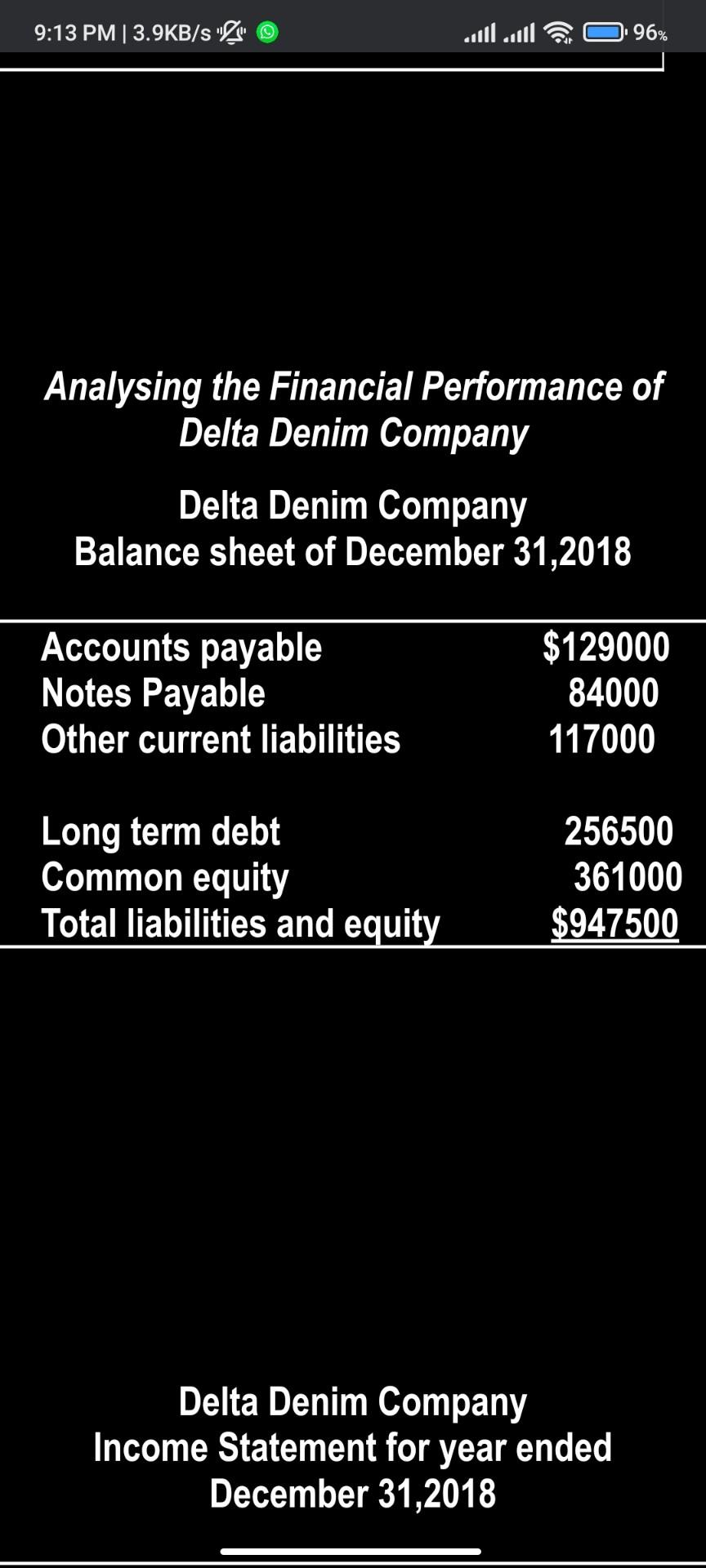

9:09 PM | 3.9KB/s 23" 97% Question No. 5 7.5 Compute the ratios given on the following table and compare them with the industry average and comment on the firm's Liquidity, Activity and Profitability on the basis of your calculation. Ratio Current ratio DSO/ Average collection period Inventory turnover Total asset turnover Net Profit margin Return on assets Return on equity Debt ratio Quick ratio Fixed asset turnover Times Interest Earned 97% 9:11 PM | 1.4KB/S "R" e are them witball average and comment on the firm's Liquidity, Activity and Profitability on the basis of your calculation. Industry average 2.0 35 Note that, some numbers are in percentage and some are in times, while interpreting do not forget to mention each, as the information does not specify them. 5.6 3.0 1.2 3.6 9 60 1. 13 4.5 Analysing the Financial Performance of Delta Denim Company Delta Denim Company 9:13 PM | 2.0KB/s "2" 96% Analysing the Financial Performance of Delta Denim Company Delta Denim Company Balance sheet of December 31, 2018 Cash Receivables Inventories Net fixed asset $77500 336000 241500 292500 Total asset $947500 Delta Denim Company Income Statement for year ended December 31,2018 9:13 PM 3.9KB/s "2" 96% Analysing the Financial Performance of Delta Denim Company Delta Denim Company Balance sheet of December 31,2018 Accounts payable Notes Payable Other current liabilities $129000 84000 117000 Long term debt Common equity Total liabilities and equity 256500 361000 $947500 Delta Denim Company Income Statement for year ended December 31, 2018 9:13 PM | 2.2KB/s "X" 96% Delta Denim Company Income Statement for year ended December 31,2018 Sales COGS Gross Profit Fixed operating expenses Depreciation EBIT $1 (13 25 (14 (41500) $7 Interest (24500) EBT Taxes 40% Net income 9:13 PM | 2.9KB/s "2" 96% Delta Denim Company Income Statement for year ended December 31,2018 ss Profit operating expenses Depreciation T $1607500 (1353000) 254500 (143000) (41500) $70000 Interest (24500) - 40% ome $45500 (18200) $ 27300 9:13 PM |3.8KB/S "23" 96% Delta Denim Company Income Statement for year ended December 31,2018 $1607500 (1353000) 254500 (143000) (41500) $70000 penses tion (24500) $45500 (18200) $ 27300

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started