Answered step by step

Verified Expert Solution

Question

1 Approved Answer

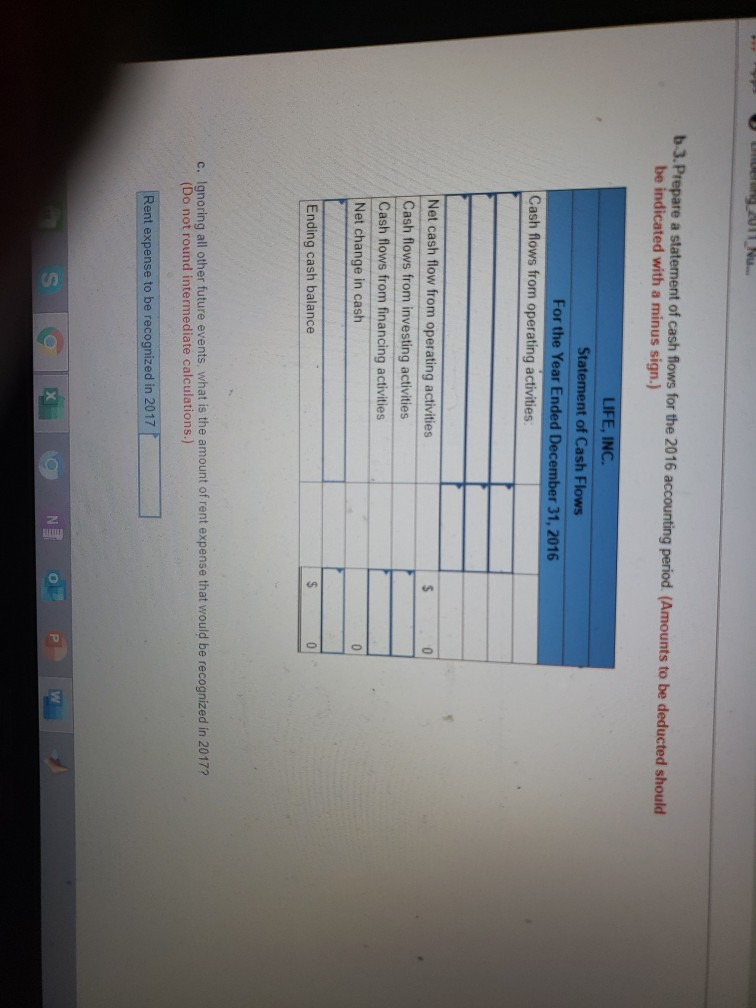

9.2011 Nu.. 6 3. Prepare a statement of cash flows for the 2016 accounting period. (Amounts to be deducted should be indicated with a minus

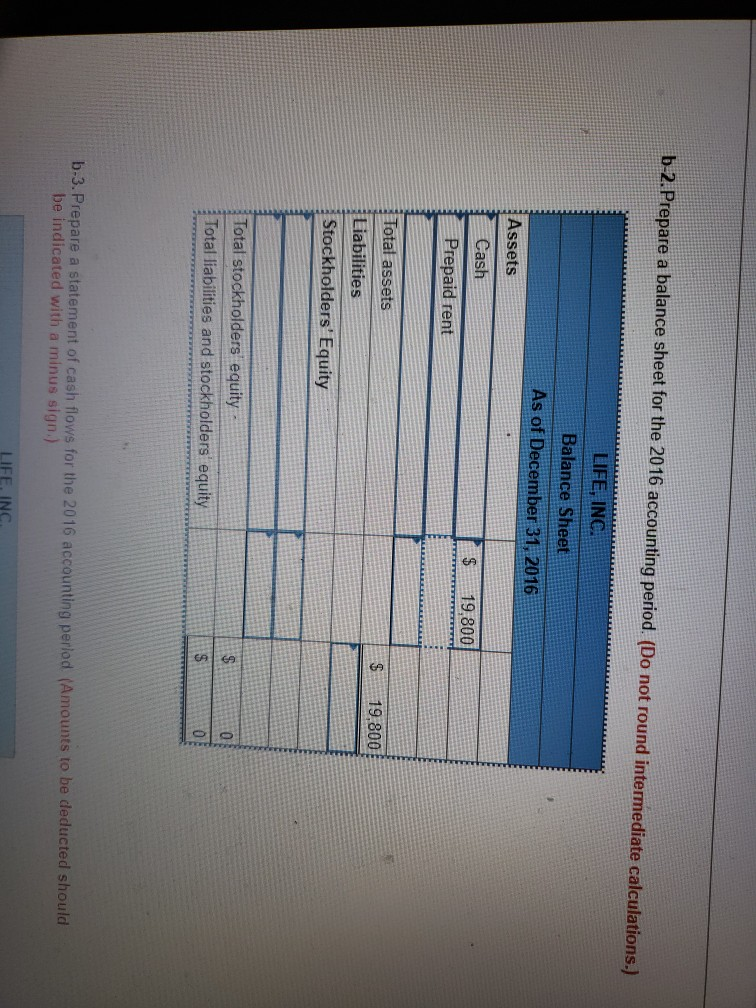

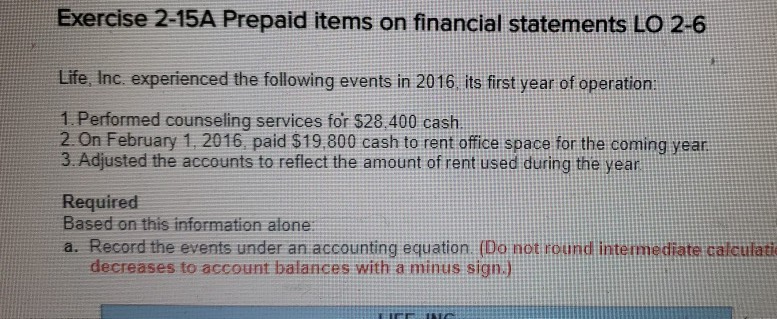

9.2011 Nu.. 6 3. Prepare a statement of cash flows for the 2016 accounting period. (Amounts to be deducted should be indicated with a minus sign.) LIFE, INC. Statement of Cash Flows For the Year Ended December 31, 2016 Cash flows from operating activities Net cash flow from operating activities Cash flows from investing activities Cash flows from financing activities Net change in cash Ending cash balance c. Ignoring all other future events, what is the amount of rent expense that would be recognized in 2017? (Do not round intermediate calculations.) Rent expense to be recognized in 2017 s xg Now 5-2. Prepare a balance sheet for the 2016 accounting period. (Do not round intermediate calculations.) LIFE, INC. Balance Sheet As of December 31, 2016 Assets Cash Prepaid rent $ 19,800 19,800 Total assets Liabilities Stockholders' Equity Total stockholders equity Total liabilities and stockholders equity CA b.3. Prepare a statement of cash flows for the 2016 accounting period (Amounts to be deducted should be indicated with a minus sign.) LIFE, INC Exercise 2-15A Prepaid items on financial statements LO 2-6 Life, Inc. experienced the following events in 2016. its first year of operation. 1. Performed counseling services for $28.400 cash. 2. On February 1, 2016. paid $19.800 cash to rent office space for the coming year. 3. Adjusted the accounts to reflect the amount of rent used during the year Required Based on this information alone a. Record the events under an accounting equation. (Do not round intermediate calculati decreases to account balances with a minus sign

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started