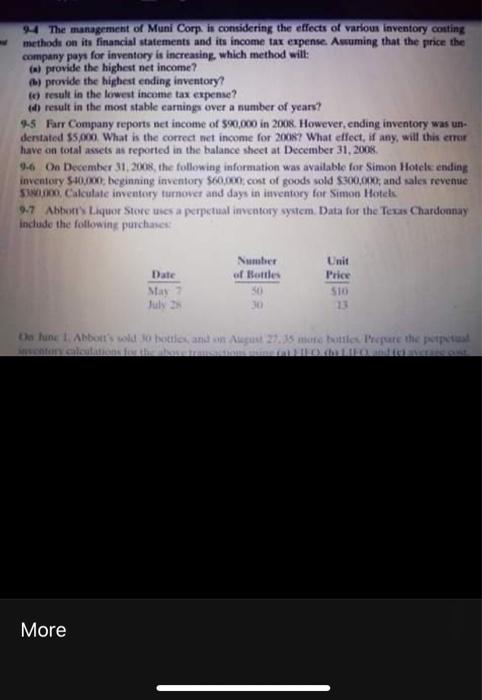

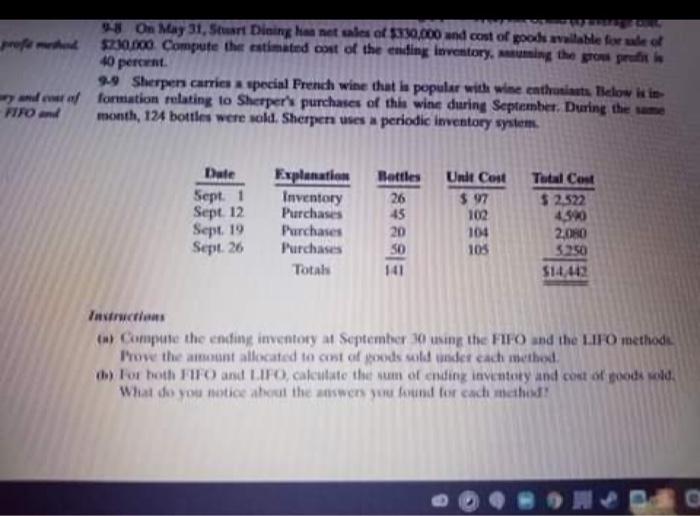

94 The management of Muni Corp. is considering the effects of various inventory conting methods on its financial statements and its income tax expense. Asuming that the price the company pays for inventory is increasing, which method will: 6) provide the highest net income? ) provide the highest ending inventory? to result in the lowest income tax expense? result in the most stable carnings over a number of years? 4-5 Furr Company reports net income of $90,000 in 2008. However, ending inventory was un- derstated $5,000. What is the correct net income for 2008? What effect, if any, will this error have on total assets as reported in the balance sheet at December 31, 2008 96 On December 31, 2008, the following information was available for Simon Hotel ending inventory $400, beginning inventory $60.000.cont of goods sold $300,000, and sales revenue 5. Calculate inventory turnover and days in inventory for Simon Hotel 9.7 Abbot Liquor Store uses a perpetual inventory system. Data for the Texas Chardonnay include the following purchases Date Mas Muly Number of Bottles 50 30 Unit Price 510 13 De lune 1 Abor's w sobottles and on past 27. le Proute the popust More 8 On May 31, Stuart Dining ha netales of $230,000 and cost of goods ille for we of $230100 Compute the estimated cost of the ending Inventory.ing the grow petits 40 percent 99 Sherpen carries a special French wine that is popular with wine enthusias Below is in af formation relating to Sherper's purchases of the wine during September. During the same month, 124 bottles were sold. Sherper uses a periodic inventory system Date Sept. 1 Sept. 12 Sept. 19 Sept. 26 Explanation Inventory Purchases Purchases Purchases Totals Bottles 26 45 20 50 141 Unit Cost $ 97 102 104 105 Total Cost $ 2,522 4.540 2.00 5250 51443 Tastrwca ts Compute the ending inventory a September 10 using the FIFO and the LIFO methode Prove the amount allocated to cost of goods sold under each method d) or hoth FIFO and LIFO, calculate the sum of ending inventory and cost of foods sold What do you notice about the answers you found for cad mahed! 94 The management of Muni Corp. is considering the effects of various inventory conting methods on its financial statements and its income tax expense. Asuming that the price the company pays for inventory is increasing, which method will: 6) provide the highest net income? ) provide the highest ending inventory? to result in the lowest income tax expense? result in the most stable carnings over a number of years? 4-5 Furr Company reports net income of $90,000 in 2008. However, ending inventory was un- derstated $5,000. What is the correct net income for 2008? What effect, if any, will this error have on total assets as reported in the balance sheet at December 31, 2008 96 On December 31, 2008, the following information was available for Simon Hotel ending inventory $400, beginning inventory $60.000.cont of goods sold $300,000, and sales revenue 5. Calculate inventory turnover and days in inventory for Simon Hotel 9.7 Abbot Liquor Store uses a perpetual inventory system. Data for the Texas Chardonnay include the following purchases Date Mas Muly Number of Bottles 50 30 Unit Price 510 13 De lune 1 Abor's w sobottles and on past 27. le Proute the popust More 8 On May 31, Stuart Dining ha netales of $230,000 and cost of goods ille for we of $230100 Compute the estimated cost of the ending Inventory.ing the grow petits 40 percent 99 Sherpen carries a special French wine that is popular with wine enthusias Below is in af formation relating to Sherper's purchases of the wine during September. During the same month, 124 bottles were sold. Sherper uses a periodic inventory system Date Sept. 1 Sept. 12 Sept. 19 Sept. 26 Explanation Inventory Purchases Purchases Purchases Totals Bottles 26 45 20 50 141 Unit Cost $ 97 102 104 105 Total Cost $ 2,522 4.540 2.00 5250 51443 Tastrwca ts Compute the ending inventory a September 10 using the FIFO and the LIFO methode Prove the amount allocated to cost of goods sold under each method d) or hoth FIFO and LIFO, calculate the sum of ending inventory and cost of foods sold What do you notice about the answers you found for cad mahed