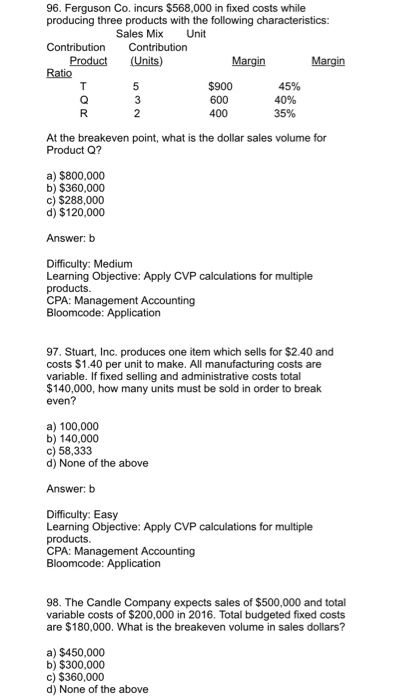

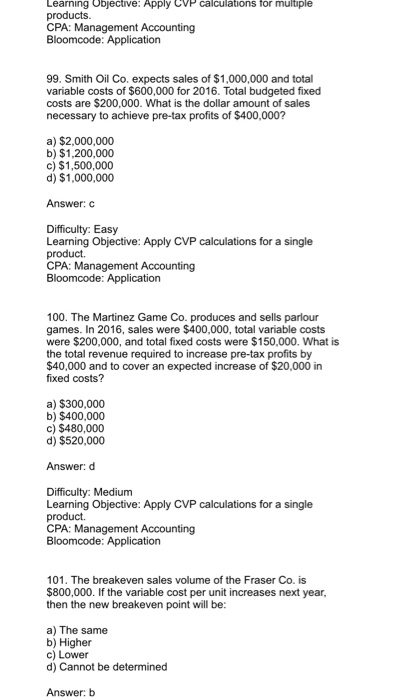

96. Ferguson Co. incurs $568,000 in fixed costs while producing three products with the following characteristics: Sales Mix Unit Product (Units) Ratio $900 600 400 45% 40% 35% At the breakeven point, what is the dollar sales volume for Product Q? a) $800,000 b) $360,000 c) $288,000 d) $120,000 Answer: b Difficulty: Medium Learning Objective: Apply CVP calculations for multiple CPA: Management Accounting 97. Stuart, Inc. produces one item which sells for $2.40 and costs $1.40 per unit to make. All manufacturing costs are variable. If fixed selling and administrative costs total $140,000, how many units must be sold in order to break even? a) 100,000 b) 140,000 c) 58,333 d) None of the above Answer: b Difficulty: Easy Learning Objective: Apply CVP calculations for multiple CPA: Management Accounting 98. The Candle Company expects sales of $500,000 and total variable costs of $200,000 in 2016. Total budgeted fixed costs are $180,000. What is the breakeven volume in sales dollars? a) $450,000 b) $300,000 c) $360,000 d) None of the above Learning Objective: Apply CyP calculations for multiple 99. Smith Oil Co, expects sales of $1,000,000 and total variable costs of $600,000 for 2016. Total budgeted fixed costs are $200,000. What is the dollar amount of sales necessary to achieve pre-tax profits of $400,000? a) $2,000,000 b) $1,200,000 c) $1,500,000 d) $1,000,000 Answer: C Difficulty: Easy Learning Objective: Apply CVP calculations for a single product. 100. The Martinez Game Co. produces and sells parlour games. In 2016, sales were $400,000, total variable costs were $200,000, and total fixed costs were $150,000. What is the total revenue required to increase pre-tax profits by $40,000 and to cover an expected increase of $20,000 in fixed costs? a) $300,000 b) $400,000 c) $480,000 d) $520,000 Answer: d Difficulty: Medium Learning Objective: Apply CVP calculations for a single product. 101. The breakeven sales volume of the Fraser Co. is 800,000. If the variable cost per unit increases next year, then the new breakeven point will be a) The same b) Higher c) Lower d) Cannot be determined Answer: b 96. Ferguson Co. incurs $568,000 in fixed costs while producing three products with the following characteristics: Sales Mix Unit Product (Units) Ratio $900 600 400 45% 40% 35% At the breakeven point, what is the dollar sales volume for Product Q? a) $800,000 b) $360,000 c) $288,000 d) $120,000 Answer: b Difficulty: Medium Learning Objective: Apply CVP calculations for multiple CPA: Management Accounting 97. Stuart, Inc. produces one item which sells for $2.40 and costs $1.40 per unit to make. All manufacturing costs are variable. If fixed selling and administrative costs total $140,000, how many units must be sold in order to break even? a) 100,000 b) 140,000 c) 58,333 d) None of the above Answer: b Difficulty: Easy Learning Objective: Apply CVP calculations for multiple CPA: Management Accounting 98. The Candle Company expects sales of $500,000 and total variable costs of $200,000 in 2016. Total budgeted fixed costs are $180,000. What is the breakeven volume in sales dollars? a) $450,000 b) $300,000 c) $360,000 d) None of the above Learning Objective: Apply CyP calculations for multiple 99. Smith Oil Co, expects sales of $1,000,000 and total variable costs of $600,000 for 2016. Total budgeted fixed costs are $200,000. What is the dollar amount of sales necessary to achieve pre-tax profits of $400,000? a) $2,000,000 b) $1,200,000 c) $1,500,000 d) $1,000,000 Answer: C Difficulty: Easy Learning Objective: Apply CVP calculations for a single product. 100. The Martinez Game Co. produces and sells parlour games. In 2016, sales were $400,000, total variable costs were $200,000, and total fixed costs were $150,000. What is the total revenue required to increase pre-tax profits by $40,000 and to cover an expected increase of $20,000 in fixed costs? a) $300,000 b) $400,000 c) $480,000 d) $520,000 Answer: d Difficulty: Medium Learning Objective: Apply CVP calculations for a single product. 101. The breakeven sales volume of the Fraser Co. is 800,000. If the variable cost per unit increases next year, then the new breakeven point will be a) The same b) Higher c) Lower d) Cannot be determined Answer: b