9.6 Please answer all parts of the question.

.

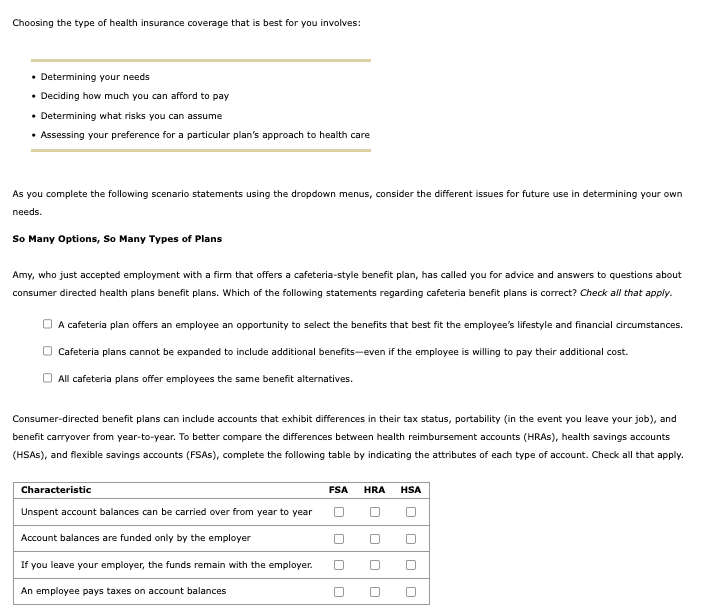

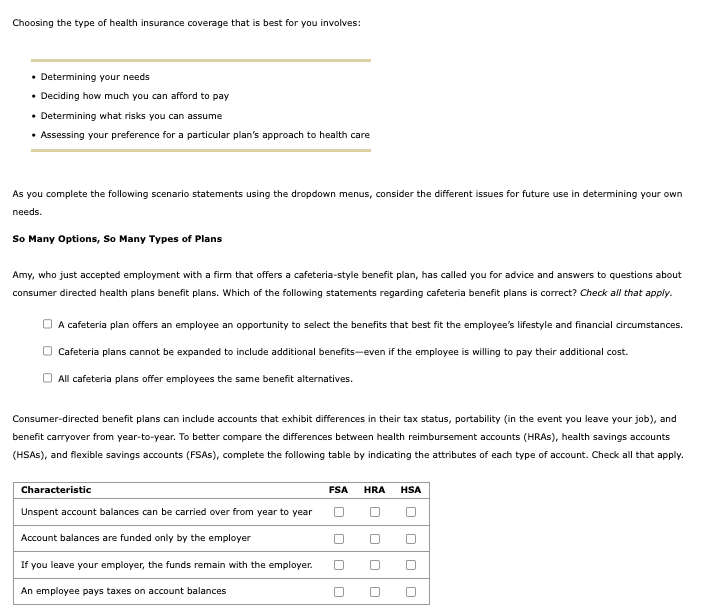

Choosing the type of health insurance coverage that is best for you involves: - Determining your needs - Deciding how much you can afford to pay - Determining what risks you can assume - Assessing your preference for a particular plan's approach to health care As you complete the following scenario statements using the dropdown menus, consider the different issues for future use in determining your own needs. So Many Options, So Many Types of Plans Amy, who just accepted employment with a firm that offers a cafeteria-style benefit plan, has called you for advice and answers to questions about consumer directed health plans benefit plans. Which of the following statements regarding cafeteria benefit plans is correct? Check all that apply. A cafeteria plan offers an employee an opportunity to select the benefits that best fit the employee's lifestyle and financial circumstances. Cafeteria plans cannot be expanded to include additional benefits-even if the employee is willing to pay their additional cost. All cafeteria plans offer employees the same benefit alternatives. Consumer-directed benefit plans can include accounts that exhibit differences in their tax status, portability (in the event you leave your job), benefit carryover from year-to-year. To better compare the differences between health reimbursement accounts (HRAs), health savings accounts (HSAs), and flexible savings accounts (FSAs), complete the following table by indicating the attributes of each type of account. Check all that apply. Choosing the type of health insurance coverage that is best for you involves: - Determining your needs - Deciding how much you can afford to pay - Determining what risks you can assume - Assessing your preference for a particular plan's approach to health care As you complete the following scenario statements using the dropdown menus, consider the different issues for future use in determining your own needs. So Many Options, So Many Types of Plans Amy, who just accepted employment with a firm that offers a cafeteria-style benefit plan, has called you for advice and answers to questions about consumer directed health plans benefit plans. Which of the following statements regarding cafeteria benefit plans is correct? Check all that apply. A cafeteria plan offers an employee an opportunity to select the benefits that best fit the employee's lifestyle and financial circumstances. Cafeteria plans cannot be expanded to include additional benefits-even if the employee is willing to pay their additional cost. All cafeteria plans offer employees the same benefit alternatives. Consumer-directed benefit plans can include accounts that exhibit differences in their tax status, portability (in the event you leave your job), benefit carryover from year-to-year. To better compare the differences between health reimbursement accounts (HRAs), health savings accounts (HSAs), and flexible savings accounts (FSAs), complete the following table by indicating the attributes of each type of account. Check all that apply