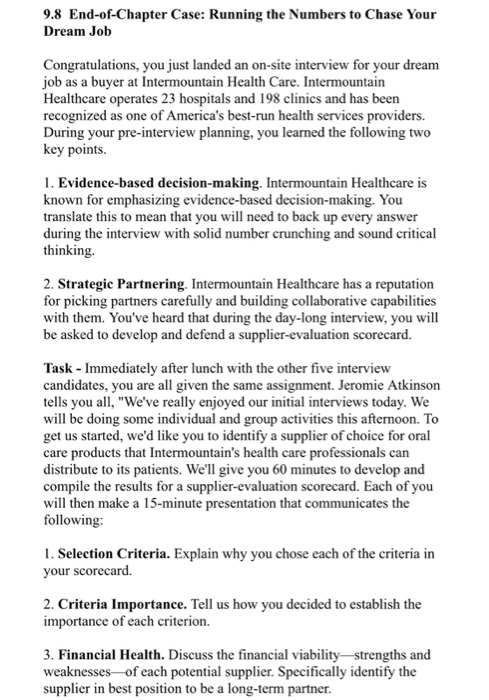

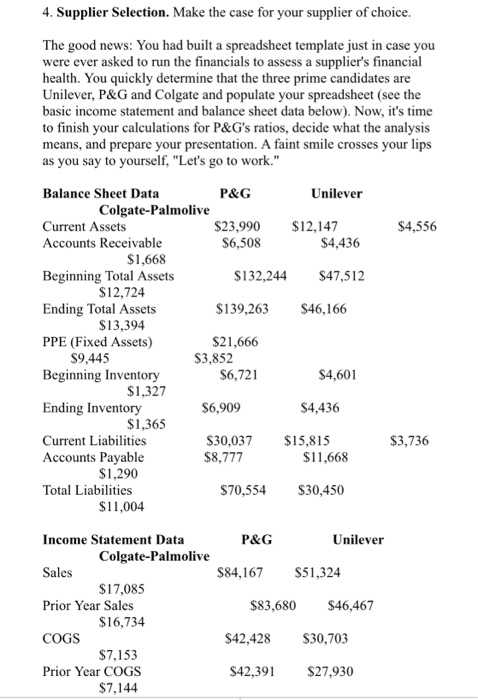

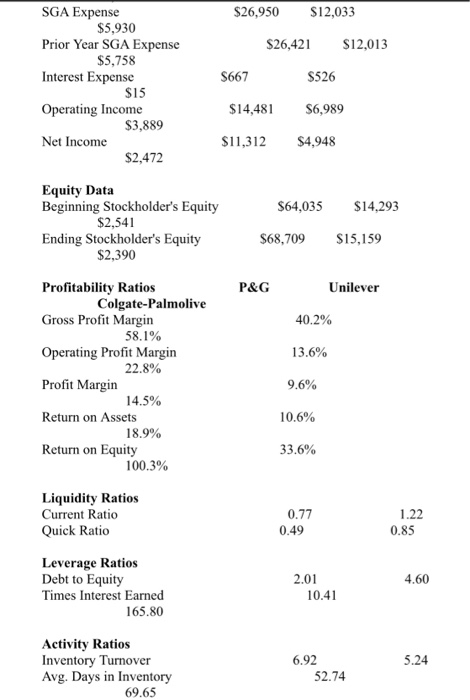

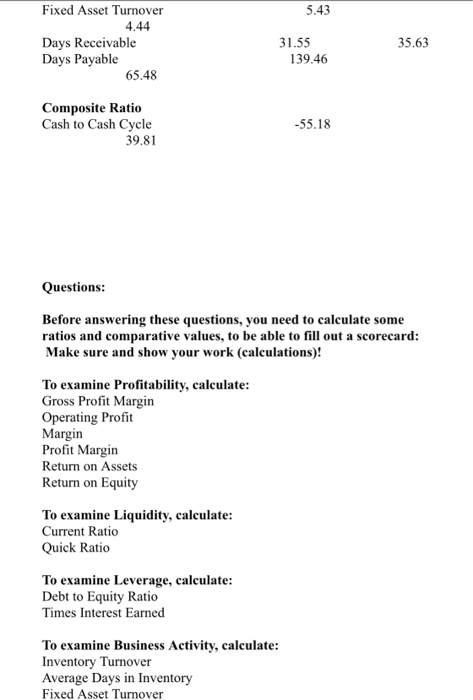

9.8 End-of-Chapter Case: Running the Numbers to Chase Your Dream Job Congratulations, you just landed an on-site interview for your dream job as a buyer at Intermountain Health Care. Intermountain Healthcare operates 23 hospitals and 198 clinics and has been recognized as one of America's best-run health services providers. During your pre-interview planning, you learned the following two key points. 1. Evidence-based decision-making. Intermountain Healthcare is known for emphasizing evidence-based decision-making. You translate this to mean that you will need to back up every answer during the interview with solid number crunching and sound critical thinking. 2. Strategic Partnering. Intermountain Healthcare has a reputation for picking partners carefully and building collaborative capabilities with them. You've heard that during the day-long interview, you will be asked to develop and defend a supplier-evaluation scorecard. Task Immediately after lunch with the other five interview candidates, you are all given the same assignment. Jeromie Atkinson tells you all, "Weve really enjoyed our initial interviews today. We will be doing some individual and g get us started, we'd like you to identify a supplier of choice for oral care products that Intermountain's health care professionals can distribute to its patients. We'll give you 60 minutes to develop and compile the results for a supplier-evaluation scorecard. Each of you will then make a 15- following roup activities this afternoon. To minute prese ntation that communicates the 1. Selection Criteria. Explain why you chose each your scorecard. of the criteria in 2. Criteria Importance. Tell us how you decided to establish the importance of each criterion. 3. Financial Health. Discuss the financial viability strengths and weaknesses-of each potential supplier. Specifically identify the supplier in best position to be a long-term partner. 4. Supplier Selection. Make th e case for your supplier of choice. The good news: You had built a spreadsheet template just in case you were ever asked to run the financials to assess a supplier's financial health. You quickly determine that the three prime candidates are Unilever, P&G and Colgate and populate your spreadsheet (see the basic income statement and balance sheet data below). Now, it's time to finish your calculations for P&G's ratios, decide what the analysis means, and prepare your presentation. A faint smile crosses your lips as you say to yourself, "Let's go to work." Balance Sheet Data P&G Unilever Colgate-Palmolive Current Assets Accounts Receivable $23,990 $12,147 $4,556 $6,508 $4,436 $1,668 Beginning Total Assets Ending Total Assets PPE (Fixed Assets) Beginning Inventory Ending Inventory S132,244S47,512 $139,263 S46,166 S21,666 $12,724 $13,394 S9,445 S3,852 S6,721 S6,909 S30,037 $15,815 S4,601 $1,327 $4,436 $1,365 Current Liabilities Accounts Payable $3,736 $8,777 $11,668 $1,290 Total Liabilities $70,554 $30,450 $11,004 P&G Income Statement Data Sales Prior Year Sales COGS Prior Year COGS Unilever Colgate-Palmolive $17,085 $16,734 $7,153 $7,144 $84,167 S51,324 $83,680 $46,467 S42,428 S30,703 S42,391 $27,930 SGA Expense $26,950 12,033 $5,930 Prior Year SGA Ex pense S26,42 S12,013 $5,758 Interest Expense S667 S526 $14,48 S6,989 $11,312 $4,948 $15 Operating Income $3,889 Net Income $2,472 Equity Data Beginning Stockholder's Equity S64,035 $14,293 $2,541 Ending Stockholder's Equity $68,709 S15,159 $2,390 Profitability Ratios Gross Profit Margin Operating Profit Margin Profit Margin Return on Assets Return on Equity P&G Unilever Colgate-Palmolive 40.2% 58.1% 22.8% 14.5% 18.9% 100.3% 13.6% 10.6% 33.6% Liquidity Ratios Current Ratio Quick Ratio 0.77 0.49 1.22 0.85 Leverage Ratios Debt to Equity Times Interest Earned 2.01 4.60 10.41 165.80 Activity Ratios Inventory Turnover Avg. Days in Inventory 6.92 5.24 52.74 69.65 Fixed Asset Turnover 5.43 4.44 Days Receivable Days Payable 31.55 35.63 139.46 65.48 Composite Ratio Cash to Cash Cycle -55.18 39.81 Questions: Before answering these questions, you need to calculate some ratios and comparative values, to be able to fill out a scorecard: Make sure and show your work (calculations)! To examine Profitability, calculate: Gross Profit Margin Operating Profit Margin Profit Margin Return on Assets Return on Equity To examine Liquidity, calculate Current Ratio Quick Ratio To examine Leverage, calculate: Debt to Equity Ratio Times Interest Earned To examine Business Activity, calculate Inventory Turnover Average Days in Inventory Fixed Asset Turnover Gross Profit Margin Operating Profit Margin Profit Margin Return on Assets Return on Equity To examine Liquidity, calculate: Current Ratio Quick Ratio To examine Leverage, calculate: Debt to Equity Ratio Times Interest Earned To examine Business Activity, calculate: Inventory Turnover Average Days in Inventory Fixed Asset Turnover Days Receivable Days Payable To look at the "composite" ratio, calculate: Cash-to-Cash Cycle Using these measures, prepare a scorecard, make an appropriately supported recommendation, and answer the following questions 1. Based solely on your financial analysis, which supplier do you recommend? How does your recommendation change when u include the other criteria on your list? yo 2. What does your scorecard look like? Be prepared to explain your 1C 3. What did you learn about each supplier from your assessment of financial health? What inferences can you draw regarding each company's long-term supplier development strategy