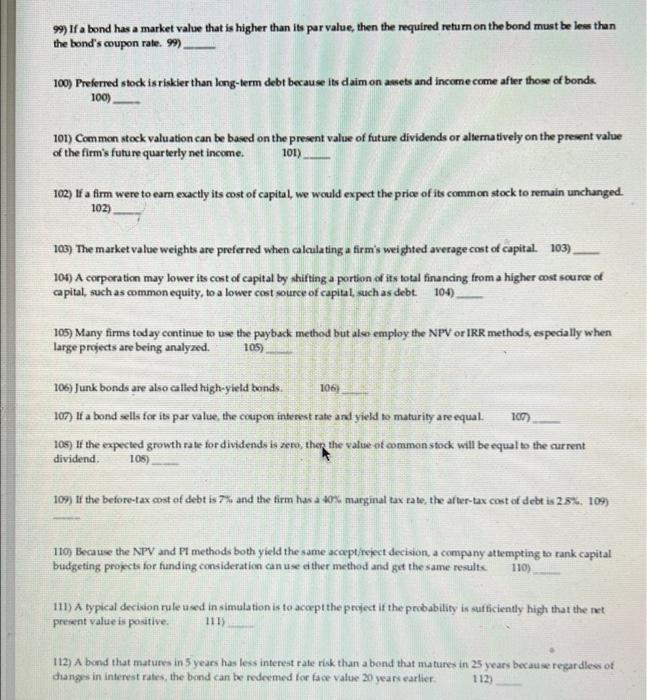

99) If a bond has a market value that is higher than its par value, then the required retum on the bond must be less than the bond's coupon rate. 99) 100) Preferred stock isriskier than long-term debt because its daim on amets and income come after those of bonds 100) 101) Common stock valuation can be based on the present value of future dividends or alternatively on the present value of the firm's future quarterly net income. 101) 102) If a firm were to cam exactly its cost of capital, we would expect the price of its common stock to remain unchanged. 102) 103) The market value weights are preferred when calculating a firm's weighted average cost of capital. 103) 106) A corporation may lower its cost of capital by shifting a portion of its total financing from a higher cost source of capital, such as common equity, to a lower cost source of capital, such as debt 104) 105) Many firms today continue to use the payback method but also employ the NPV or IRR methods especially when large projects are being analyzed. 105) 106) Junk bonds are also called high-yield bonds. 106) 107) If a bond sells for its par value, the coupon interest rate and yield te maturity are equal. 1071 105) If the expected growth rate for dividends is zero, there the value of common stock will be equal to the current dividend 105) 109) If the before-tax cost of debt is 7% and the firm has a 40% marginal tax rate, the after-tax cost of debt is 28%. 109 110) Because the NPV and P1 methods both yield the same accept/reject decidon a company attempting to rank capital budgeting projects for funding consideration can use either method and get the same results 110) 111) ALY A typical decision rule u red in simulation is to accept the project if the probability is sufficiently high that the net present value is positive 111) 112) A bond that matures in 5 years has less interest rate risk than a bond that matures in 25 years because regardless of changes in interest rates the bond can be redeemed for face value 20 years earlier 112