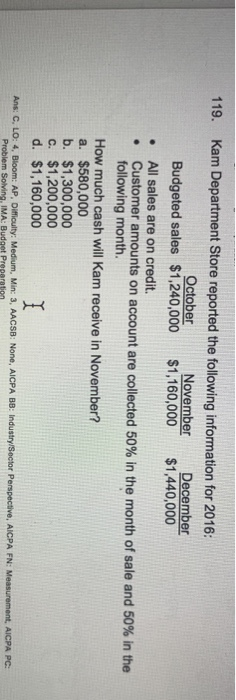

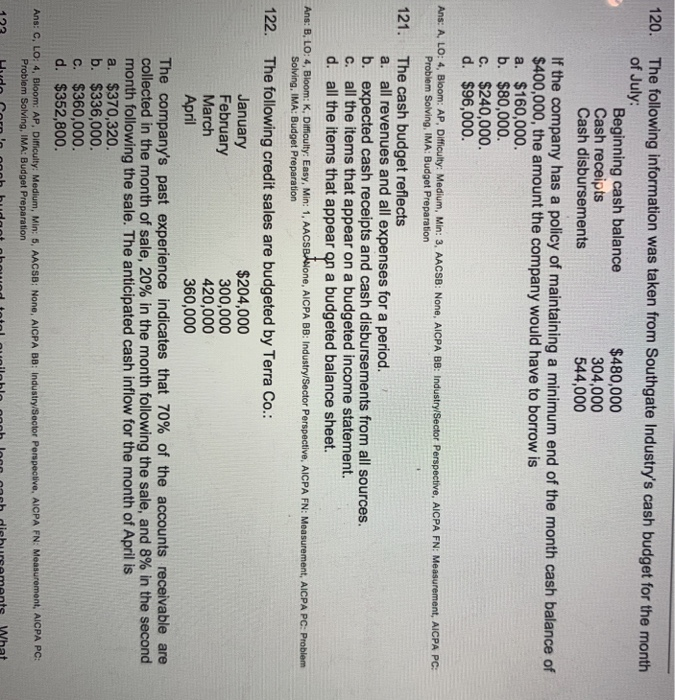

99. Off-Line Co. has 9,000 units in beginning finished goods. The sales budget shows expected sales to be 36,000 units. If the production budget shows that 42,000 units are required for production, what was the desired ending finished goods? a. 3,000 b. 9,000. C. 15,000. d. 27,000. Ans: C, LO: 2, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Resource Management, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Budget Preparation 100. Lion Industries required production for June is 132,000 units. To make one unit of finished product, three pounds of direct material Z are required. Actual beginning and desired ending inventories of direct material Z are 300,000 and 330,000 pounds, respectively. How many pounds of direct material Z must be purchased? a. 378,000 b. 396,000. C. 408,000. d. 426,000. 101. Haft Construction Company determines that 54,000 pounds of direct materials are needed for production in July. There are 3,200 pounds of direct materials on hand at July 1 and the desired ending inventory is 2,800 pounds. If the cost per unit of direct materials is $3. what is the budgeted total cost of direct materials purchases? a. 158,400 b. 160,800 c. 163,200. d. 165,600. Ans: B, LO: 2. Bloom: AP. Diculty: Medium, Min: 5. AACSB: Analytic, AICPA BB: Resource Management, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Budget Preparation 102. Pell Manufacturing is preparing its direct labor budget for May. Projections for the month are that 33,400 units are to be produced and that direct labor time is three hours per unit. If the labor cost per hour is $12, what is the total budgeted direct labor cost for May? a. 1,159,200. b. 1,180,800. c. 1,202,400. d. 1,296,000. Ans: C, LO: 3, Bloom: AP. Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Resource Management, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Budget Preparation 103. Dolce Co. estimates its sales at 180,000 units in the first quarter and that sales will increase by 18,000 units each quarter over the year. They have, and desire, a 25% ending inventory of finished goods. Each unit sells for $25. 40% of the sales are for cash. 70% of the credit customers pay within the quarter. The remainder is received in the quarter following sale. M Production in units for the third quarter should be budgeted at a. 220,500 b. 207,000. C. 274,500. d. 216,000. A LO: 2, Bloom: AP, outy, Hard, Min: 6, AACSB: Analytic, AICPA BB: Resource Management, AICPA FN: Measuremen AICPA PC: Problem Solving, IMA:Budget Preparation 104. Dolce Co. estimates its sales at 180,000 units in the first quarter and that sales will increase by 18,000 units each quarter over the year. They have, and desire, a 25% ending inventory of finished goods. Each unit sells for $25. 40% of the sales are for cash. 70% of the credit customers pay within the quarter. The remainder is received in the quarter following sale. Cash collections for the third quarter are budgeted at a. $3,051,000. b. $4,428,000 c. $5,319,000 d. $6,156,000 Budgetary Planning 9-23 105. Bear, Inc. estimates its sales at 200,000 units in the first quarter and that sales will increase by 20,000 units each quarter over the year. They have, and desire, a 25% ending inventory of finished goods. Each unit sells for $35. 40% of the sales are for cash. 70% of the credit customers pay within the quarter. The remainder is received in the quarter following sale. Production in units for the third quarter should be budgeted at a. 245,000. b. 230,000. c. 305,000. d. 240,000 Ans: A LO: 2, Bloom: AP. Difficulty: Hard, Min: 5, AACSB: Analytic, AICPA BB: Resource Management, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Budget Preparation 106. Bear, Inc. estimates its sales at 200,000 units in the first quarter and that sales will increase by 20,000 units each quarter over the year. They have, and desire, a 25% ending inventory of finished goods. Each unit sells for $35. 40% of the sales are for cash. 70% of the credit customers pay within the quarter. The remainder is received in the quarter following sale. Cash collections for the third quarter are budgeted at a. $4,746,000. b. $6,888,000. c. $8,274,000. d. $9,576,000. Ans: C, LO: 4, Bloom: AP. Difficulty: Hard, Min: 6, AACSB: Analytic, AICPA BB: Resource Management, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Budget Preparation 107. A company determined that the budgeted cost of producing a product is $30 per unit. On June 1, there were 80,000 units on hand, the sales department budgeted sales of 300,000 units in June, and the company desires to have 120,000 units on hand on June 30. The budgeted cost of goods sold for June would be a. $7,800,000 b. $11,400,000. c. $9,000,000. d. $10,200,000. Ans: D, LO: 3, Bloom: AP, Difficulty: Medium, Min: 5, AACSB: Analytie, AICPA BB: Resource Management, AICPA FN: Measurement, AICPA PC: Problem Solving. IMA: Budget Procaration 110. A company has budgeted direct materials purchases of $300,000 in July and $480,000 in August. Past experience indicates that the company pays for 70% of its purchases in the month of purchase and the remaining 30% in the next month. During August, the following items were budgeted: Wages Expense $150,000 Purchase of office equipment 72,000 Selling and Administrative Expenses 48,000 Depreciation Expense 36,000 The budgeted cash disbursements for August are a. $648,000. b. $426,000. C. $696,000. d. $732,000. Ans: C, LO: 4, Bloom: AP. Difficulty: Medium, Min: 5, AACSB: Analytie, AICPA BB: Resource Management, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Budget Preparation 111. Astor Manufacturing has the following budgeted sales: January $120,000, February $180,000, and March $150,000. 40% of the sales are for cash and 60% are on credit. For the credit sales, 50% are collected in the month of sale, and 50% the next month. The total expected cash receipts during March are: a. $168,000 b. $159,000 c. $157,500 d. $150,000. Ans: B, LO: 4, Bloom: AP, Difficulty: Hard, Min: 5, AACSB: Analytic, AICPA BB: Resource Management, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Budget Preparation 112. Garnett Co. expects to purchase $180,000 of materials in July and $210,000 of materials in August. Three-fourths of all purchases are paid for in the month of purchase, and the other one-fourth are paid for in the month following the month of purchase. How much will August's cash disbursements for materials purchases be? a. $135,000 b. $157,500 c. $202,500 d. $210,000 Ans: O, LO: 4, Bloom: AP, Difficulty: Medium, Min: 6, AACSB: Analytic, AICPA BB: Resource Management, AICPA FN: Measurement, AICPA PC Problem Solving, IMA: Budget Preparation 113. The single most important outnuit in nrenaring financial hudents in thn 119. Kam Department Store reported the following information for 2016: October November December Budgeted sales $1,240,000 $1,160,000 $1,440,000 All sales are on credit. Customer amounts on account are collected 50% in the month of sale and 50% in the following month. How much cash will Kam receive in November? a. $580,000 b. $1,300,000 c. $1,200,000 d. $1,160,000 Ans: C, LO: 4, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: None, AICPA BB: Industry/Sector Perspective, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Budget Preparation 120. The following information was taken from Southgate Industry's cash budget for the month of July: Beginning cash balance $480,000 Cash receipts 304,000 Cash disbursements 544,000 If the company has a policy of maintaining a minimum end of the month cash balance of $400,000, the amount the company would have to borrow is a. $160,000. b. $80,000. c. $240,000. d. $96,000. Ans: A, LO: 4, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: None, AICPA BB: Industry/Sector Perspective, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Budget Preparation 121. The cash budget reflects a. all revenues and all expenses for a period. b. expected cash receipts and cash disbursements from all sources. c. all the items that appear on a budgeted income statement. d. all the items that appear on a budgeted balance sheet. Ans: B, LO: 4, Bloom: K. Difficulty: Easy, Min: 1, AACSBllone, AICPA BB: Industry/Sector Perspective, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Budget Preparation 122. The following credit sales are budgeted by Terra Co.: January $204,000 February 300,000 March 420,000 360,000 The company's past experience indicates that 70% of the accounts receivable are collected in the month of sale, 20% in the month following the sale, and 8% in the second month following the sale. The anticipated cash inflow for the month of Aprilis a. $370,320. b. $336,000. c. $360,000. d. $352,800. April Ans: C, LO: 4, Bloom: AP. Difficulty: Medium, Min: 5, AACSB: None, AICPA BB: Industry/Sector Perspective, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Budget Preparation Pudo Corn' nanh hudant hood total unilablo nanh lon noh disbursements What