Answered step by step

Verified Expert Solution

Question

1 Approved Answer

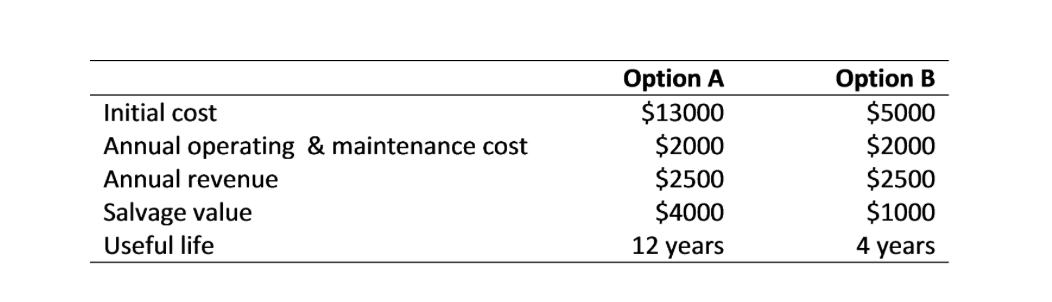

a. (10) Based on a present worth analysis with an interest rate (MARR) of 6% what is the most economically attractive option? What is the

a. (10) Based on a present worth analysis with an interest rate (MARR) of 6% what is the most economically attractive option? What is the present worth of each option over the analysis period?

b. (10) Calculate the incremental rate of return ?IRR for these two options. At a MARR of 6%, which of these two options is the most economically attractive option? Briefly explain why.

Initial cost Annual operating & maintenance cost Annual revenue Salvage value Useful life Option A $13000 $2000 $2500 $4000 12 years Option B $5000 $2000 $2500 $1000 4 yearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started