Answered step by step

Verified Expert Solution

Question

1 Approved Answer

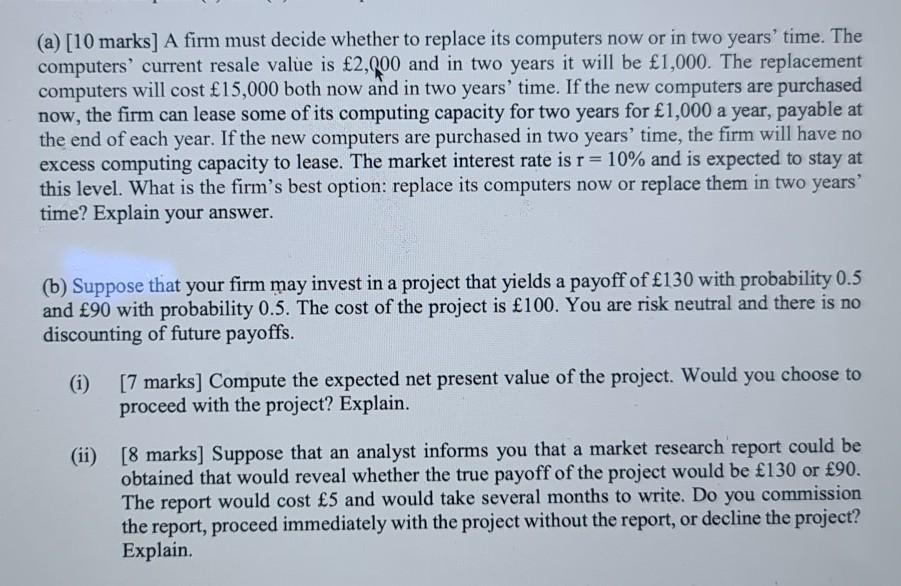

(a) [10 marks] A firm must decide whether to replace its computers now or in two years' time. The computers' current resale value is 2,000

(a) [10 marks] A firm must decide whether to replace its computers now or in two years' time. The computers' current resale value is 2,000 and in two years it will be 1,000. The replacement computers will cost 15,000 both now and in two years' time. If the new computers are purchased now, the firm can lease some of its computing capacity for two years for 1,000 a year, payable at the end of each year. If the new computers are purchased in two years' time, the firm will have no excess computing capacity to lease. The market interest rate is r = 10% and is expected to stay at this level. What is the firm's best option: replace its computers now or replace them in two years' time? Explain your answer. (b) Suppose that your firm may invest in a project that yields a payoff of 130 with probability 0.5 and 90 with probability 0.5. The cost of the project is 100. You are risk neutral and there is no discounting of future payoffs. [7 marks] Compute the expected net present value of the project. Would you choose to proceed with the project? Explain. (ii) [8 marks] Suppose that an analyst informs you that a market research report could be obtained that would reveal whether the true payoff of the project would be 130 or 90. The report would cost 5 and would take several months to write. Do you commission the report, proceed immediately with the project without the report, or decline the project? Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started