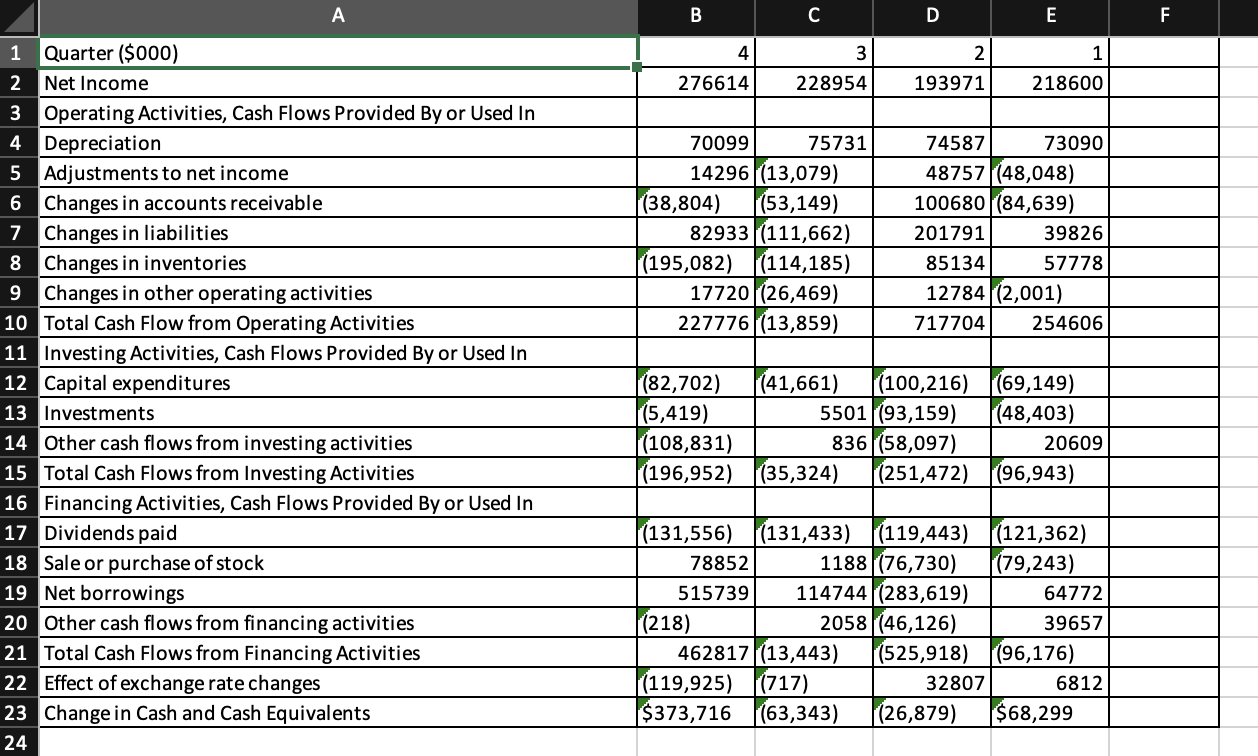

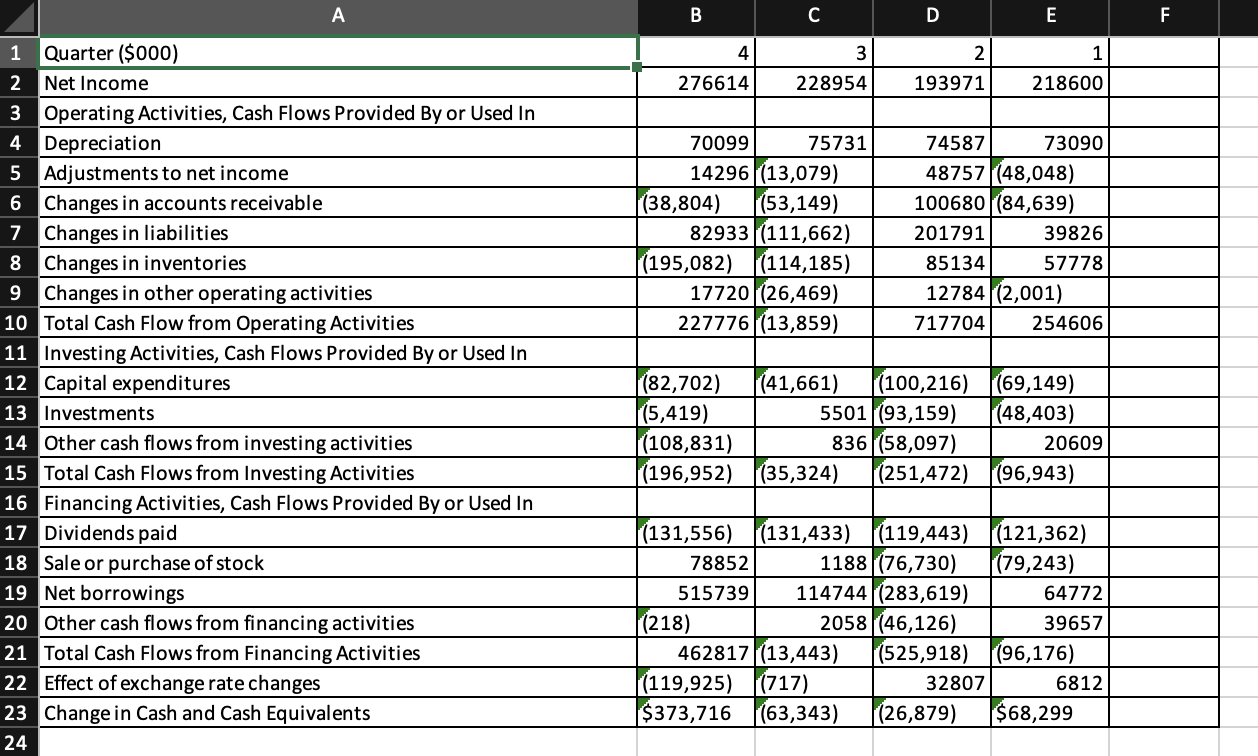

Consider the following cash flow statement. Click the icon to view the cash flow statement. a. What were the company's cumulative earnings over these four quarters? What were its cumulative cash flows from operating activities? b. What fraction of the cash from operating activities was used for investment over the four quarters? c. What fraction of the cash from operating activities was used for financing activities over the four quarters? a. What were the company's cumulative earnings over these four quarters? The cumulative earnings were $ (000). (Round to the nearest integer.) A B C D E F 4 3 2 1 276614 228954 193971 218600 70099 75731 14296 (13,079) (38,804) (53,149) 82933|(111,662) (195,082) (114,185) 17720 (26,469) 227776 (13,859) 74587 73090 48757 (48,048) 100680 (84,639) 201791 39826 85134 57778 12784 (2,001) 717704 254606 1 Quarter ($000) 2 Net Income 3 Operating Activities, Cash Flows Provided By or Used In 4 Depreciation 5 Adjustments to net income 6 Changes in accounts receivable 7 Changes in liabilities 8 Changes in inventories 9 Changes in other operating activities 10 Total Cash Flow from Operating Activities 11 Investing Activities, Cash Flows Provided By or Used In 12 Capital expenditures 13 Investments 14 Other cash flows from investing activities 15 Total Cash Flows from Investing Activities 16 Financing Activities, Cash Flows Provided By or Used In 17 Dividends paid 18 Sale or purchase of stock 19 Net borrowings 20 Other cash flows from financing activities 21 Total Cash Flows from Financing Activities 22 Effect of exchange rate changes 23 Change in Cash and Cash Equivalents 24 (82,702) (41,661) (100,216) (69,149) (5,419) 5501 (93,159) (48,403) (108,831) 836 (58,097) 20609 (196,952) (35,324) (251,472) (96,943) (131,556) (131,433) (119,443) (121,362) 78852 1188 (76,730) (79,243) 515739 114744 (283,619) 64772 (218) 2058 (46,126) 39657 462817 (13,443) (525,918) (96,176) (119,925) (717) 32807 6812 $373,716 (63,343) (26,879) $68,299 In December 2018, General Electric (GE) had a book value of equity of $51.6 billion, 8.8 billion shares outstanding, and a market price of $7.94 per share. GE also had cash of $70.6 billion, and total debt of $108.1 billion. a. What was GE's market capitalization? What was GE's market-to-book ratio? b. What was GE's book debt-equity ratio? What was GE's market debt-equity ratio? c. What was GE's enterprise value? a. What was GE's market capitalization? GE's market capitalization was $ billion. (Round to one decimal place.)