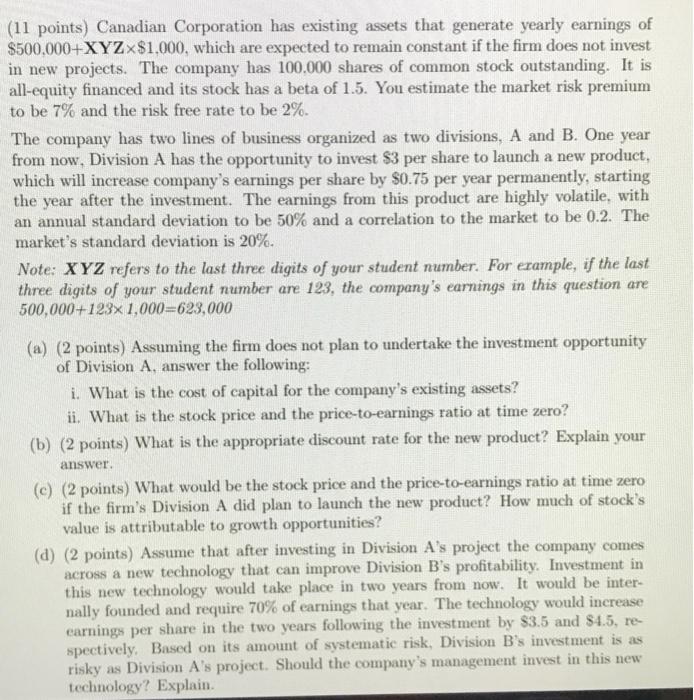

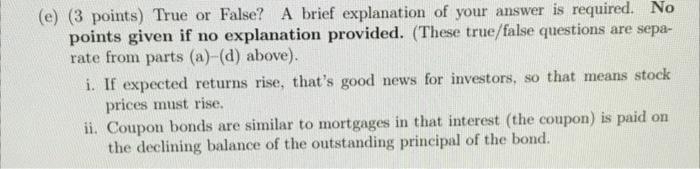

a (11 points) Canadian Corporation has existing assets that generate yearly earnings of $500,000+XYZX$1.000, which are expected to remain constant if the firm does not invest in new projects. The company has 100.000 shares of common stock outstanding. It is all-equity financed and its stock has a beta of 1.5. You estimate the market risk premium to be 7% and the risk free rate to be 2%. The company has two lines of business organized as two divisions, A and B. One year from now, Division A has the opportunity to invest $3 per share to launch a new product, which will increase company's earnings per share by $0.75 per year permanently, starting the year after the investment. The earnings from this product are highly volatile, with an annual standard deviation to be 50% and a correlation to the market to be 0.2. The market's standard deviation is 20%. Note: XYZ refers to the last three digits of your student number. For example, if the last three digits of your student number are 123, the company's earnings in this question are 500,000+123x 1,000=623,000 (a) (2 points) Assuming the firm does not plan to undertake the investment opportunity of Division A, answer the following: i. What is the cost of capital for the company's existing assets? ii. What is the stock price and the price-to-earnings ratio at time zero? (b) (2 points) What is the appropriate discount rate for the new product? Explain your answer (c) (2 points) What would be the stock price and the price-to-earnings ratio at time zero if the firm's Division A did plan to launch the new product? How much of stock's value is attributable to growth opportunities? (d) (2 points) Assume that after investing in Division A's project the company comes across a new technology that can improve Division B's profitability. Investment in this new technology would take place in two years from now. It would be inter- nally founded and require 70% of earnings that year. The technology would increase earnings per share in the two years following the investment by $3.5 and $4.5, re- spectively. Based on its amount of systematic risk, Division B's investment is as risky as Division A's project. Should the company's management invest in this new technology? Explain. (e) (3 points) True or False? A brief explanation of your answer is required. No points given if no explanation provided. (These true/false questions are sepa- rate from parts (a)-(d) above). i. If expected returns rise, that's good news for investors, so that means stock prices must rise. ii. Coupon bonds are similar to mortgages in that interest (the coupon) is paid on the declining balance of the outstanding principal of the bond. a (11 points) Canadian Corporation has existing assets that generate yearly earnings of $500,000+XYZX$1.000, which are expected to remain constant if the firm does not invest in new projects. The company has 100.000 shares of common stock outstanding. It is all-equity financed and its stock has a beta of 1.5. You estimate the market risk premium to be 7% and the risk free rate to be 2%. The company has two lines of business organized as two divisions, A and B. One year from now, Division A has the opportunity to invest $3 per share to launch a new product, which will increase company's earnings per share by $0.75 per year permanently, starting the year after the investment. The earnings from this product are highly volatile, with an annual standard deviation to be 50% and a correlation to the market to be 0.2. The market's standard deviation is 20%. Note: XYZ refers to the last three digits of your student number. For example, if the last three digits of your student number are 123, the company's earnings in this question are 500,000+123x 1,000=623,000 (a) (2 points) Assuming the firm does not plan to undertake the investment opportunity of Division A, answer the following: i. What is the cost of capital for the company's existing assets? ii. What is the stock price and the price-to-earnings ratio at time zero? (b) (2 points) What is the appropriate discount rate for the new product? Explain your answer (c) (2 points) What would be the stock price and the price-to-earnings ratio at time zero if the firm's Division A did plan to launch the new product? How much of stock's value is attributable to growth opportunities? (d) (2 points) Assume that after investing in Division A's project the company comes across a new technology that can improve Division B's profitability. Investment in this new technology would take place in two years from now. It would be inter- nally founded and require 70% of earnings that year. The technology would increase earnings per share in the two years following the investment by $3.5 and $4.5, re- spectively. Based on its amount of systematic risk, Division B's investment is as risky as Division A's project. Should the company's management invest in this new technology? Explain. (e) (3 points) True or False? A brief explanation of your answer is required. No points given if no explanation provided. (These true/false questions are sepa- rate from parts (a)-(d) above). i. If expected returns rise, that's good news for investors, so that means stock prices must rise. ii. Coupon bonds are similar to mortgages in that interest (the coupon) is paid on the declining balance of the outstanding principal of the bond