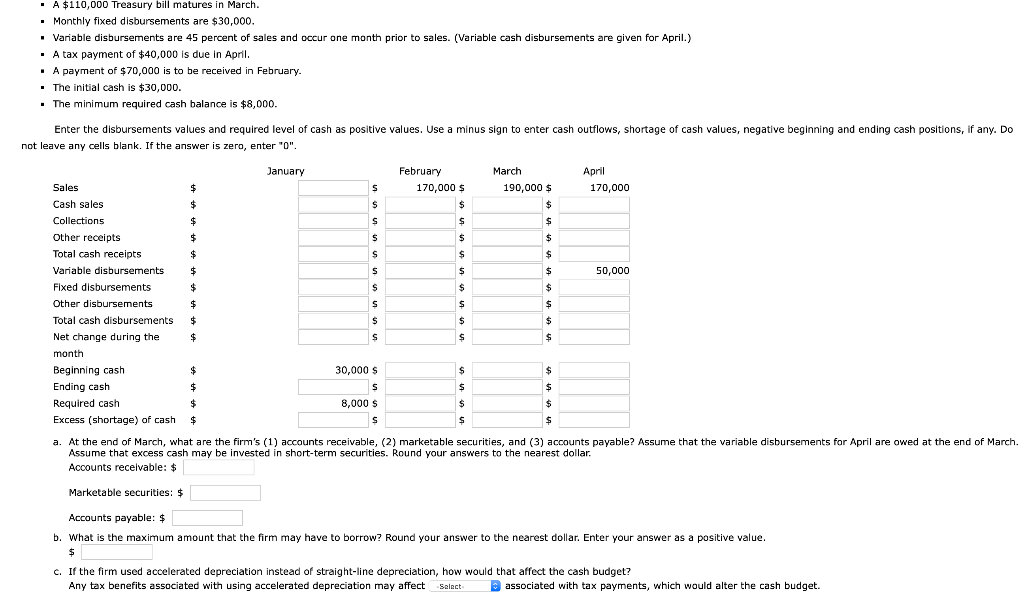

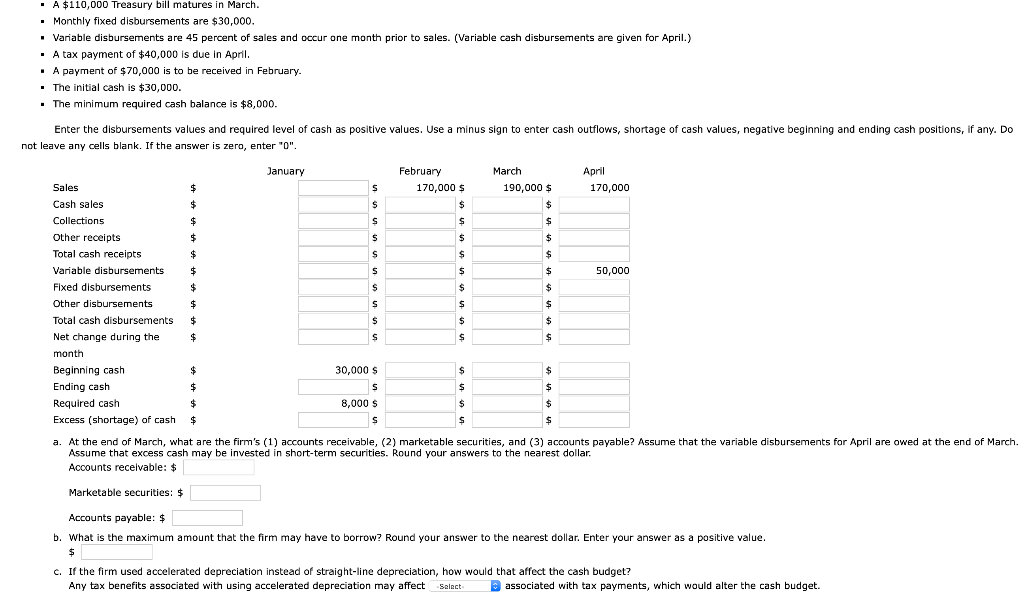

A $110,000 Treasury bill matures in March. Monthly fixed disbursements are $30,000. Variable disbursements are 45 percent of sales and occur one month prior to sales. (Variable cash disbursements are given for April.) A tax payment of $40,000 is due in April. A payment of $70,000 is to be received in February. The initial cash is $30,000. The minimum required cash balance is $8,000. Enter the disbursements values and required level of cash as positive values. Use a minus sign to enter cash outflows, shortage of cash values, negative beginning and ending cash positions, if any. Do not leave any cells blank. If the answer is zero, enter "O". January February March April Sales $ s 170,000 $ 190,000 $ 170,000 Cash sales S $ $ Collections $ s S $ Other receipts $ $ $ $ Total cash receipts $ s S $ Variable disbursements $ S $ $ 50,000 > Fixed disbursements $ S $ $ Other disbursements $ S $ $ $ Total cash disbursements $ $ $ $ Net change during the $ S $ $ $ $ month Beginning cash 30,000 $ $ $ Ending cash $ S $ $ Required cash $ 8,000 $ $ $ Excess (shortage) of cash $ S $ $ a. At the end of March, what are the firm's (1) accounts receivable, (2) marketable securities, and (3) accounts payable? Assume that the variable disbursements for April are owed at the end of March. Assume that excess cash may be invested in short-term securities. Round your answers to the nearest dollar. Accounts receivable: $ Marketable securities: $ Accounts payable: $ b. What is the maximum amount that the firm may have to borrow? Round your answer to the nearest dollar. Enter your answer as a positive value. . . $ c. If the firm used accelerated depreciation instead of straight-line depreciation, how would that affect the cash budget? Any tax benefits associated with using accelerated depreciation may affect associated with tax payments, which would alter the cash budget. Select A $110,000 Treasury bill matures in March. Monthly fixed disbursements are $30,000. Variable disbursements are 45 percent of sales and occur one month prior to sales. (Variable cash disbursements are given for April.) A tax payment of $40,000 is due in April. A payment of $70,000 is to be received in February. The initial cash is $30,000. The minimum required cash balance is $8,000. Enter the disbursements values and required level of cash as positive values. Use a minus sign to enter cash outflows, shortage of cash values, negative beginning and ending cash positions, if any. Do not leave any cells blank. If the answer is zero, enter "O". January February March April Sales $ s 170,000 $ 190,000 $ 170,000 Cash sales S $ $ Collections $ s S $ Other receipts $ $ $ $ Total cash receipts $ s S $ Variable disbursements $ S $ $ 50,000 > Fixed disbursements $ S $ $ Other disbursements $ S $ $ $ Total cash disbursements $ $ $ $ Net change during the $ S $ $ $ $ month Beginning cash 30,000 $ $ $ Ending cash $ S $ $ Required cash $ 8,000 $ $ $ Excess (shortage) of cash $ S $ $ a. At the end of March, what are the firm's (1) accounts receivable, (2) marketable securities, and (3) accounts payable? Assume that the variable disbursements for April are owed at the end of March. Assume that excess cash may be invested in short-term securities. Round your answers to the nearest dollar. Accounts receivable: $ Marketable securities: $ Accounts payable: $ b. What is the maximum amount that the firm may have to borrow? Round your answer to the nearest dollar. Enter your answer as a positive value. . . $ c. If the firm used accelerated depreciation instead of straight-line depreciation, how would that affect the cash budget? Any tax benefits associated with using accelerated depreciation may affect associated with tax payments, which would alter the cash budget. Select