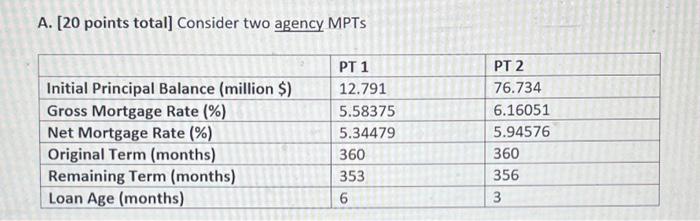

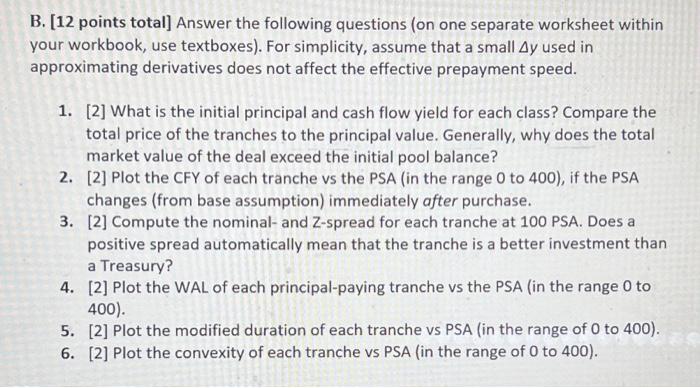

A. [20 points total] Consider two agency MPTs B. [12 points total] Answer the following questions (on one separate worksheet within your workbook, use textboxes). For simplicity, assume that a small y used in approximating derivatives does not affect the effective prepayment speed. 1. [2] What is the initial principal and cash flow yield for each class? Compare the total price of the tranches to the principal value. Generally, why does the total market value of the deal exceed the initial pool balance? 2. [2] Plot the CFY of each tranche vs the PSA (in the range 0 to 400 ), if the PSA changes (from base assumption) immediately after purchase. 3. [2] Compute the nominal- and Z-spread for each tranche at 100 PSA. Does a positive spread automatically mean that the tranche is a better investment than a Treasury? 4. [2] Plot the WAL of each principal-paying tranche vs the PSA (in the range 0 to 400). 5. [2] Plot the modified duration of each tranche vs PSA (in the range of 0 to 400). 6. [2] Plot the convexity of each tranche vs PSA (in the range of 0 to 400 ). A. [20 points total] Consider two agency MPTs B. [12 points total] Answer the following questions (on one separate worksheet within your workbook, use textboxes). For simplicity, assume that a small y used in approximating derivatives does not affect the effective prepayment speed. 1. [2] What is the initial principal and cash flow yield for each class? Compare the total price of the tranches to the principal value. Generally, why does the total market value of the deal exceed the initial pool balance? 2. [2] Plot the CFY of each tranche vs the PSA (in the range 0 to 400 ), if the PSA changes (from base assumption) immediately after purchase. 3. [2] Compute the nominal- and Z-spread for each tranche at 100 PSA. Does a positive spread automatically mean that the tranche is a better investment than a Treasury? 4. [2] Plot the WAL of each principal-paying tranche vs the PSA (in the range 0 to 400). 5. [2] Plot the modified duration of each tranche vs PSA (in the range of 0 to 400). 6. [2] Plot the convexity of each tranche vs PSA (in the range of 0 to 400 )