Question

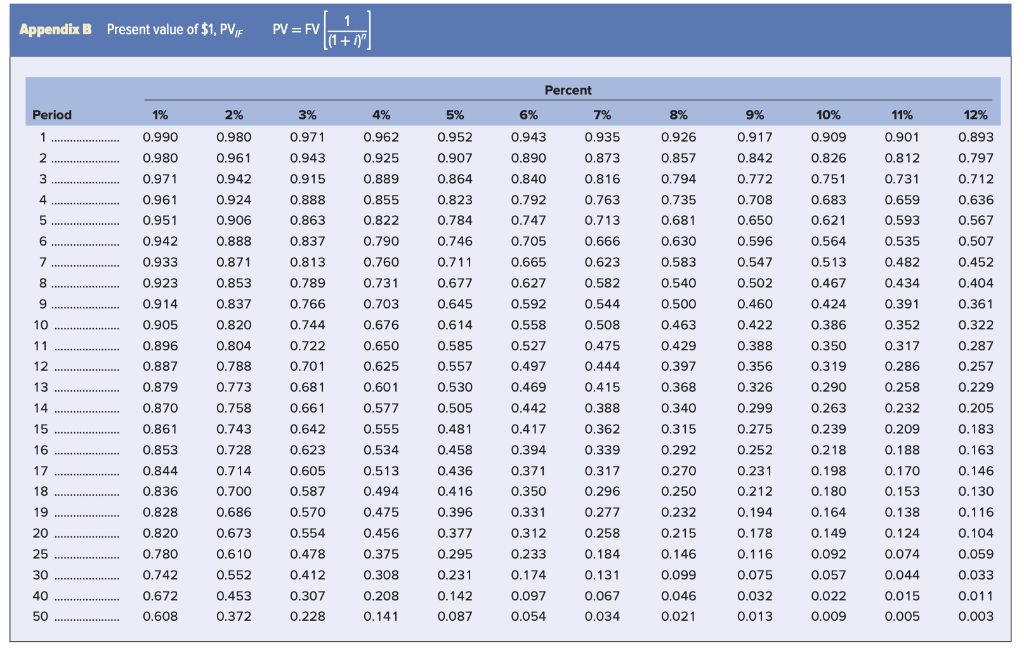

A 20-year, $1,000 par value zero-coupon rate bond is to be issued to yield 9 percent. Use Appendix B for an approximate answer but calculate

A 20-year, $1,000 par value zero-coupon rate bond is to be issued to yield 9 percent. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods.

a. What should be the initial price of the bond? (Assume annual compounding. Do not round intermediate calculations and round your answer to 2 decimal places.)

b. If immediately upon issue, interest rates dropped to 8 percent, what would be the value of the zero-coupon rate bond? (Assume annual compounding. Do not round intermediate calculations and round your answer to 2 decimal places.)

c. If immediately upon issue, interest rates increased to 11 percent, what would be the value of the zero-coupon rate bond? (Assume annual compounding. Do not round intermediate calculations and round your answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started