Answered step by step

Verified Expert Solution

Question

1 Approved Answer

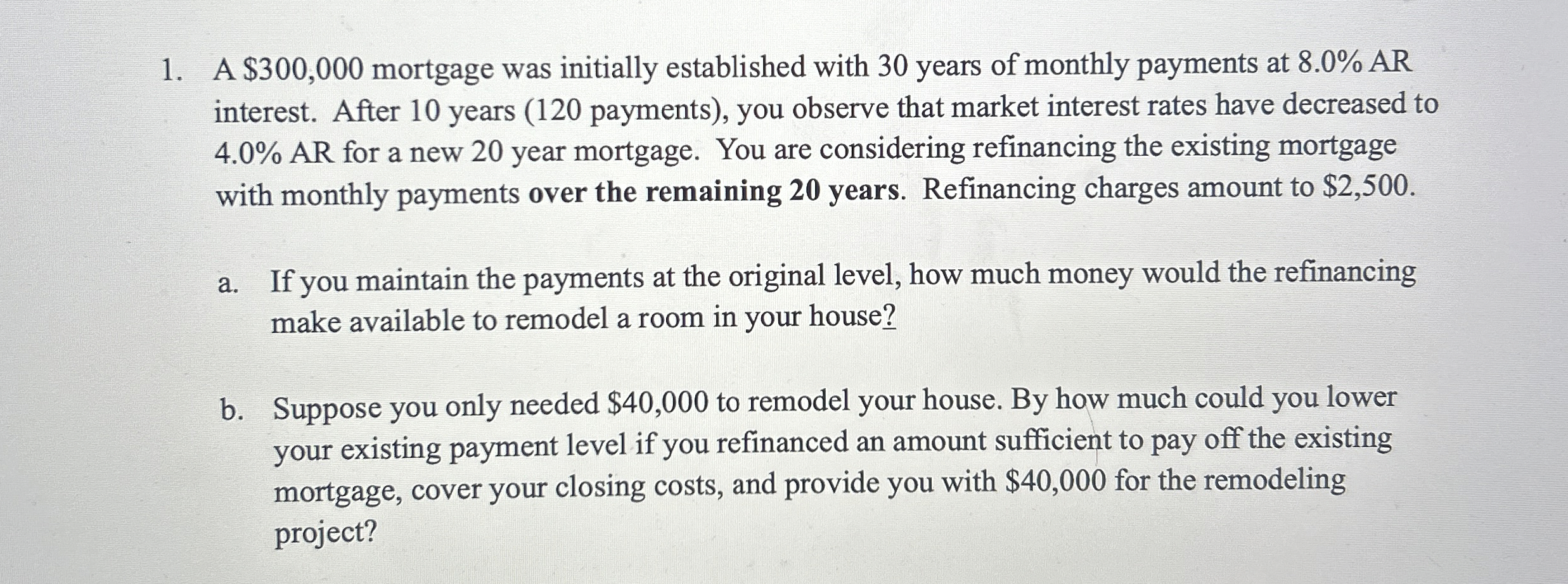

A $ 3 0 0 , 0 0 0 mortgage was initially established with 3 0 years of monthly payments at 8 . 0 %

A $ mortgage was initially established with years of monthly payments at

interest. After years payments you observe that market interest rates have decreased to

AR for a new year mortgage. You are considering refinancing the existing mortgage

with monthly payments over the remaining years. Refinancing charges amount to $

a If you maintain the payments at the original level, how much money would the refinancing

make available to remodel a room in your house?

b Suppose you only needed $ to remodel your house. By how much could you lower

your existing payment level if you refinanced an amount sufficient to pay off the existing

mortgage, cover your closing costs, and provide you with $ for the remodeling

project?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started