Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz l have onle 20 min lf you do it l will give you like Q3: You are analyzing a project and have prepared the

plz l have onle 20 min

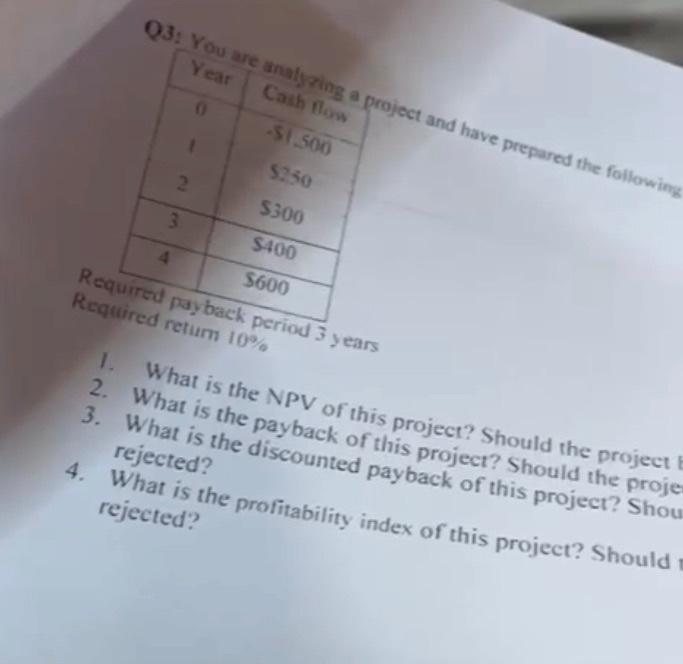

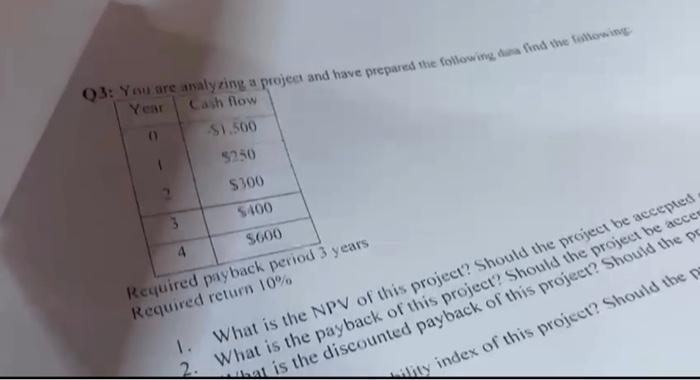

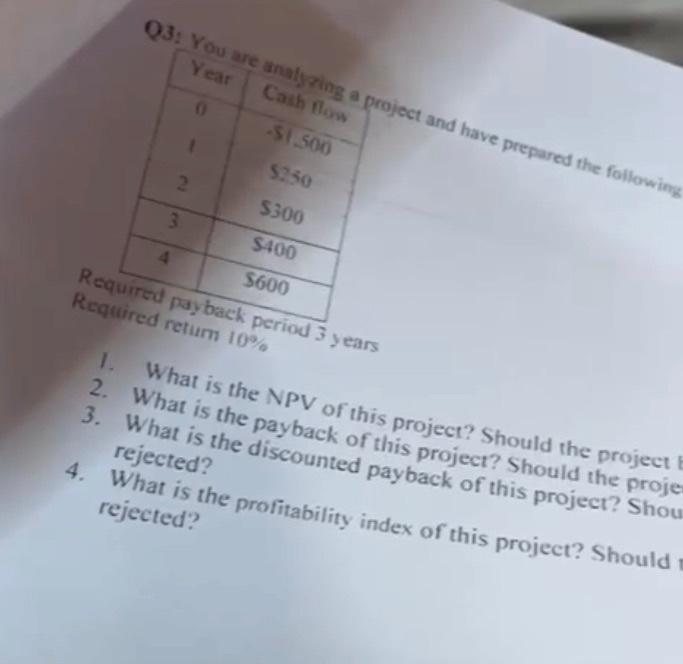

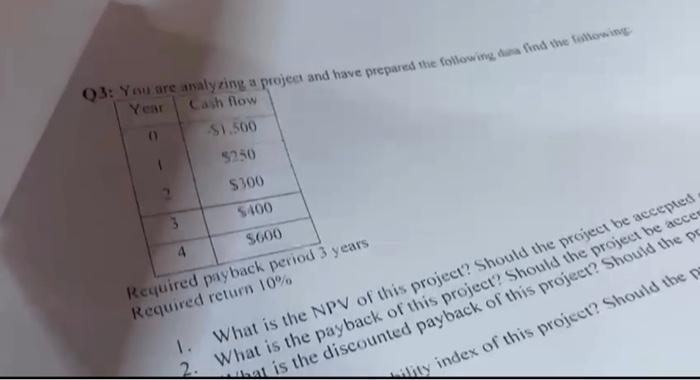

Q3: You are analyzing a project and have prepared the following Year Cash flow 0 S1.500 $250 2 $300 3 S-400 4 $600 Required payback period 3 years Required return 10% 1. What is the NPV of this project? Should the project 2. What is the payback of this project? Should the proje 3. What is the discounted payback of this project? Shou rejected? 4. What is the profitability index of this project? Should rejected? Q3: You are analyzing a project and have prepared the following find the low Year Cash flow $1.500 $250 $300 5400 3 4 5000 Required payback period 3 years Required return 10% 1. What is the NPV of this project? Should the project be accepted 2. What is the payback of this project? Should the project be acces at is the discounted payback of this project? Should the po Vity index of this project? Should the pe lf you do it l will give you like

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started