Question

A 3-year forward contract on Mathcorp shares is to be issued. The current share price is 4.50 and the last dividend which was paid

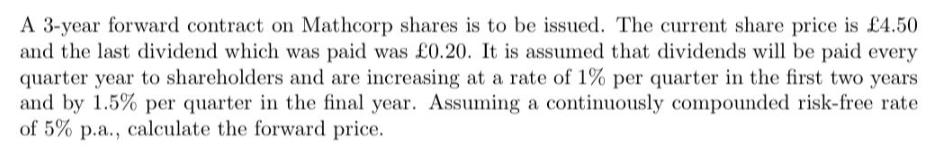

A 3-year forward contract on Mathcorp shares is to be issued. The current share price is 4.50 and the last dividend which was paid was 0.20. It is assumed that dividends will be paid every quarter year to shareholders and are increasing at a rate of 1% per quarter in the first two years and by 1.5% per quarter in the final year. Assuming a continuously compounded risk-free rate of 5% p.a., calculate the forward price.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

First lets calculate the future dividends For the first two years Div...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Corporate Finance

Authors: Jonathan Berk, Peter DeMarzo, Jarrad Harford

6th Edition

0137852584, 9780137852581

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App