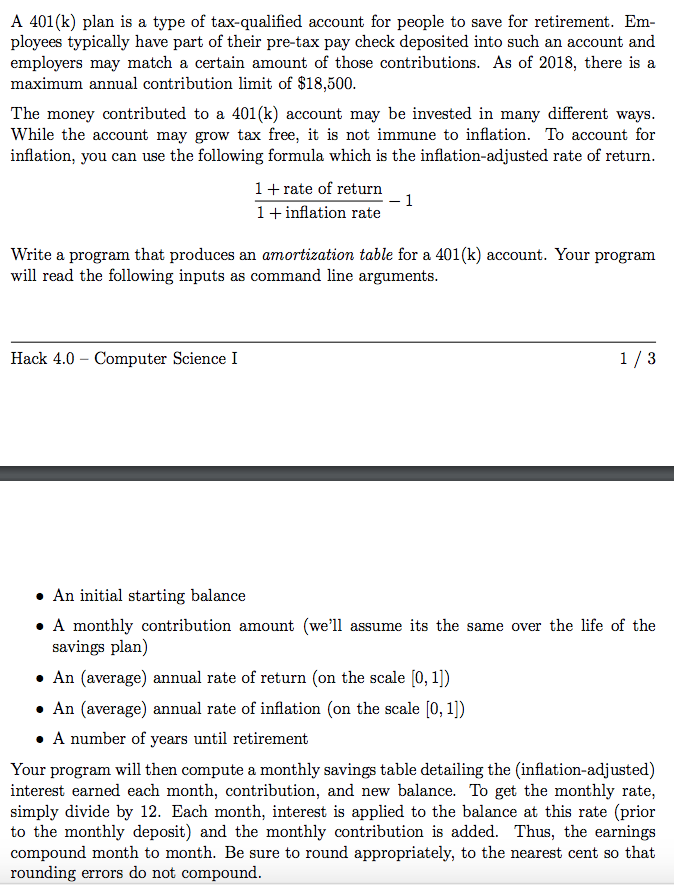

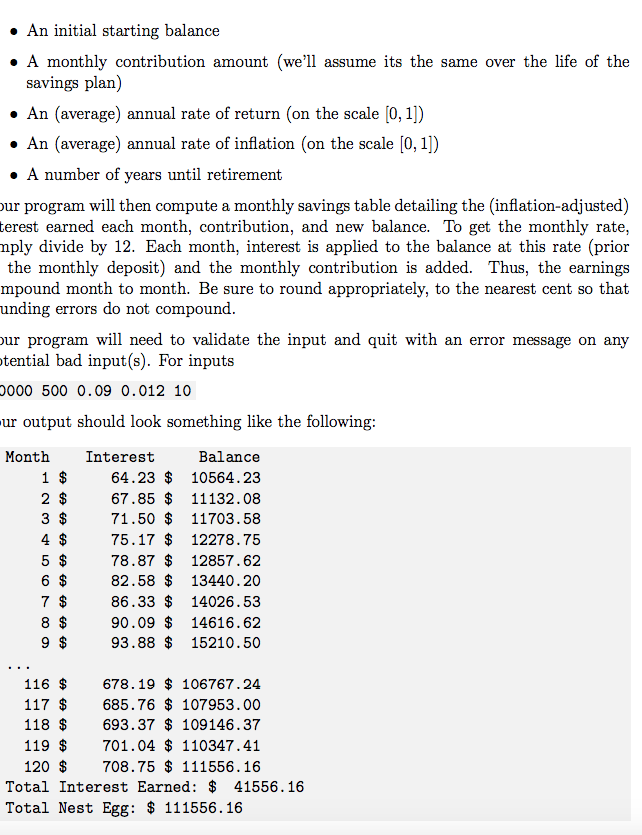

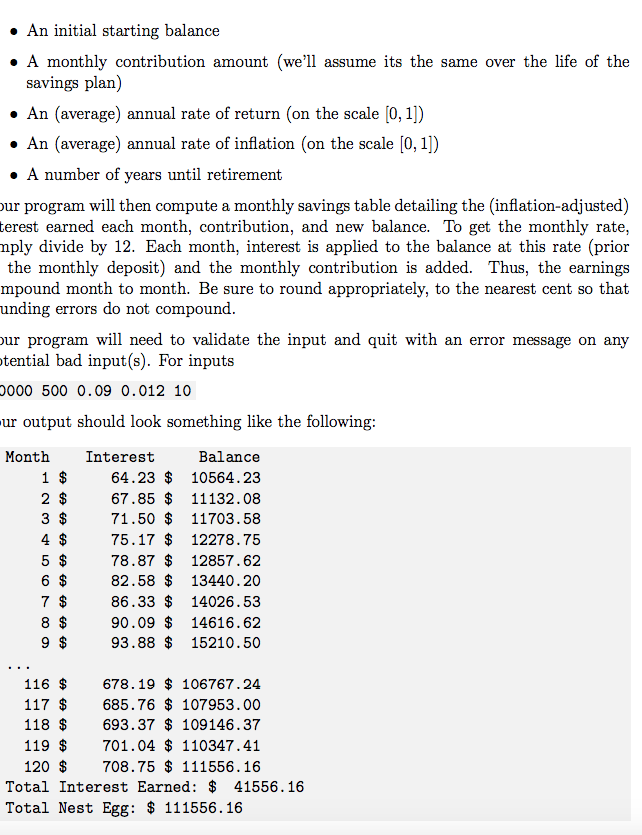

A 401 (k) plan is a type of tax-qualified account for people to save for retirement. Em ployees typically have part of their pre-tax pay check deposited into such an account and employers may match a certain amount of those contributions. As of 2018, there is a maximum annual contribution limit of $18,500 The money contributed to a 401(k) account may be invested in many different ways While the account may grow tax free, it is not immune to inflation. To account for inflation, you can use the following formula which is the inflation-adjusted rate of return 1 +rate of returrn 1 + inflation rate Write a program that produces an amortization table for a 401(k) account. Your program will read the following inputs as command line arguments Hack 4.0 - Computer Science I . An initial starting balance A monthly contribution amount (we'll assume its the same over the life of the savings plan An (average) annual rate of return (on the scale [0,1]) An (average) annual rate of inflation (on the scale [0,1]) A number of years until retirement Your program will then compute a monthly savings table detailing the (inflation-adjusted) interest earned each month, contribution, and new balance. To get the monthly rate, simply divide by 12. Each month, interest is applied to the balance at this rate (prior to the monthly deposit) and the monthly contribution is added. Thus, the earnings compound month to month. Be sure to round appropriately, to the nearest cent so that rounding errors do not compound. A 401 (k) plan is a type of tax-qualified account for people to save for retirement. Em ployees typically have part of their pre-tax pay check deposited into such an account and employers may match a certain amount of those contributions. As of 2018, there is a maximum annual contribution limit of $18,500 The money contributed to a 401(k) account may be invested in many different ways While the account may grow tax free, it is not immune to inflation. To account for inflation, you can use the following formula which is the inflation-adjusted rate of return 1 +rate of returrn 1 + inflation rate Write a program that produces an amortization table for a 401(k) account. Your program will read the following inputs as command line arguments Hack 4.0 - Computer Science I . An initial starting balance A monthly contribution amount (we'll assume its the same over the life of the savings plan An (average) annual rate of return (on the scale [0,1]) An (average) annual rate of inflation (on the scale [0,1]) A number of years until retirement Your program will then compute a monthly savings table detailing the (inflation-adjusted) interest earned each month, contribution, and new balance. To get the monthly rate, simply divide by 12. Each month, interest is applied to the balance at this rate (prior to the monthly deposit) and the monthly contribution is added. Thus, the earnings compound month to month. Be sure to round appropriately, to the nearest cent so that rounding errors do not compound