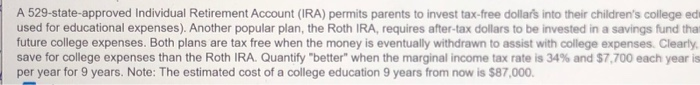

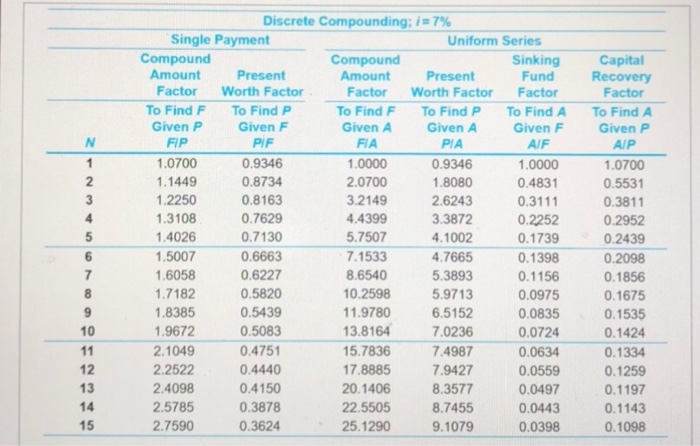

A 529-state-approved Individual Retirement Account (IRA) permits parents to invest tax-free dollars into their children's college edu used for educational expenses). Another popular plan, the Roth IRA, requires after-tax dollars to be invested in a savings fund tha future college expenses. Both plans are tax free when the money is eventually withdrawn to assist with college expenses. Clearly, save for college expenses than the Roth IRA. Quantify "better" when the marginal income tax rate is 34% and $7,700 each year is per year for 9 years. Note: The estimated cost of a college education 9 years from now is $87,000. N 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Discrete Compounding; i = 7% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F FIP PIF FIA PIA AIF 1.0700 0.9346 1.0000 0.9346 1.0000 1.1449 0.8734 2.0700 1.8080 0.4831 1.2250 0.8163 3.2149 2.6243 0.3111 1.3108 0.7629 4.4399 3.3872 0.2252 1.4026 0.7130 5.7507 4.1002 0.1739 1.5007 0.6663 7.1533 4.7665 0.1398 1.6058 0.6227 8.6540 5.3893 0.1156 1.7182 0.5820 10.2598 5.9713 0.0975 1.8385 0.5439 11.9780 6.5152 0.0835 1.9672 0.5083 13.8164 7.0236 0.0724 2.1049 0.4751 15.7836 7.4987 0.0634 2.2522 0.4440 17.8885 7.9427 0.0559 2.4098 0.4150 20.1406 8.3577 0.0497 2.5785 0.3878 22.5505 8.7455 0.0443 2.7590 0.3624 25.1290 9.1079 0.0398 Capital Recovery Factor To Find A Given P AIP 1.0700 0.5531 0.3811 0.2952 0.2439 0.2098 0.1856 0.1675 0.1535 0.1424 0.1334 0.1259 0.1197 0.1143 0.1098 dollars into their children's college education fund (this money may only be s to be invested in a savings fund that may or may not) be used for paying assist with college expenses. Clearly, the 529 IRA plan is a better way to rate is 34% and $7,700 each year is invested in a mutual fund earning 7% 7.000 A 529-state-approved Individual Retirement Account (IRA) permits parents to invest tax-free dollars into their children's college edu used for educational expenses). Another popular plan, the Roth IRA, requires after-tax dollars to be invested in a savings fund tha future college expenses. Both plans are tax free when the money is eventually withdrawn to assist with college expenses. Clearly, save for college expenses than the Roth IRA. Quantify "better" when the marginal income tax rate is 34% and $7,700 each year is per year for 9 years. Note: The estimated cost of a college education 9 years from now is $87,000. N 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Discrete Compounding; i = 7% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F FIP PIF FIA PIA AIF 1.0700 0.9346 1.0000 0.9346 1.0000 1.1449 0.8734 2.0700 1.8080 0.4831 1.2250 0.8163 3.2149 2.6243 0.3111 1.3108 0.7629 4.4399 3.3872 0.2252 1.4026 0.7130 5.7507 4.1002 0.1739 1.5007 0.6663 7.1533 4.7665 0.1398 1.6058 0.6227 8.6540 5.3893 0.1156 1.7182 0.5820 10.2598 5.9713 0.0975 1.8385 0.5439 11.9780 6.5152 0.0835 1.9672 0.5083 13.8164 7.0236 0.0724 2.1049 0.4751 15.7836 7.4987 0.0634 2.2522 0.4440 17.8885 7.9427 0.0559 2.4098 0.4150 20.1406 8.3577 0.0497 2.5785 0.3878 22.5505 8.7455 0.0443 2.7590 0.3624 25.1290 9.1079 0.0398 Capital Recovery Factor To Find A Given P AIP 1.0700 0.5531 0.3811 0.2952 0.2439 0.2098 0.1856 0.1675 0.1535 0.1424 0.1334 0.1259 0.1197 0.1143 0.1098 dollars into their children's college education fund (this money may only be s to be invested in a savings fund that may or may not) be used for paying assist with college expenses. Clearly, the 529 IRA plan is a better way to rate is 34% and $7,700 each year is invested in a mutual fund earning 7% 7.000