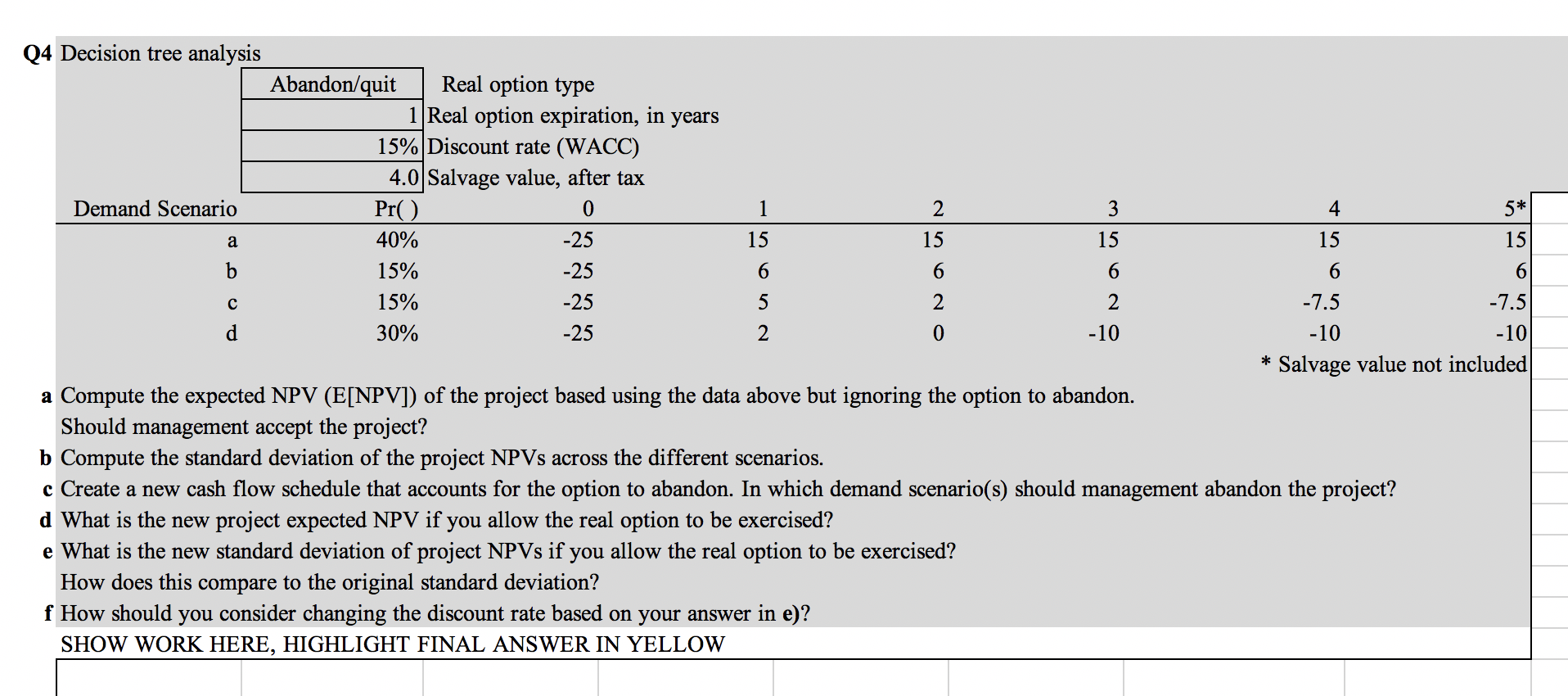

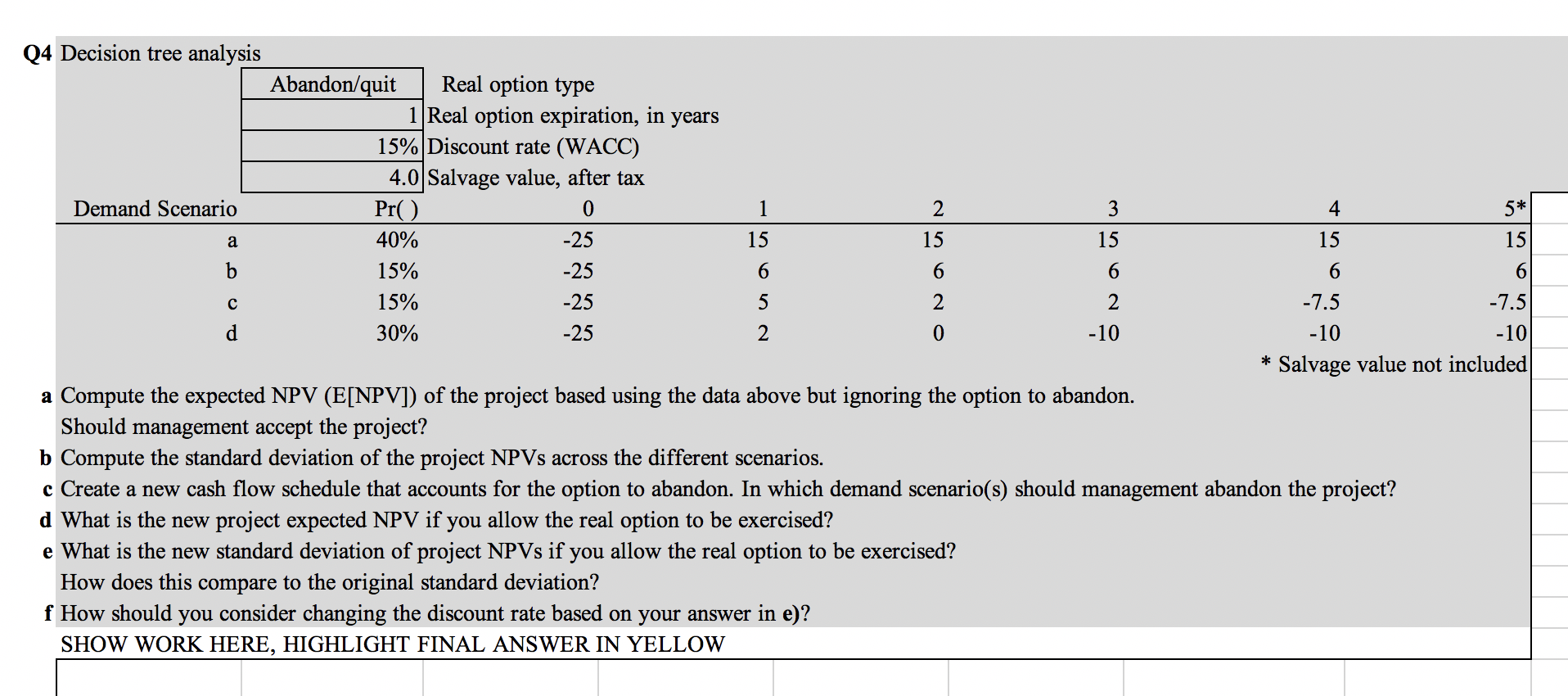

a 6 Q4 Decision tree analysis Abandon/quit Real option type 1 Real option expiration, in years 15% Discount rate (WACC) 4.0 Salvage value, after tax Demand Scenario Pr() 0 1 2 3 4 5* 40% -25 15 15 15 15 15 b 15% -25 6 6 6 6 15% -25 5 2 2 -7.5 -7.5 d 30% -25 2 0 -10 -10 -10 Salvage value not included a Compute the expected NPV (E[NPV]) of the project based using the data above but ignoring the option to abandon. Should management accept the project? b Compute the standard deviation of the project NPVs across the different scenarios. c Create a new cash flow schedule that accounts for the option to abandon. In which demand scenario(s) should management abandon the project? d What is the new project expected NPV if you allow the real option to be exercised? e What is the new standard deviation of project NPVs if you allow the real option to be exercised? How does this compare to the original standard deviation? f How should you consider changing the discount rate based on your answer in e)? SHOW WORK HERE, HIGHLIGHT FINAL ANSWER IN YELLOW ** a 6 Q4 Decision tree analysis Abandon/quit Real option type 1 Real option expiration, in years 15% Discount rate (WACC) 4.0 Salvage value, after tax Demand Scenario Pr() 0 1 2 3 4 5* 40% -25 15 15 15 15 15 b 15% -25 6 6 6 6 15% -25 5 2 2 -7.5 -7.5 d 30% -25 2 0 -10 -10 -10 Salvage value not included a Compute the expected NPV (E[NPV]) of the project based using the data above but ignoring the option to abandon. Should management accept the project? b Compute the standard deviation of the project NPVs across the different scenarios. c Create a new cash flow schedule that accounts for the option to abandon. In which demand scenario(s) should management abandon the project? d What is the new project expected NPV if you allow the real option to be exercised? e What is the new standard deviation of project NPVs if you allow the real option to be exercised? How does this compare to the original standard deviation? f How should you consider changing the discount rate based on your answer in e)? SHOW WORK HERE, HIGHLIGHT FINAL ANSWER IN YELLOW **