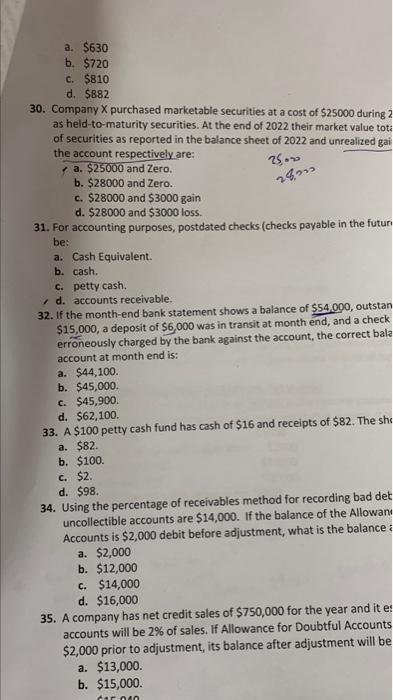

a. $630 b. $720 c. $810 d. $882 30. Company X purchased marketable securities at a cost of $25000 during 2 as held-to-maturity securities. At the end of 2022 their market value toti of securities as reported in the balance sheet of 2022 and unrealized gai the account respectively are: a. \$25000 and Zero. b. $28000 and Zero. c. $28000 and $3000 gain d. $28000 and $3000 loss. 31. For accounting purposes, postdated checks (checks payable in the futuri be: a. Cash Equivalent. b. cash. c. petty cash. d. accounts receivable. 32. If the month-end bank statement shows a balance of $54,000, outstan $15,000, a deposit of $6,000 was in transit at month end, and a check erroneously charged by the bank against the account, the correct bala account at month is: a. $44,100. b. $45,000. c. $45,900. d. $62,100. 33. A $100 petty cash fund has cash of $16 and receipts of $82. The sho a. $82. b. $100. c. $2. d. $98. 34. Using the percentage of receivables method for recording bad det uncollectible accounts are $14,000. If the balance of the Allowani Accounts is $2,000 debit before adjustment, what is the balance : a. $2,000 b. $12,000 c. $14,000 d. $16,000 35. A company has net credit sales of $750,000 for the year and it e: accounts will be 2% of sales. If Allowance for Doubtful Accounts $2,000 prior to adjustment, its balance after adjustment will be a. $13,000. b. $15,000. a. $630 b. $720 c. $810 d. $882 30. Company X purchased marketable securities at a cost of $25000 during 2 as held-to-maturity securities. At the end of 2022 their market value toti of securities as reported in the balance sheet of 2022 and unrealized gai the account respectively are: a. \$25000 and Zero. b. $28000 and Zero. c. $28000 and $3000 gain d. $28000 and $3000 loss. 31. For accounting purposes, postdated checks (checks payable in the futuri be: a. Cash Equivalent. b. cash. c. petty cash. d. accounts receivable. 32. If the month-end bank statement shows a balance of $54,000, outstan $15,000, a deposit of $6,000 was in transit at month end, and a check erroneously charged by the bank against the account, the correct bala account at month is: a. $44,100. b. $45,000. c. $45,900. d. $62,100. 33. A $100 petty cash fund has cash of $16 and receipts of $82. The sho a. $82. b. $100. c. $2. d. $98. 34. Using the percentage of receivables method for recording bad det uncollectible accounts are $14,000. If the balance of the Allowani Accounts is $2,000 debit before adjustment, what is the balance : a. $2,000 b. $12,000 c. $14,000 d. $16,000 35. A company has net credit sales of $750,000 for the year and it e: accounts will be 2% of sales. If Allowance for Doubtful Accounts $2,000 prior to adjustment, its balance after adjustment will be a. $13,000. b. $15,000