Question

Change 2,200,000 to 1,800,000 (new machinery cost) and change 150,000 to 200,000 (salvage value). Change 40 to 50 (price) and 32 to 30 (costs). These

Change 2,200,000 to 1,800,000 (new machinery cost) and change 150,000 to 200,000 (salvage value). Change 40 to 50 (price) and 32 to 30 (costs). These revisions will change most of the numbers in Table 1.

Please fill in Xs in Table 1. 427-30. Change in NWC (net working capital) = inventories. Price + freight + installation + change in NWC = net investment outlay = project NCF (net cash flow) at year 0. Salvage value X tax rate = SV (salvage value) tax in year 4. Salvage value SV tax + recovery of NWC = termination CF (cash flow). Net op (operating) cash flow + termination CF = project NCF.

Press CE/C to clear 1 number on screen of Texas Instrument Ba II Plus Financial calculator. If you ever need to clear CFs (cash flows), etc. in your calculator, press 2nd (to get yellow above key functions) +I- (1 key) (reset) ENTER (set) 2nd CPT (quit).

Fill in Xs. 393-8, 409-10, 427-30. Payback period of S = about 2 years, L = about 3 years. Omit MIRR.

Depreciable basis = price + freight + installation. In year 1, 2,000,000 X 33% (or 0.33) MACRS factor = 660,000 (depreciation expense). 2,000,000 660,000 = 1,340,000 end-of-year book value.

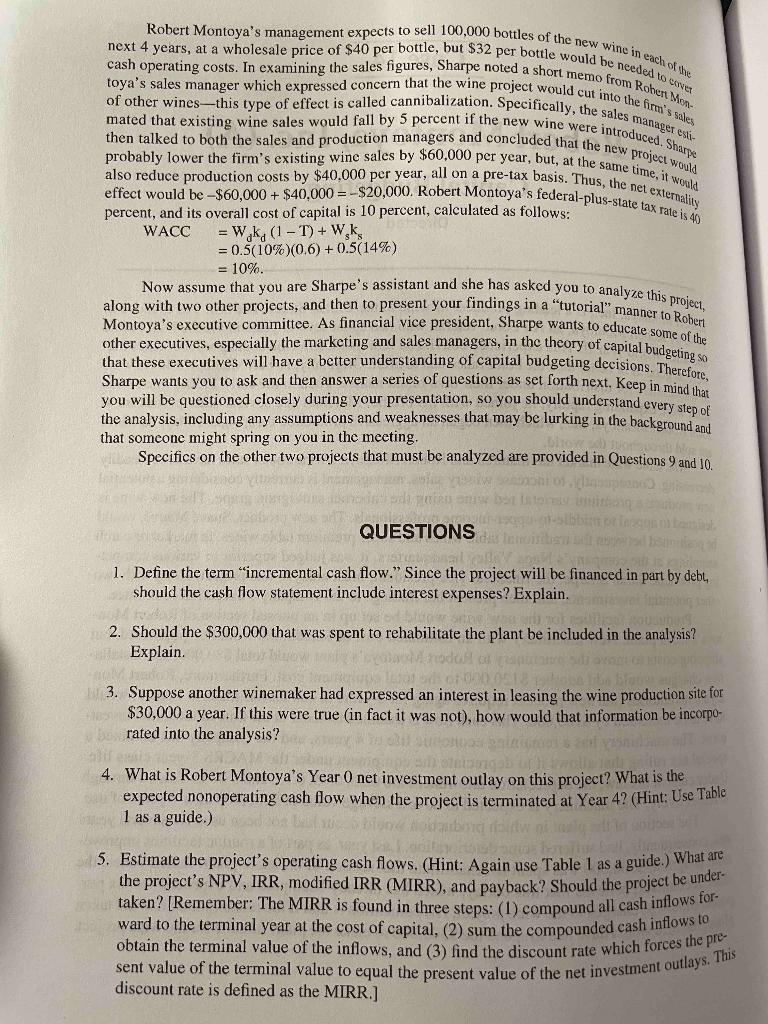

Table 1

MACRS Depr. End-of-year

Year Factor Expense Book Value

1 33% $660,000 $1,340,000

2 X X X

3 X X X

4 7 140,000 0

100% 2,000,000

See years 1 and 4 as examples in Table 1. In year 1, 50 X 100,000 = 5,000,000 3,000,000 (100,000 X 30) 660,000 - 20,000 = 1,320,000 528,000 = 792,000 + 660,000 = 1,452,000 = project NCF

Cash Flow Statements:

Year 0 Year 1 Year 2 Year 3 Year 4

Unit price $ 50 X X $ 50

Unit sales 100,000 X X 100,000

Revenues 5,000,000 X X 5,000,000

Operating costs 3,000,000 X X 3,000,000

Depreciation 660,000 X X 140,000

Other project effects 20,000 X X 20,000

Before tax income 1,320,000 X X 1,840,000

Taxes 528,000 X X 736,000

Net income 792,000 X X 1,104,000

Plus depreciation 660,000 X X 140,000

Net op cash flow 1,452,000 X X 1,244,000

Salvage value 200,000

SV tax X

Recovery of NWC X

Termination CF X

Project NCF ($-2,100,000) X X X X

========= = = = =

Robert Montoya's management expects to sell 100,000 bottles of the new wine in each te next 4 years, at a wholesale price of $40 per bottle, but $32 per bottle would be needed to creer toya's sales manager which expressed concern that the wine project would cut into the firm's sales cash operating costs. In examining the sales figures, Sharpe noted a short memo from Robert of other wines--this type of effect is called cannibalization. Specifically, the sales manager esti- mated that existing wine sales would fall by 5 percent if the new wine were introduced. Share then talked to both the sales and production managers and concluded that the new project would probably lower the firm's existing wine sales by $60,000 per year, but, at the same time, it wald also reduce production costs by $40.000 per year, all on a pre-tax basis. Thus, the net externality effect would be $60,000+ $40,000 = -$20,000. Robert Montoya's federal-plus-state tax rate is 4) percent, and its overall cost of capital is 10 percent, calculated as follows: WACC = Wyko (1 - 1)+ WK = 0.5(10%)(0.6) + 0.5(14%) = 10%. Now assume that you are Sharpe's assistant and she has asked you to analyze this project, Montoya's executive committee. As financial vice president, Sharpe wants to educate some of the along with two other projects, and then to present your findings in a "tutorial" manner to Robert other executives, especially the marketing and sales managers, in the theory of capital budgeting se that these executives will have a better understanding of capital budgeting decisions. Therefore Sharpe wants you to ask and then answer a series of questions as set forth next. Keep in mind that the analysis, including any assumptions and weaknesses that may be lurking in the background and you will be questioned closely during your presentation, so you should understand every step of that someone might spring on you in the meeting. Vile Specifics on the other two projects that must be analyzed are provided in Questions 9 and 10. 1 1 1 0 1 Siro GROOT QUESTIONS 1. Define the term "incremental cash flow." Since the project will be financed in part by debt, should the cash flow statement include interest expenses? Explain. 2. Should the $300,000 that was spent to rehabilitate the plant be included in the analysis? Explained code control FOST 3. Suppose another winemaker had expressed an interest in leasing the wine production site for the $30,000 a year. If this were true in fact it was not), how would that information be incorpo- berated into the analysis? Sant Bolibar 4. What is Robert Montoya's Year 0 net investment outlay on this project? What is the expected nonoperating cash flow when the project is terminated at Year 4? (Hint: Use Table 1 as a guide.) och 5. Estimate the project's operating cash flows. (Hint: Again use Table I as a guide . What are the project's NPV, IRR, modified IRR (MIRR), and payback? Should the project be under taken? [Remember: The MIRR is found in three steps: (1) compound all cash inflows for ward to the terminal year at the cost of capital, (2) sum the compounded cash inflows to obtain the terminal value of the inflows, and (3) find the discount rate which forces the prin sent value of the terminal value to equal the present value of the net investment outlays. This discount rate is defined as the MIRR.] 6. Now suppose the project had involved replacement rather than expansion of existing facili- ties . Describe briefly how the analysis would have to be changed to deal with a replacement project. 000.00 (000.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started