Question

A 9%, 16-year annual pay bond has a yield to maturity of 11% and Macaulay duration of 9.25 years. If the market yield declines

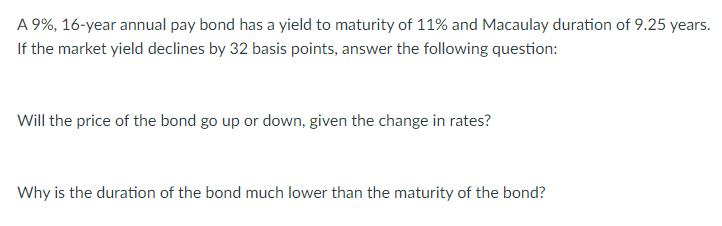

A 9%, 16-year annual pay bond has a yield to maturity of 11% and Macaulay duration of 9.25 years. If the market yield declines by 32 basis points, answer the following question: Will the price of the bond go up or down, given the change in rates? Why is the duration of the bond much lower than the maturity of the bond?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Given that the market yield declines by 32 basis points we can expect the price of the bond to go up This is because when market yields decreas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Investment Analysis and Portfolio Management

Authors: Frank K. Reilly, Keith C. Brown

10th Edition

538482109, 1133711774, 538482389, 9780538482103, 9781133711773, 978-0538482387

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App