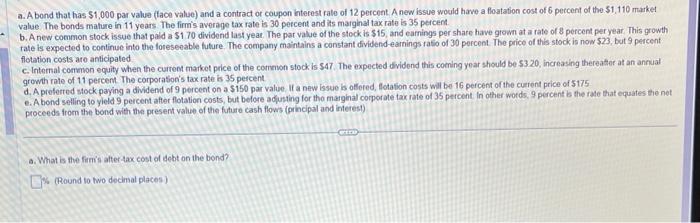

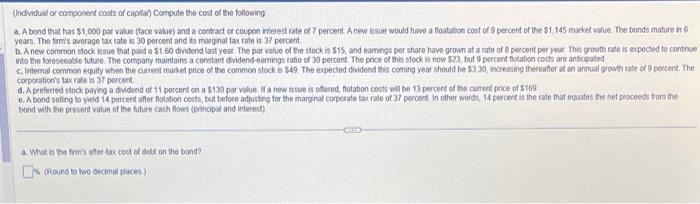

a. A bond that has $1,000 par value (tace value) and a contract of coupon interest rate of 12 percent. A new issue would have a floatation cost of 6 percent of the $1,110 market value. The bonds mature in 11 years. The firm's average tax rate is 30 percent and its maiginal tax rate is 35 percent. b. A new common stock issue that pald a $170 dividend last yeat. The par value of the stock is $15, and earnings per share have grown at a rate of 8 percent per year. This growth tate is expected to continue into the foreseeable future. The company maintains a constant dividend-earnings tatio of 30 percent. The price of this stock is now 523 , but 9 percent flotation costs are anticipated c. Intemal common equity when the current market price of the correwon stock is $47. The expected dividend this coening year should be 5320 , increasing thereaser at an annual growth rate of 11 percent The corporation's tax rate is 35 peicent. d. A preferred stock paying a dividend of 9 percent on a $150 par value. If a new issue is olfered, flotation costs will ber 16 percent of the curtent price of 5175 e. A bond selling to yield 9 percent after flotation costs, but belore adiusting for tho marginal corporate tax rate of 35 percent in other words. 9 percent b the rade that equates the net. proceeds from the bond with the present value of the future cash flows (pincipal and interest) a. What is the firnis alter 4ax cost of debt on the bond? (Round to two decimal places ) (indivoual or componert costs of ceptal) Compute the cost of the following a. Abond that has $1,000 par value (tace vatue) and a contrad of coupon riterest rate of 7 percent. A rew issue would have a floatation cost of 9 percent of the 51,145 maket value the bonds mature in 6 years. The firm's average tax rate is 30 percent and is maginal tex rate is 37 percent b. A new comonon slock issue that paid a $160 dinidend last year. The par value of the stock is 515 , and oamings per stiare have grosn at a rate of 8 percent per yeur. This growth rate is expected to contrue into the foreseeable future. The company maintains a conslart dividens-earnings tatio of 30 percont The price of this slock is now $23, but 9 percent folation costs are ansoputed corpotation's tax rate is 3 percent. d. A pefected stod payng a dividend of 11 percent on a 5130 par value if a new intee is ofeced, flotation cocts will be 13 percert of the cuttent pice of 5169 0. A bond seling to ywid 14 petceet after foodition costs, but befoce adjusting for the marginut corperate tac rate of 37 percent in other woids. 14 percert is the rate that equates he net proceess tam the bond with the prosent value of the fiflure cash fows (orinopal and interest) a. What in the firmis aftertax cost or bett on the bond? (Roound bo teo Secimail placet)