Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) A bond with par value RM1,000 has coupon payment dates every April 15th and October 15th. The nominal coupon rate payable semi-annually is

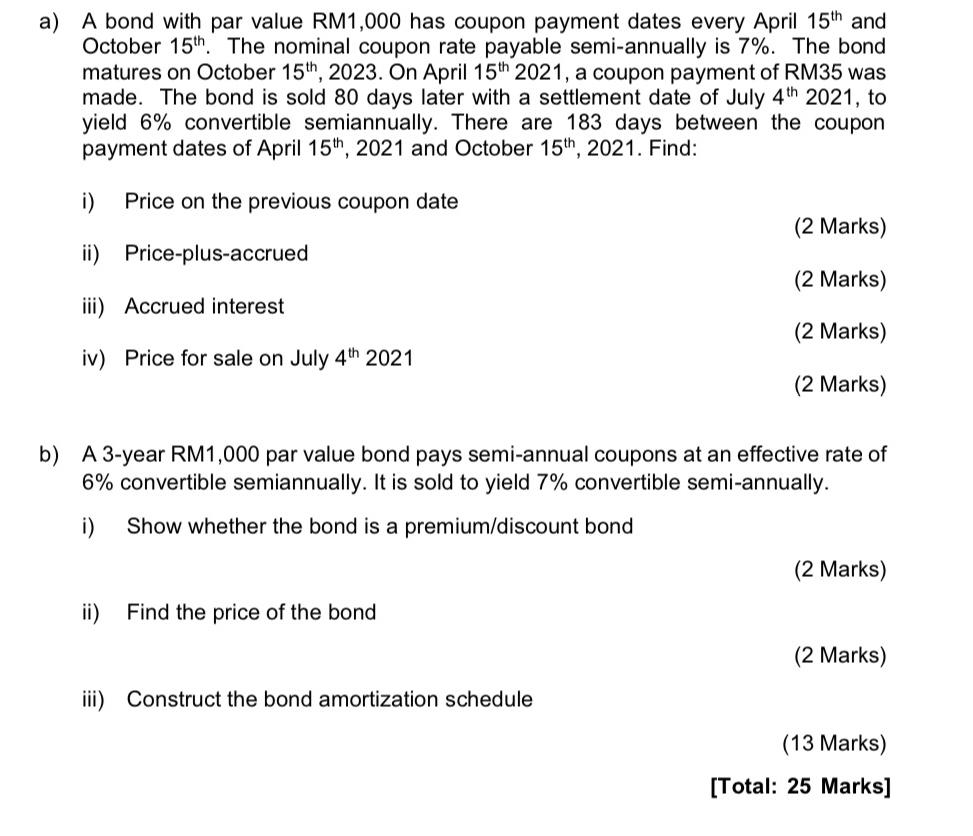

a) A bond with par value RM1,000 has coupon payment dates every April 15th and October 15th. The nominal coupon rate payable semi-annually is 7%. The bond matures on October 15th, 2023. On April 15th 2021, a coupon payment of RM35 was made. The bond is sold 80 days later with a settlement date of July 4th 2021, to yield 6% convertible semiannually. There are 183 days between the coupon payment dates of April 15th, 2021 and October 15th, 2021. Find: i) Price on the previous coupon date ii) Price-plus-accrued iii) Accrued interest iv) Price for sale on July 4th 2021 (2 Marks) (2 Marks) (2 Marks) (2 Marks) b) A 3-year RM1,000 par value bond pays semi-annual coupons at an effective rate of 6% convertible semiannually. It is sold to yield 7% convertible semi-annually. i) Show whether the bond is a premium/discount bond ii) Find the price of the bond iii) Construct the bond amortization schedule (2 Marks) (2 Marks) (13 Marks) [Total: 25 Marks]

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a i Price on previous coupon date Apr 15 2021 Coupon rate 72 35 semiannually Time since last coupon ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started