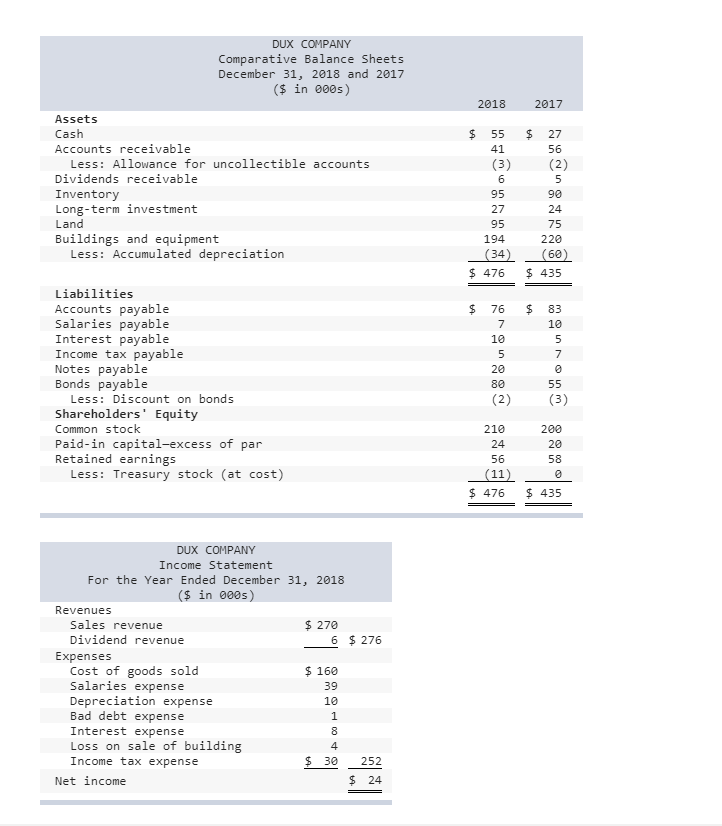

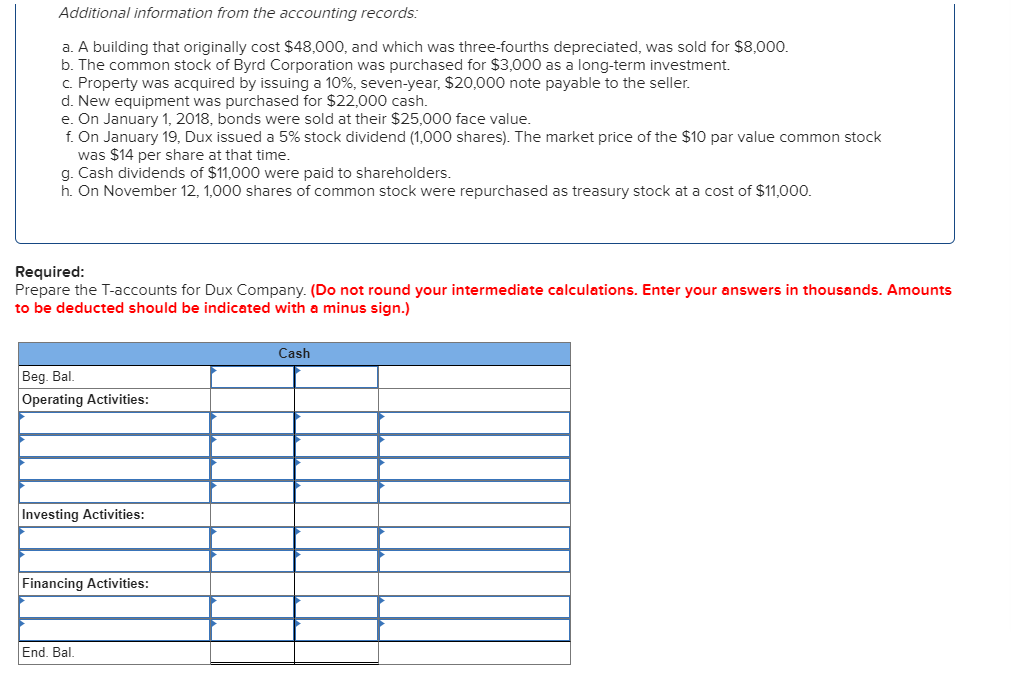

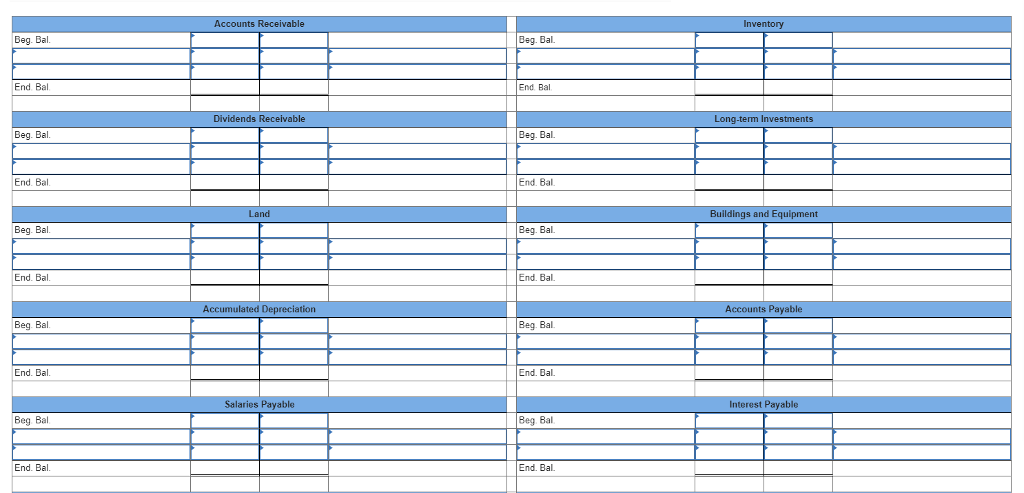

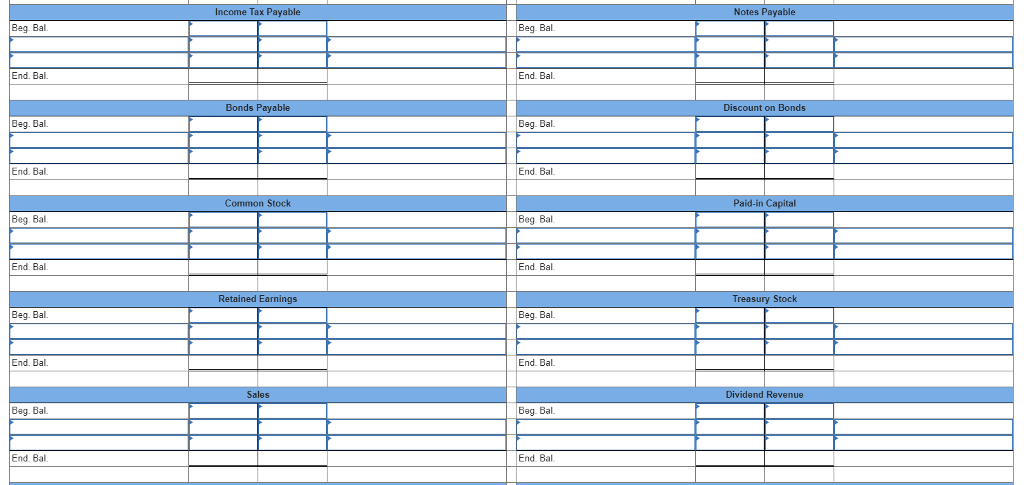

Question

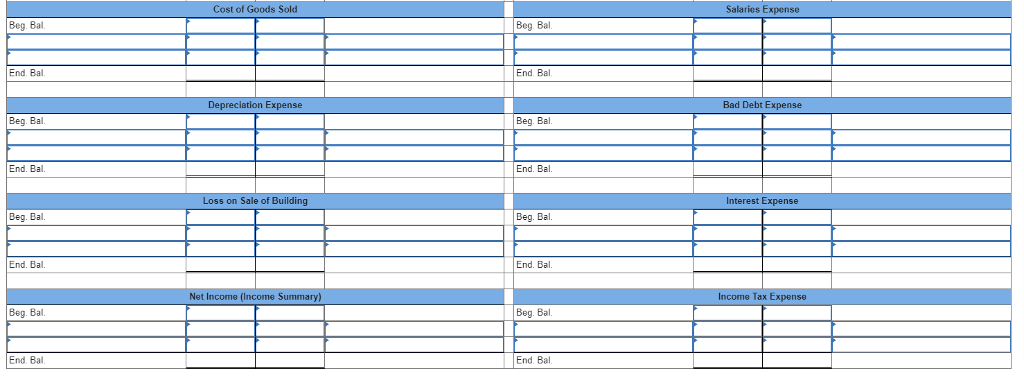

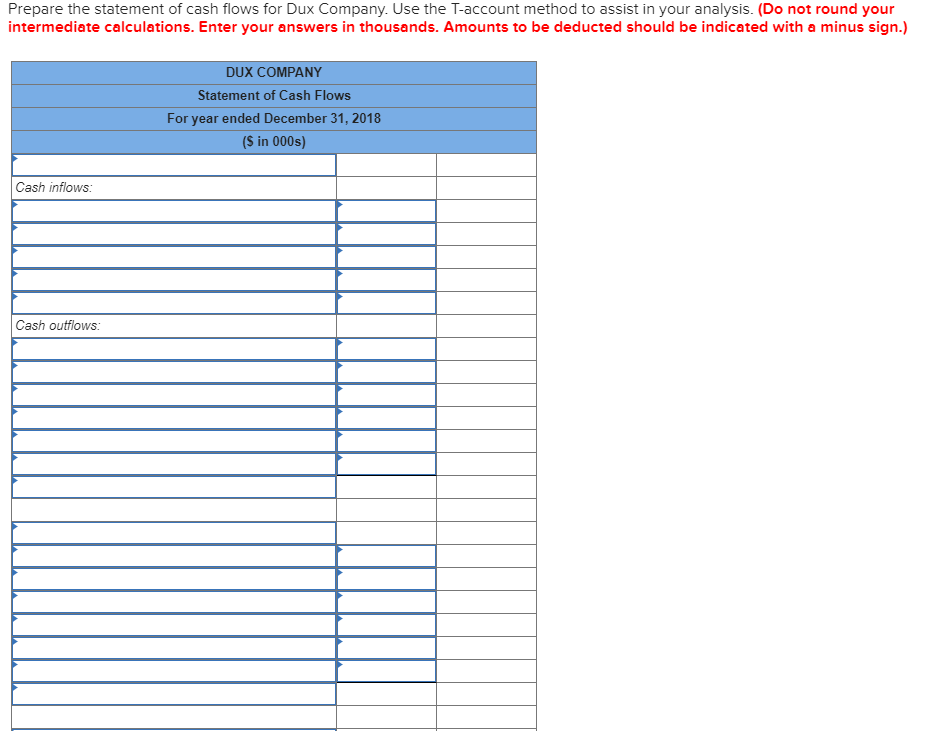

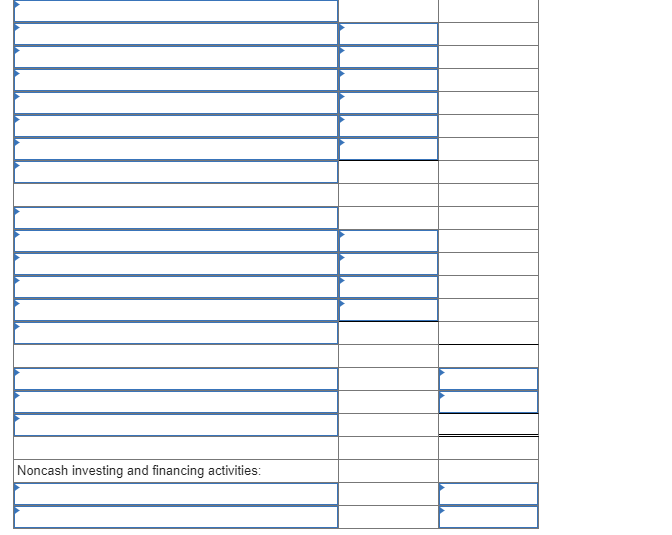

a. A building that originally cost $48,000, and which was three-fourths depreciated, was sold for $8,000. b. The common stock of Byrd Corporation was purchased

a. A building that originally cost $48,000, and which was three-fourths depreciated, was sold for $8,000.

b. The common stock of Byrd Corporation was purchased for $3,000 as a long-term investment.

c. Property was acquired by issuing a 10%, seven-year, $20,000 note payable to the seller.

d. New equipment was purchased for $22,000 cash.

e. On January 1, 2018, bonds were sold at their $25,000 face value.

f. On January 19, Dux issued a 5% stock dividend (1,000 shares). The market price of the $10 par value common stock was $14 per share at that time.

g. Cash dividends of $11,000 were paid to shareholders.

h.On November 12, 1,000 shares of common stock were repurchased as treasury stock at a cost of $11,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started