Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) A company is now considering to replace an old machine. The old machine was purchased at $600,000 four years ago and it is

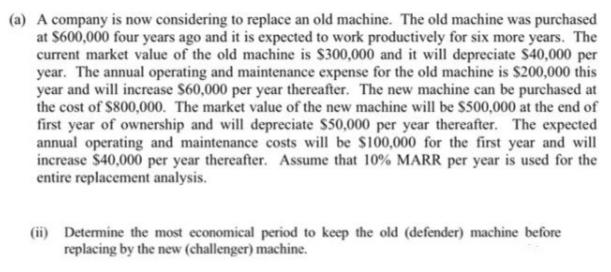

(a) A company is now considering to replace an old machine. The old machine was purchased at $600,000 four years ago and it is expected to work productively for six more years. The current market value of the old machine is $300,000 and it will depreciate $40,000 per year. The annual operating and maintenance expense for the old machine is S200,000 this year and will increase S60,000 per year thereafter. The new machine can be purchased at the cost of $800,000. The market value of the new machine will be $500,000 at the end of first year of ownership and will depreciate $50,000 per year thereafter. The expected annual operating and maintenance costs will be $100,000 for the first year and will increase $40,000 per year thereafter. Assume that 10% MARR per year is used for the entire replacement analysis. (ii) Determine the most economical period to keep the old (defender) machine before replacing by the new (challenger) machine.

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started